Question

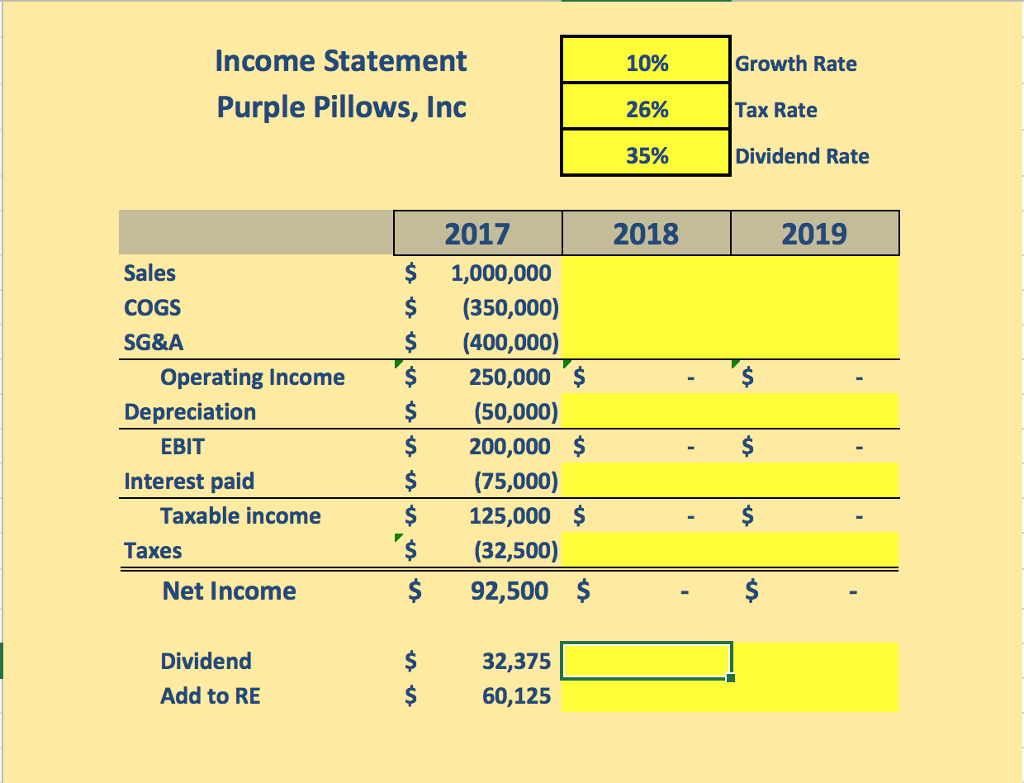

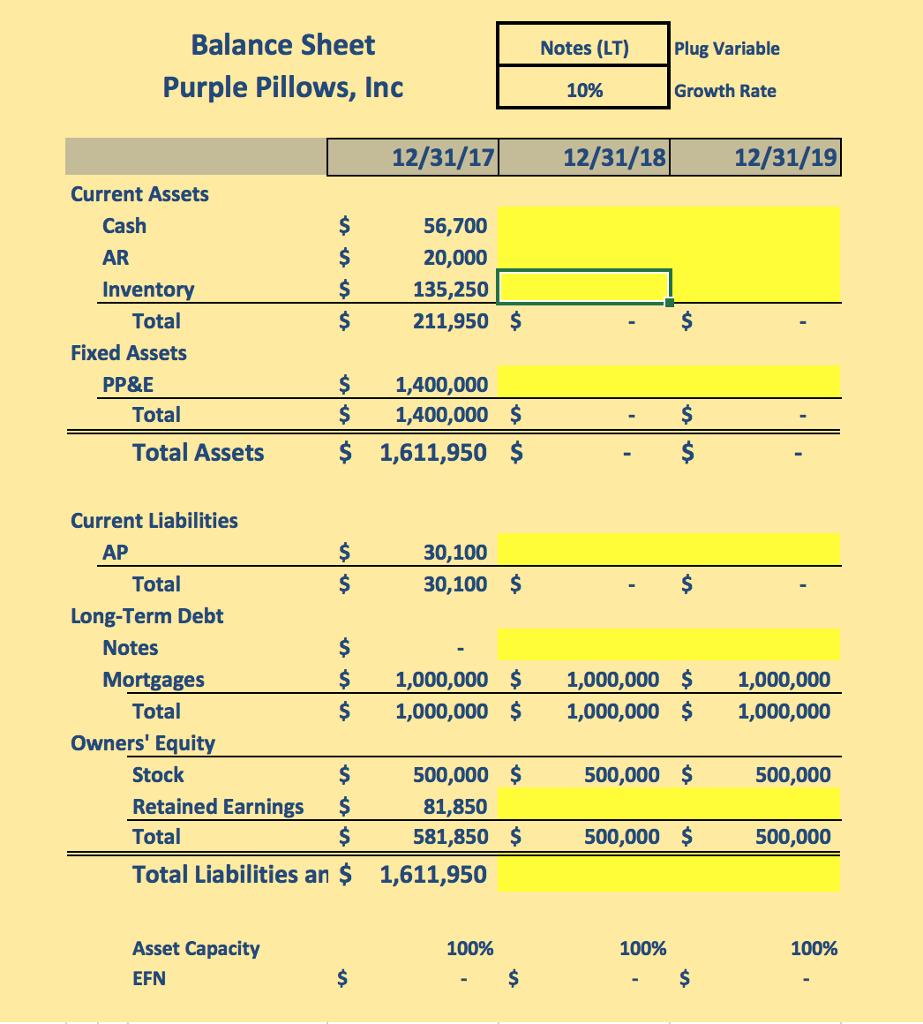

Purple Pillows, Inc is using the percent-of-sales method to calculate External Financing Needed (EFN) over the next two years. Assume the following: * They are

Purple Pillows, Inc is using the percent-of-sales method to calculate External Financing Needed (EFN) over the next two years. Assume the following:

* They are at 100% asset capacity

* Depreciation, and interest grow in proportion with sales

* The tax rate remains constant over the three years

* Long-term notes are the plug variable

1) Fill in all the blank yellow cells with the appropriate functions

2) Balance the balance sheet using LT notes as the plug

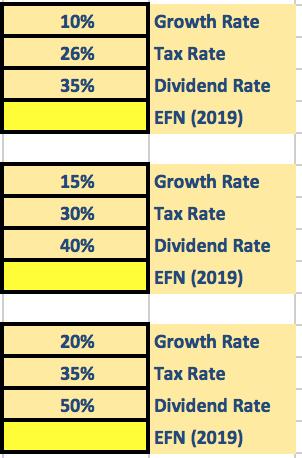

3) Ensure that your spreadsheet is fully dynamic by changing the yellow-highlighted growth, tax, and dividend rates

4) Use your sheet to calculate EFN for the three scenarios

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started