Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pucket's Buckets, Inc. (PB) currently has an enterprise value (Vo) of $1,147,447. It has a beta of 1.3 with a capital structure that includes

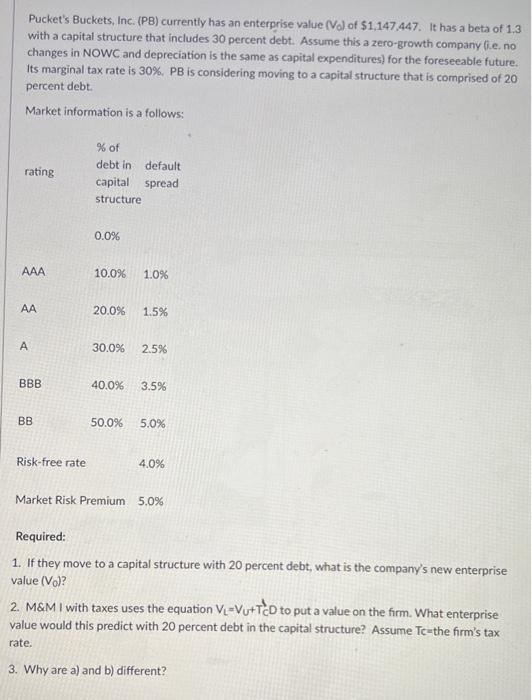

Pucket's Buckets, Inc. (PB) currently has an enterprise value (Vo) of $1,147,447. It has a beta of 1.3 with a capital structure that includes 30 percent debt. Assume this a zero-growth company (.e. no changes in NOWC and depreciation is the same as capital expenditures) for the foreseeable future. Its marginal tax rate is 30%. PB is considering moving to a capital structure that is comprised of 20 percent debt. Market information is a follows: rating AAA AA A BBB BB Risk-free rate % of debt in default capital spread structure 0.0% 10.0% 1.0% 20.0% 1.5% 30.0% 2.5% 40.0% 3.5% 50.0% 5.0% 4.0% Market Risk Premium 5.0% Required: 1. If they move to a capital structure with 20 percent debt, what is the company's new enterprise value (Vo)? 2. M&M I with taxes uses the equation V-Vu+TED to put a value on the firm. What enterprise value would this predict with 20 percent debt in the capital structure? Assume Tc-the firm's tax rate. 3. Why are a) and b) different?

Step by Step Solution

★★★★★

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started