Answered step by step

Verified Expert Solution

Question

1 Approved Answer

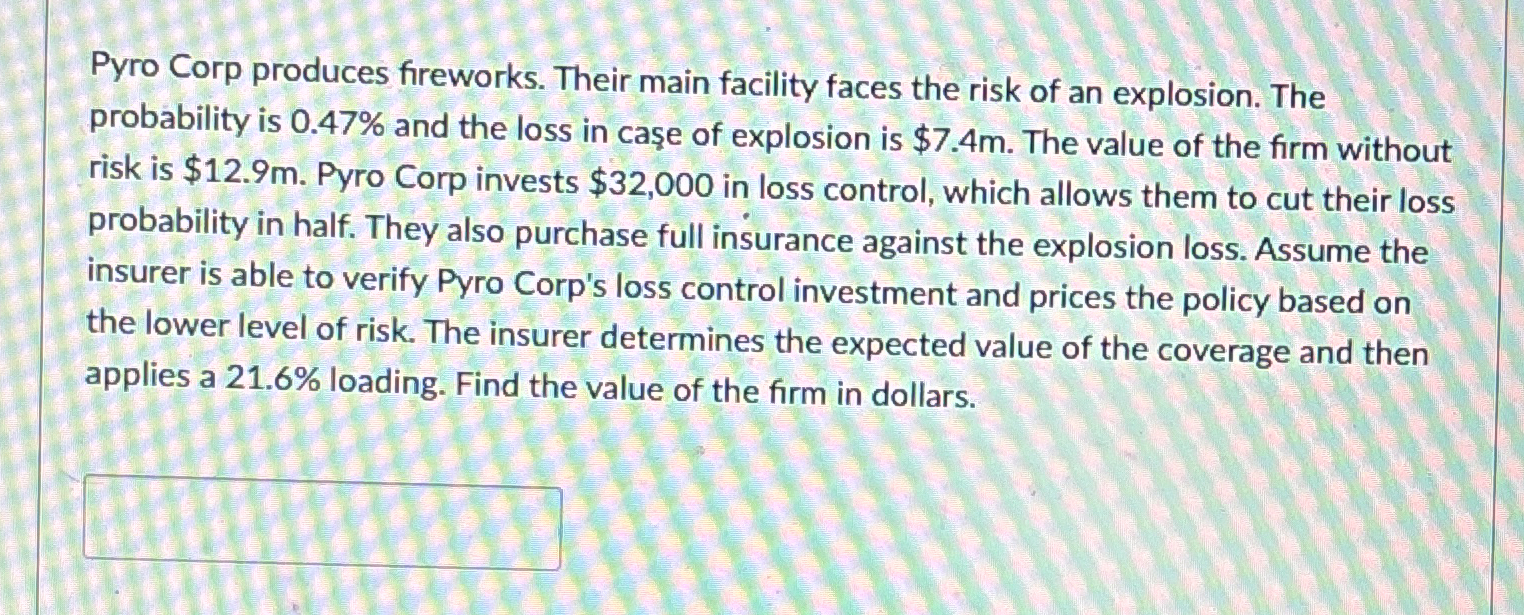

Pyro Corp produces fireworks. Their main facility faces the risk of an explosion. The probability is 0 . 4 7 % and the loss in

Pyro Corp produces fireworks. Their main facility faces the risk of an explosion. The probability is and the loss in cae of explosion is $ The value of the firm without risk is $ Pyro Corp invests $ in loss control, which allows them to cut their loss probability in half. They also purchase full insurance against the explosion loss. Assume the insurer is able to verify Pyro Corp's loss control investment and prices the policy based on the lower level of risk. The insurer determines the expected value of the coverage and then applies a loading. Find the value of the firm in dollars.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started