Punch Taverns owns over 3,500 pubs (bars) in Britain. The group borrowed heavily to grow, but was hit by a ban on smoking in bars,

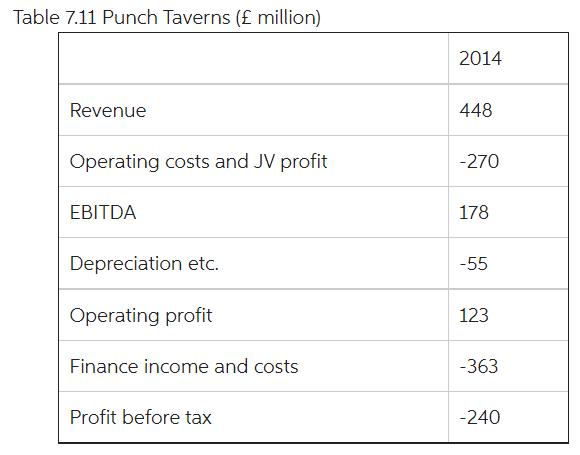

Punch Taverns owns over 3,500 pubs (bars) in Britain. The group borrowed heavily to grow, but was hit by a ban on smoking in bars, higher taxes on beer, and the Great Recession. In October 2014, the group negotiated with creditors to exchange £0.6 billion of debt for equity. The restructuring reduced the group's debt by a quarter to £1.8 billion and left the original shareholders with just 15% of the shares. Table 7.11 reports the group's income statement for 2014. (Sources: “Punch Taverns wins final restructuring approval”, Financial Times, October 7, 2014; Punch Taverns PLC, Preliminary Results, August 23, 2014.).

Explain which concept of cost can justify Punch Tavern's expansion strategy.

Which items in the income statement would the restructuring affect?

How would the restructuring affect Punch Tavern's EBITDA?

If the income statement took account of opportunity cost of capital, would the restructuring improve the group's financial performance?

Table 7.11 Punch Taverns ( million) 2014 Revenue 448 Operating costs and JV profit -270 EBITDA 178 Depreciation etc. -55 Operating profit 123 Finance income and costs -363 Profit before tax -240

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a Economies of scale By operating at larger scale it can reduce ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started