Question

PT Garuda Indonesia (Persero) Tbk is an Indonesia-based company primarily engaged in the commercial aviation business. Its business is classified into three segments: aviation operations,

PT Garuda Indonesia (Persero) Tbk is an Indonesia-based company primarily engaged in the commercial aviation business. Its business is classified into three segments: aviation operations, aircraft maintenance services and

other operations. The company operates full- service transport aircraft under the brand name Garuda Indonesia, while its subsidiary, PT

Citilink Indonesia operates economy transport aircraft under the brand name Citilink. Its aircraft maintenance service business is run by its subsidiary, PT Garuda Maintenance Facility Aero Asia. Other business operations are carried out by its subsidiaries such as PT Aero Wisata, which is engaged in the hospitality and tourism industry; PT Abacus Distribution Systems Indonesia, Garuda Indonesia's vision is to become a reliable airline company by offering quality services to the world community using Indonesian hospitality. Garuda Indonesia has a mission to maintain quality as an Indonesian flag carrier airline that promotes Indonesia to the world to support national economic development by providing professional services. The policy of reducing the capacity of the number of airplane passengers during the pandemic and the quietness of the tourism industry due to the widespread spread of Covid-19 cases were one of the causes of the decline in Garuda Indonesia's turnover. In the third quarter of 2020, the issuer coded GIAA experienced a net loss of US$ 1.07 billion or Rp. 16.03 trillion. Quoted from Tempo.com, several steps have been taken by Garuda Indonesia. Unable to rely on the regular passenger business, Garuda has actually turned to relying on cargo and service flights. However, the efforts were not enough to help the company's finances. Garuda finally made a number of efficiencies, including cutting the number of employees. President Director of PTGarudaIndonesia (Persero) Tbk Irfan Setiaputra said the company had reduced more than 20 percent of its employees since the Covid-19 pandemic through an early retirement scheme and accelerated contract periods. Irfan guarantees that the company will fulfill severance pay and other rights for employees who retire early, one of which is by setting aside pension funds from operating funds.

In addition to reducing employees, Garuda is reviewing routes that are not profitable. Management opens the option to reduce the number of domestic flight frequencies, including on favorite routes such as Bali. Garuda has also opened the option to close international routes that are losing money and will focus on domestic services. Because according to data before Covid-19, 78 percent of Garuda passengers are customers of domestic routes. Garuda's finances worsened after the company bore debts that had accumulated up to US$ 4.5 billion or Rp 70 trillion. The debt is estimated to increase to Rp 1 trillion every month. Garuda also lost US$ 100 million a month. Therefore, apart from reducing operating expenses, Garuda is currently suppressing financial problems by restructuring its debts by negotiating with its 36 lessors.

Question: a. Based on the Garuda Indonesia company profile above, prepare a risk assessment and a risk register for the conditions faced by the company in 2020. Add references as supporting data. Use the table according to the format provided. b. Referring to the concept of financial risk management, explain how the proper implementation of financial risk management is carried out to improve the performance of the Garuda Indonesia company?

Answer Business cycle -Does the company depend on the business cycle? Score: Reason:

2 Financial Position - Have the company's sales decreased over the last two years or so? - Is there a major part of the company that suffers losses? - Does the company have excessive borrowing? - Does the company have a large amount of bad debt (credit)?

- Does the company have large overhead costs? - Does the company not have a fast and informative management information system?

Score: Reason:

3 Takeover (Takeover Markets)

- Is the company vulnerable to takeovers? - Is the company in a declining market or low profits? - Does the company depend on commodities, derivatives or other high risk areas?

Score: Reason:

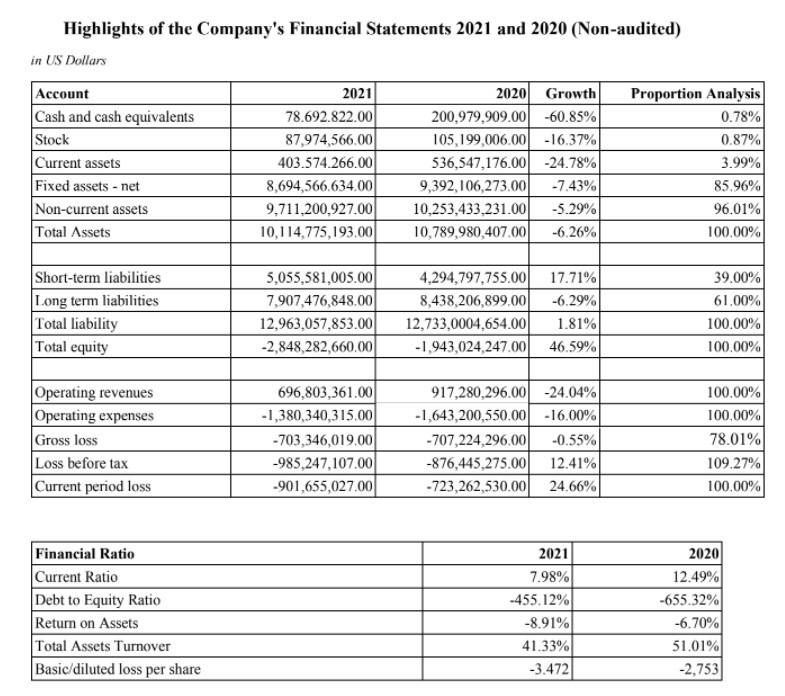

Highlights of the Company's Financial Statements 2021 and 2020 (Non-audited) in US Dollars Account Cash and cash equivalents Stock Current assets Fixed assets - net Non-current assets Total Assets 2021 78.692.822.00 87,974,566.00 403.574.266.00 8,694,566.634.00 9,711,200,927.00 10,114,775,193.00 2020 Growth 200,979.909.00 -60.85% 105,199,006.00 -16.37% 536,547,176.00 -24.78% 9,392,106,273.00 -7.43% 10,253,433,231.00 -5.29% 10,789,980,407.000 -6.26% Proportion Analysis 0.78% 0.87% 3.99% 85.96% 96.01% 100.00% Short-term liabilities Long term liabilities Total liability Total equity 5,055,581,005.00 7,907,476,848.00 12,963,057,853.00 -2,848,282,660.00 4,294,797,755.000 8,438,206,899.00 12,733,0004,654.00 -1.943,024 247.00 17.71% -6.29% 1.81% 46.59% 39.00% 61.00% 100.00% 100.00% Operating revenues Operating expenses Gross loss Loss before tax Current period loss 696,803,361.00 -1,380,340,315.00 -703,346,019.00 -985,247,107.00 -901,655,027.00 917,280,296.00 -24.04% -1,643,200,550.00 -16.00% -707,224,296.00 -0.55% -876,445,275.00 12.41% -723,262,530.000 24.66% 100.00% 100,00% 78.01% 109.27% 100.00% Financial Ratio Current Ratio Debt to Equity Ratio Return on Assets Total Assets Turnover Basic/diluted loss per share 2021 7.98% -455.12% -8.91% 41.33% -3.472 2020 12.49% -655.32% -6.70% 51,01% -2,753 Risk Register PT Garuda Indonesia (Persero) Tbk. No. Risk Events Reason Frequency Severity Risk Level Handling (Probability) (Impact) (Probability (Mitigation) X Impact) Risk 1 2 3 4 etc. Highlights of the Company's Financial Statements 2021 and 2020 (Non-audited) in US Dollars Account Cash and cash equivalents Stock Current assets Fixed assets - net Non-current assets Total Assets 2021 78.692.822.00 87,974,566.00 403.574.266.00 8,694,566.634.00 9,711,200,927.00 10,114,775,193.00 2020 Growth 200,979.909.00 -60.85% 105,199,006.00 -16.37% 536,547,176.00 -24.78% 9,392,106,273.00 -7.43% 10,253,433,231.00 -5.29% 10,789,980,407.000 -6.26% Proportion Analysis 0.78% 0.87% 3.99% 85.96% 96.01% 100.00% Short-term liabilities Long term liabilities Total liability Total equity 5,055,581,005.00 7,907,476,848.00 12,963,057,853.00 -2,848,282,660.00 4,294,797,755.000 8,438,206,899.00 12,733,0004,654.00 -1.943,024 247.00 17.71% -6.29% 1.81% 46.59% 39.00% 61.00% 100.00% 100.00% Operating revenues Operating expenses Gross loss Loss before tax Current period loss 696,803,361.00 -1,380,340,315.00 -703,346,019.00 -985,247,107.00 -901,655,027.00 917,280,296.00 -24.04% -1,643,200,550.00 -16.00% -707,224,296.00 -0.55% -876,445,275.00 12.41% -723,262,530.000 24.66% 100.00% 100,00% 78.01% 109.27% 100.00% Financial Ratio Current Ratio Debt to Equity Ratio Return on Assets Total Assets Turnover Basic/diluted loss per share 2021 7.98% -455.12% -8.91% 41.33% -3.472 2020 12.49% -655.32% -6.70% 51,01% -2,753 Risk Register PT Garuda Indonesia (Persero) Tbk. No. Risk Events Reason Frequency Severity Risk Level Handling (Probability) (Impact) (Probability (Mitigation) X Impact) Risk 1 2 3 4 etc

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started