Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Purpose This task provides you with opportunities to learn the knowledge (GLO1 & ULO1) and skills (GLO 5 & ULO2) required in studying and

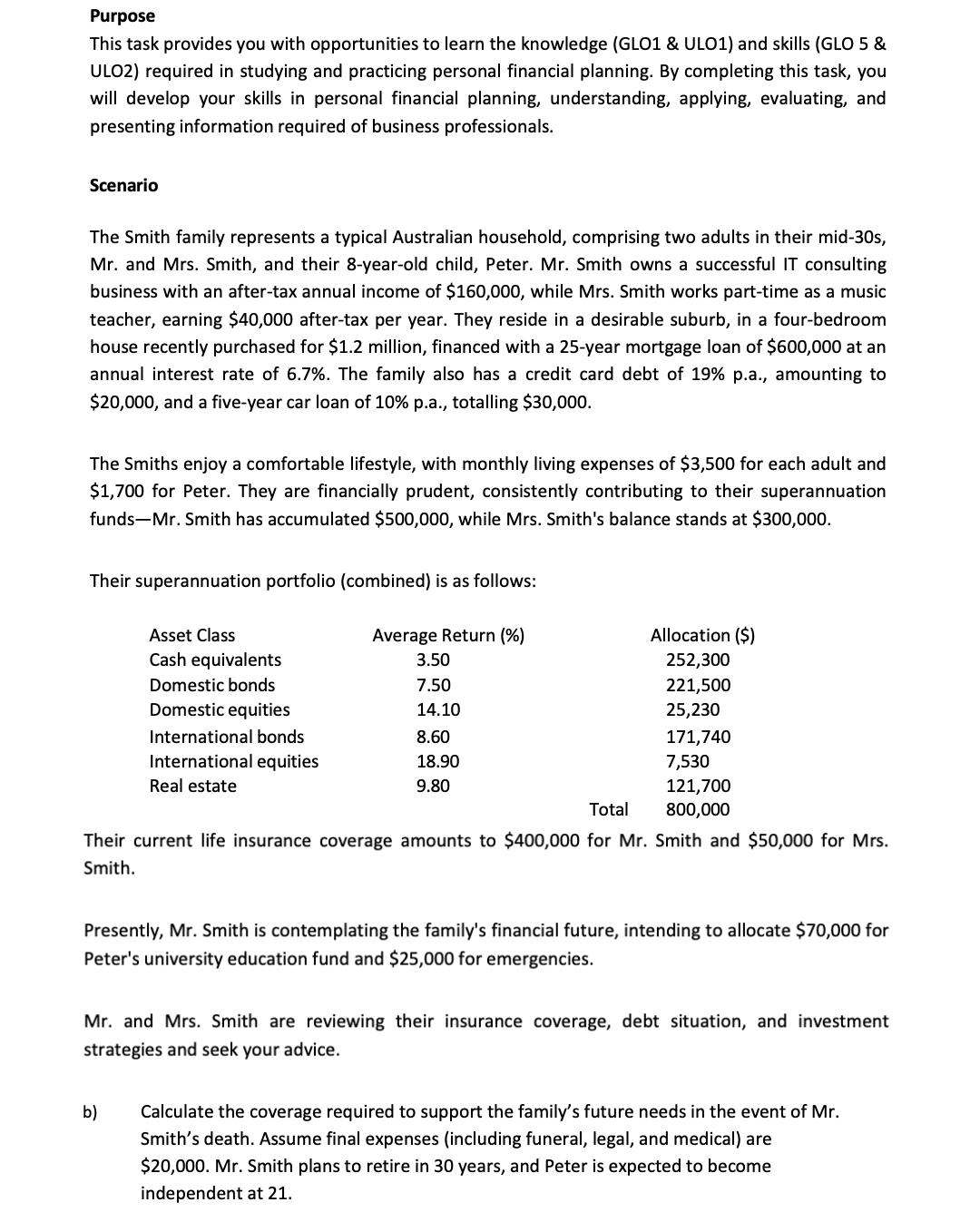

Purpose This task provides you with opportunities to learn the knowledge (GLO1 & ULO1) and skills (GLO 5 & ULO2) required in studying and practicing personal financial planning. By completing this task, you will develop your skills in personal financial planning, understanding, applying, evaluating, and presenting information required of business professionals. Scenario The Smith family represents a typical Australian household, comprising two adults in their mid-30s, Mr. and Mrs. Smith, and their 8-year-old child, Peter. Mr. Smith owns a successful IT consulting business with an after-tax annual income of $160,000, while Mrs. Smith works part-time as a music teacher, earning $40,000 after-tax per year. They reside in a desirable suburb, in a four-bedroom house recently purchased for $1.2 million, financed with a 25-year mortgage loan of $600,000 at an annual interest rate of 6.7%. The family also has a credit card debt of 19% p.a., amounting to $20,000, and a five-year car loan of 10% p.a., totalling $30,000. The Smiths enjoy a comfortable lifestyle, with monthly living expenses of $3,500 for each adult and $1,700 for Peter. They are financially prudent, consistently contributing to their superannuation funds Mr. Smith has accumulated $500,000, while Mrs. Smith's balance stands at $300,000. Their superannuation portfolio (combined) is as follows: Asset Class Average Return (%) Allocation ($) Cash equivalents Domestic bonds 3.50 252,300 7.50 221,500 Domestic equities 14.10 25,230 International bonds 8.60 171,740 International equities Real estate 18.90 7,530 9.80 121,700 Total 800,000 Their current life insurance coverage amounts to $400,000 for Mr. Smith and $50,000 for Mrs. Smith. Presently, Mr. Smith is contemplating the family's financial future, intending to allocate $70,000 for Peter's university education fund and $25,000 for emergencies. Mr. and Mrs. Smith are reviewing their insurance coverage, debt situation, and investment strategies and seek your advice. b) Calculate the coverage required to support the family's future needs in the event of Mr. Smith's death. Assume final expenses (including funeral, legal, and medical) are $20,000. Mr. Smith plans to retire in 30 years, and Peter is expected to become independent at 21.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started