Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q) Prepare - 1) projected cash flow 2) projected p&l 3) break-even and balance sheet All in excel using the case study information attached. Note

Q) Prepare -

1) projected cash flow

2) projected p&l

3) break-even and balance sheet

All in excel using the case study information attached.

Note that where no data available, make assumptions.

Q) Prepare projected cash flow, projected p&l, break-even and balance sheet in excel using the case study information attached.

Note that where no data available, make assumptions.

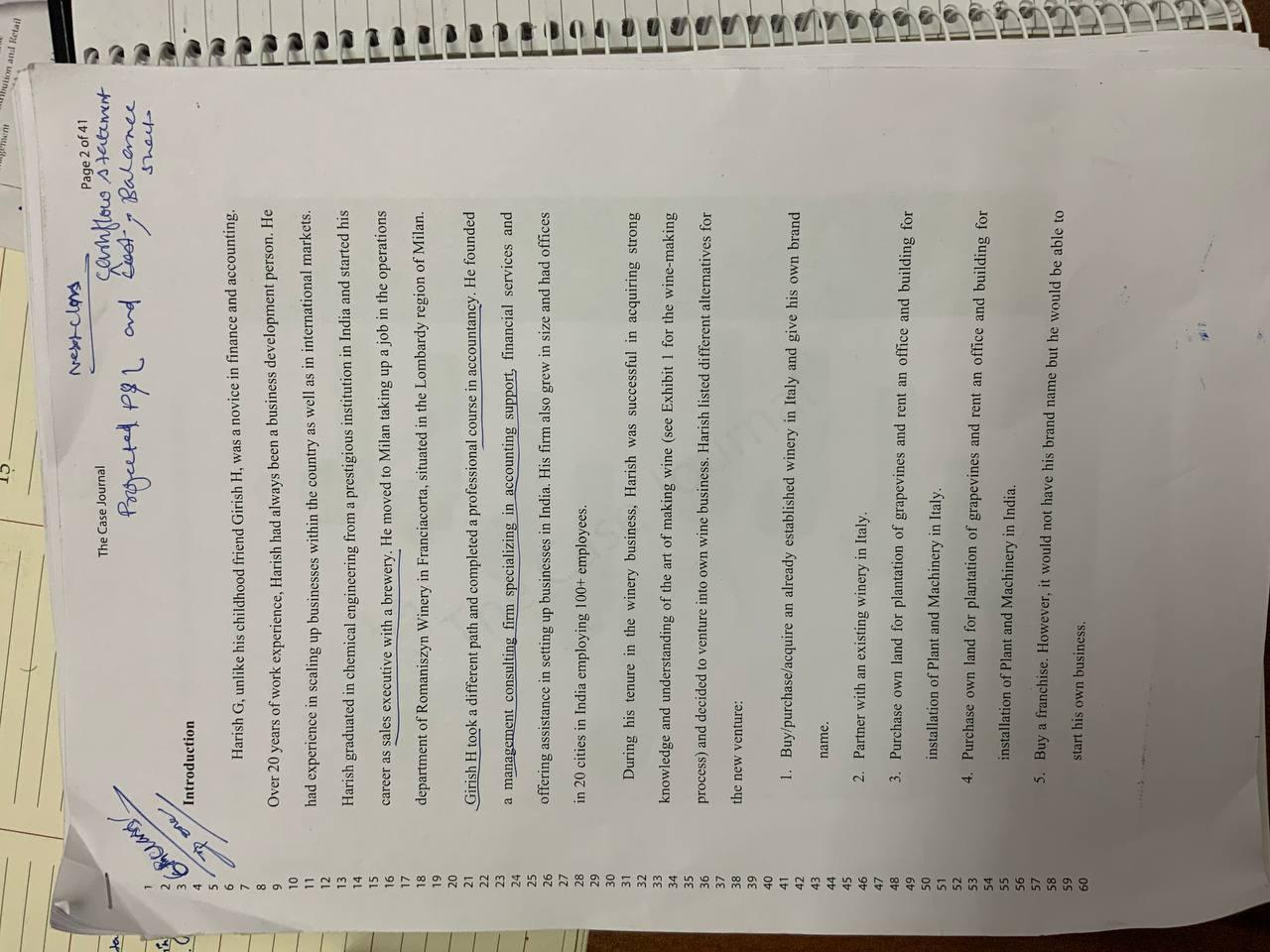

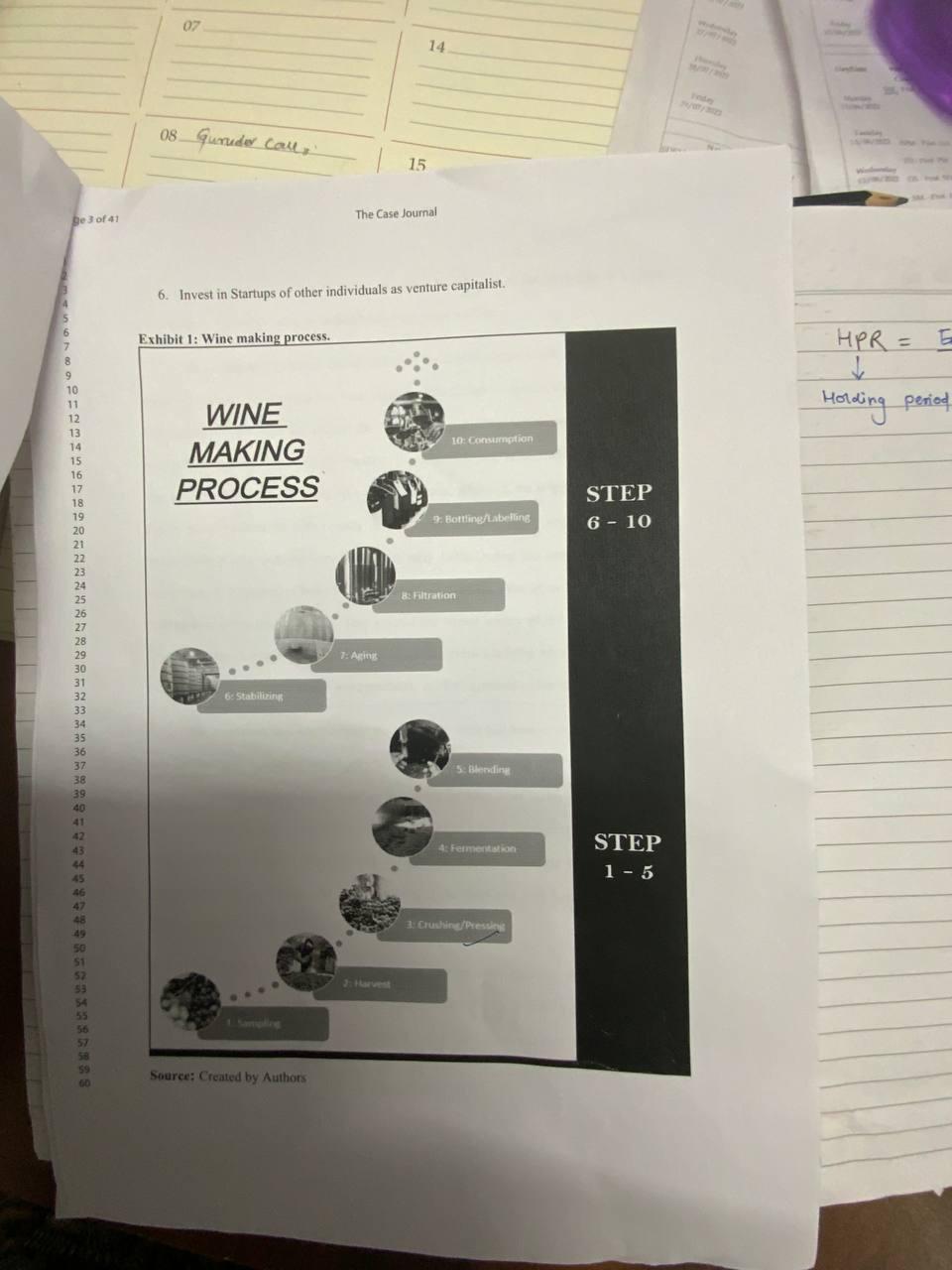

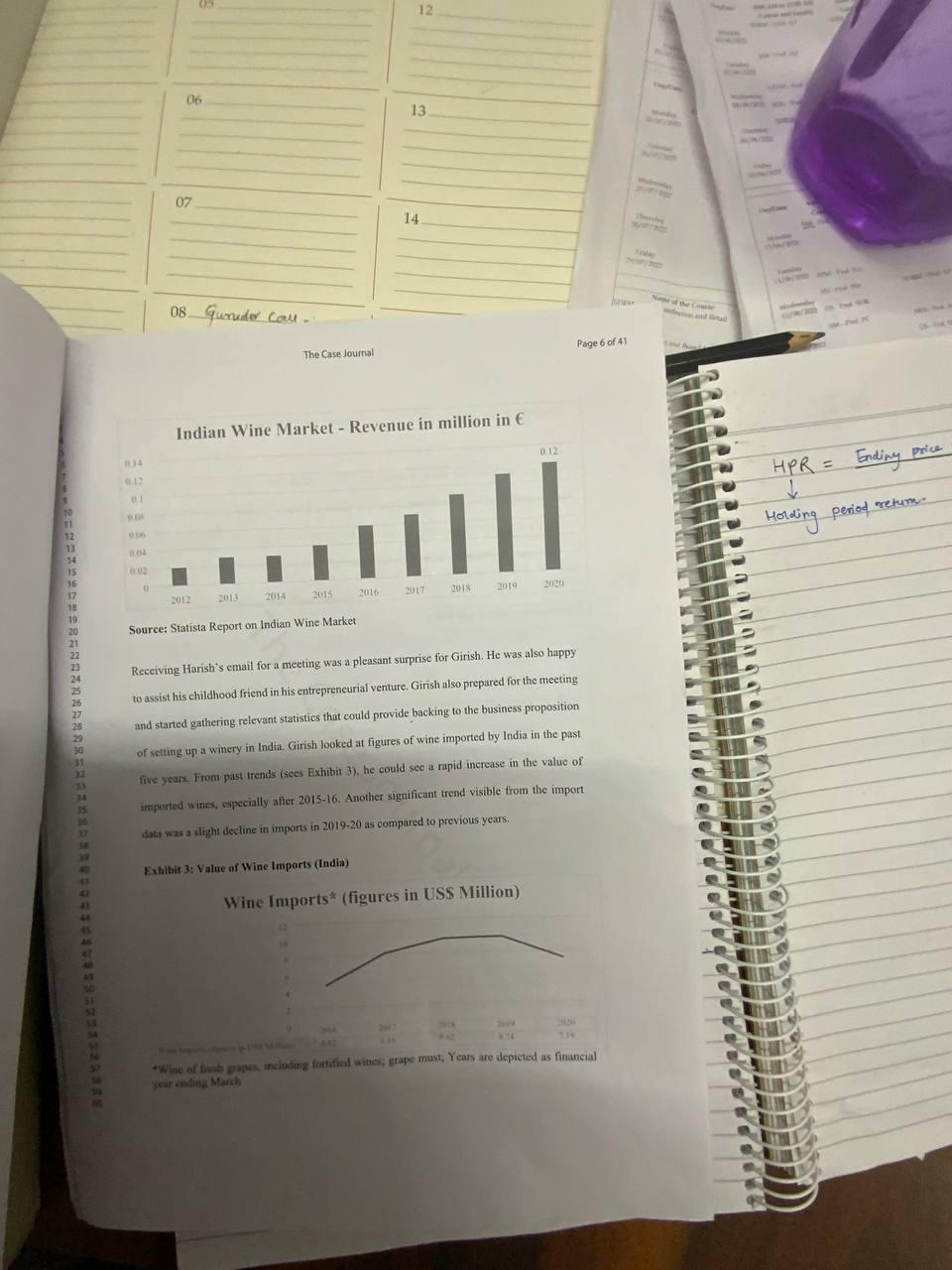

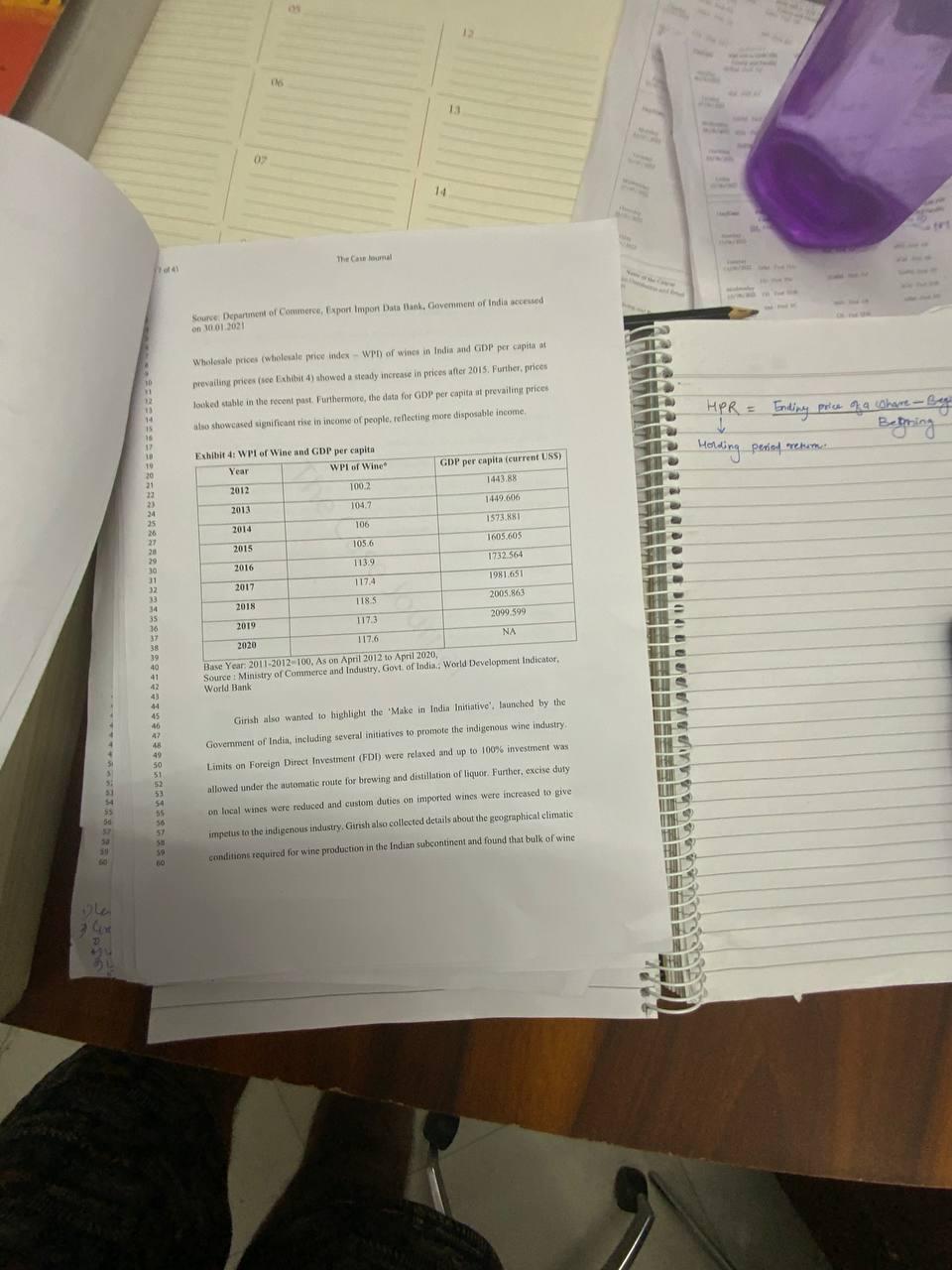

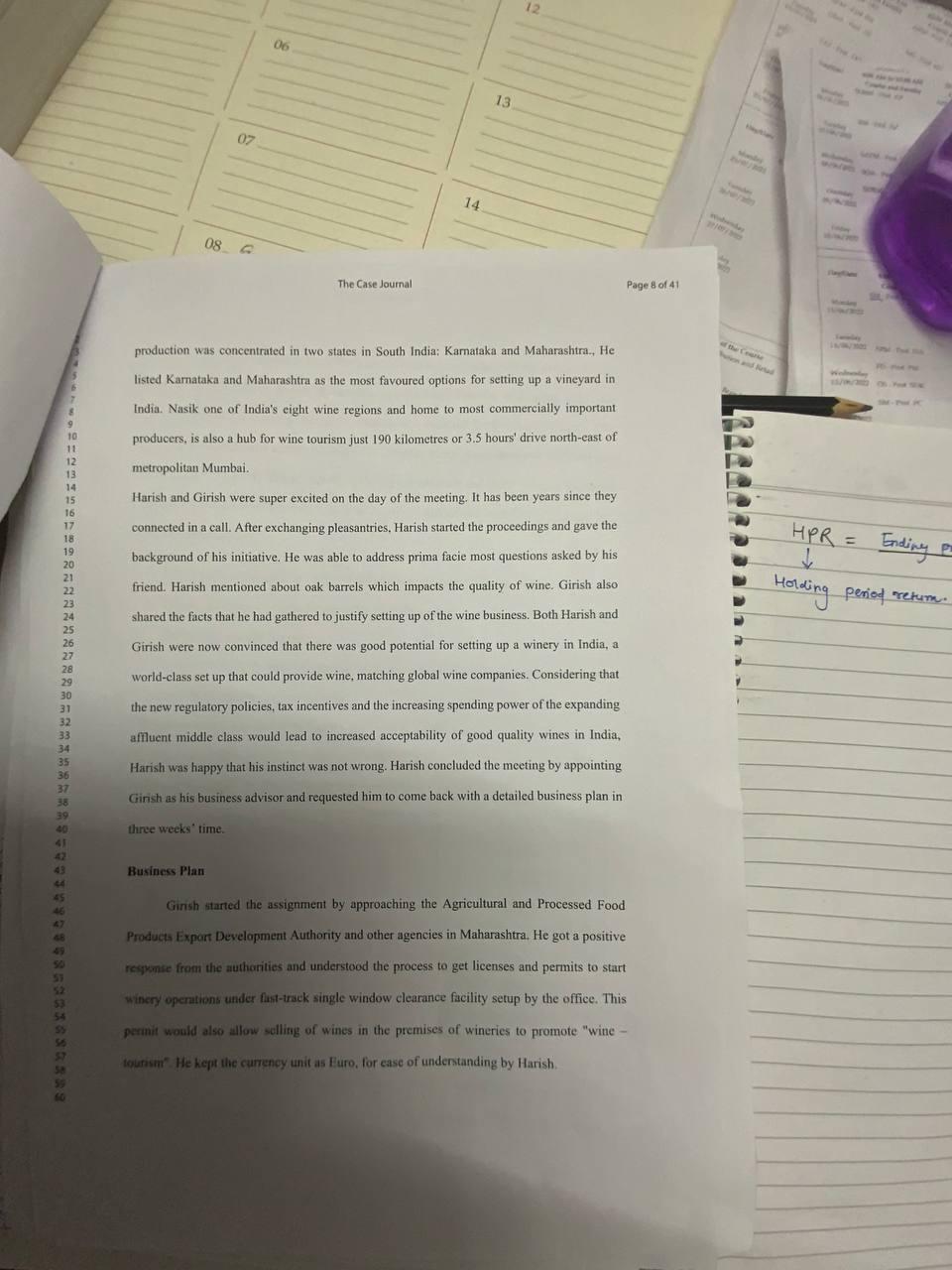

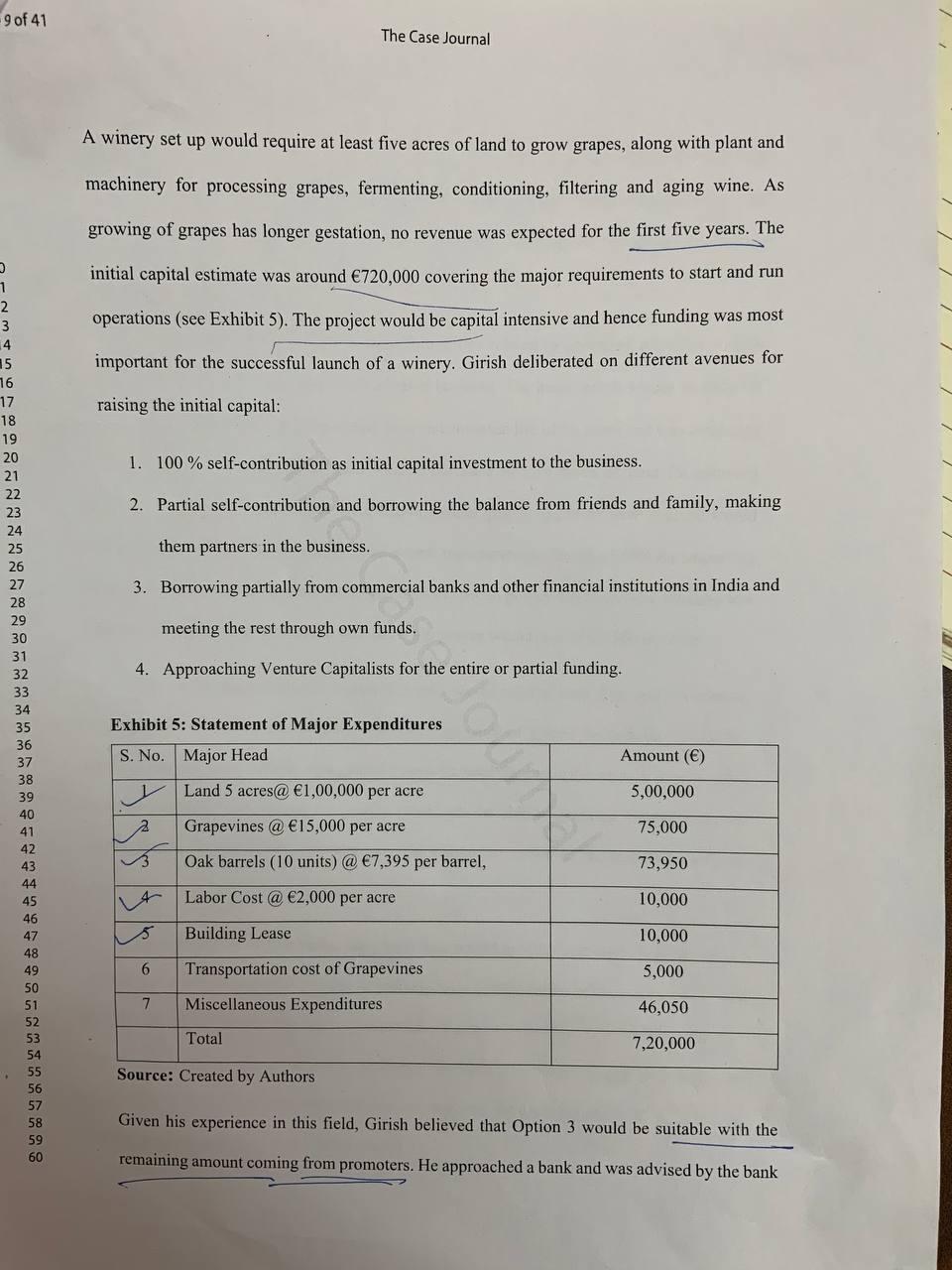

4 9 7 8 9 10 10 11 "1 12 12 13 14 15 17 " 41 12 42 15 43 ^^ 44 AE 45 46 47 48 49 20 50 21 51 57 58 59 60 The Case Journal Eticians Ione Bemen Page 2 of 41 camflow statement and cost Balance Next class Projected P&L Introduction Harish G, unlike his childhood friend Girish H, was a novice in finance and accounting. Over 20 years of work experience, Harish had always been a business development person. He had experience in scaling up businesses within the country as well as in international markets. Harish graduated in chemical engineering from a prestigious institution in India and started his career as sales executive with a brewery. He moved to Milan taking up a job in the operations department of Romaniszyn Winery in Franciacorta, situated in the Lombardy region of Milan. Girish H took a different path and completed a professional course in accountancy. He founded a management consulting firm specializing in accounting support, financial services and offering assistance in setting up businesses in India. His firm also grew in size and had offices in 20 cities in India employing 100+ employees. During his tenure in the winery business, Harish was successful in acquiring strong knowledge and understanding of the art of making wine (see Exhibit 1 for the wine-making process) and decided to venture into own wine business. Harish listed different alternatives for the new venture: 1. Buy/purchase/acquire an already established winery in Italy and give his own brand name. 2. Partner with an existing winery in Italy. 3. Purchase own land for plantation of grapevines and rent an office and building for installation of Plant and Machinery in Italy. 4. Purchase own land for plantation of grapevines and rent an office and building for installation of Plant and Machinery in India. 5. Buy a franchise. However, it would not have his brand name but he would be able to start his own business. bution and Retail 6 7 De 3 of 41 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 5 26 7 28 29 30 1 2 33 3435 6 7 8 27 31 32 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 07 08 Guruder Call 15 The Case Journal 6. Invest in Startups of other individuals as venture capitalist. Exhibit 1: Wine making process. WINE MAKING 10: Consumption PROCESS 9: Bottling/Labelling 6: Stabilizing Source: Created by Authors 7: Aging 14 8: Filtration 5: Blending 4: Fermentation 3: Crushing/Pressing STEP 6-10 STEP 1-5 Inde HPR = Holding period 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 3.3 34 35 36 37 38 39 40 42 43 44 45 46 **************** 48 50 51 52 51 54 56 57 06 13 07 14. 08 Guruder Call, 15 The Case Journal tementation. With his business sense and gut, Harish went with option 4; also, in the hindsight, this option helped him to return to India, as he had been longing for a while. Once clear about choice, Harish called in his trusted friend Girish to seek guidance about the venture. He set up a two-hour meeting with Girish to discuss the venture and the different challenges expected around the proposition. Knowing Girish as a detail-oriented person, Harish prepared well for the meeting. He referred several reports and articles to get an idea about the prospects of setting up a winery in India. Although the origin of wine in India can be traced back to the 13th century through historical and literary sources, roots of the. modern Indian wine industry were laid in the early 1980s.During this time, two pioneering entrepreneurs, Shymarao Chowgule and Kanwal Grover set themselves the challenge of making own wines on Indian soil. They created the largest winery of the time, Chowgule's Chateau Indage that was well known for its Omar Khayyam sparkling wine. Further, entry of Sula Vineyards, the largest Indian wine producer, in 2000, symbolised the hope of the times. The regulatory landscape around the winery business had been evolving. Maharashtra was the first State to adopt a wine policy in India in 2001. This led to the setting up of a large number of new wineries. Wine policies were adopted by three other States - Madhya Pradesh and Tamil Nadu in 2006, and Karnataka in 2007. After a good start, many producers were forced into bankruptcy by the financial crisis of 2007-2008, including the liquidation of Chowgule's Chateau Indage, the largest winery at the time and well known for its Omar Khayyam sparkling wine. Despite the difficulties posed by the burgeoning Indian wine industry, financial investors stepped in. The Indian Grape Processing Board was also set up in 2009 and India joined the OIV (International Organisation of Vive and Wine) in 2011. This was followed by the launch of big winery ventures over the years including Alpine Wineries, Fratelli Wines, Charosa dy vey Friday 70/10/201 Name of the Corse Mies Mi Dondur Page 4 of 41 Mal WORD AMBA Windvendas 15/N/ THE K HPR = Ending Ending price of a Holding period retum. F D P ge 5 of 41 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 42 41 44 46 48 51 1 59 58 59 06 13 14 15 07 08 Guruder Call The Case Journal Winery, Four Seasons, KRSMA Farms, Vallonn Vineyards and SDU Winery. Further, Pernod Ricard, Diageo and Mot Hennessy, global drink companies, too began to take an interest and set up shop in India. After studying the trends in the Indian context, Harish kept world statistics handy as that would be a follow up question from Girish. Among the top five countries in terms of revenue generation (2020) in the wine market (see Exhibit 2) United States was the leading nation with 44,099 million, followed by France (22,461 million), China (19,527 million), United Kingdom (18,890 million) and Italy (18,465 million). While comparing these global statistics with India, Harish found that the country was currently ranked 142 with a revenue generation of only 0.12 million. Exhibit 2: Revenue generation of top five countries of the world Revenue in million in the year 2020 50000 45000 40000 35000 30000 25000 20000 15000 ||| 10000 5000 D France United Kingdom Italy Source: Statista Report on Indian Wine Market 0.12 India Theplay Tury Walender 26/09/2007 Trady 24/07/2022 SENEM Sales Managem and tal Name of the Course Deye (5/06/222067 PHK HPR = Endi Holding period m 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 33 34 35 36 37 18 39 40 41 43 44 45 46 49 31 52 54 06 11.14 6.12 B1 12 13. 14 07 08 Guruder Call- The Case Journal Indian Wine Market - Revenue in million in 0.12 K 006 0.04 0.02 6 2014 2013 2012 2016 2015 2020 2017 2019. 2018 Source: Statista Report on Indian Wine Market Receiving Harish's email for a meeting was a pleasant surprise for Girish. He was also happy to assist his childhood friend in his entrepreneurial venture. Girish also prepared for the meeting and started gathering relevant statistics that could provide backing to the business proposition of setting up a winery in India. Girish looked at figures of wine imported by India in the past. five years. From past trends (sees Exhibit 3), he could see a rapid increase in the value of imported wines, especially after 2015-16. Another significant trend visible from the import data was a slight decline in imports in 2019-20 as compared to previous years. Exhibit 3: Value of Wine Imports (India) Wine Imports* (figures in USS Million) 12 2017 974 7.19 Wine of fresh grapes, including fortified wines; grape must, Years are depicted as financial year ending March Page 6 of 41 Today W HPR = Ending price Holding period retum. *********** 53 54 55 56 50 stops 12 13 14 15 16 17 18 10 20 21 23 23 24 25 26 27 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 07 14 The Case Journal of 4) Source Department of Commerce, Export Import Data Blank, Goverment of India accessed on 30.01 2021 Wholesale prices (wholesale price index-WPI) of wines in India and GDP per capita at prevailing prices (see Exhibit 4) showed a steady increase in prices after 2015. Further, prices looked stable in the recent past. Furthermore, the data for GDP per capita at prevailing prices also showcased significant rise in income of people, reflecting more disposable income. Exhibit 4: WPI of Wine and GDP per capita Year: WPI of Wine GDP per capita (current USS). 2012 100.2 1443.88 2013 104.7 1449.6067 2014 106 1573.881 2015 105.6 1605.605 2016 113.9 1732.564 2017 1174 1981.651 2018 118.5 2005.863 2019 117.3 2099.599 2020 117.6 NA Base Year: 2011-2012-100, As on April 2012 to April 2020, Source: Ministry of Commerce and Industry, Govt. of India., World Development Indicator, World Bank Girish also wanted to highlight the 'Make in India Initiative', launched by the Government of India, including several initiatives to promote the indigenous wine industry Limits on Foreign Direct Investment (FDI) were relaxed and up to 100% investment was allowed under the automatic route for brewing and distillation of liquor. Further, excise duty on local wines were reduced and custom duties on imported wines were increased to give impetus to the indigenous industry. Girish also collected details about the geographical climatic conditions required for wine production in the Indian subcontinent and found that bulk of wine 55 56 57 50 59 60 06 12 13 ILS THUS 15 19 THIS HILL S S HOLT tr Ending price of a Whare - By Betning HPR = Holding period retum 9 299RRRE 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 07 06 13 12 14 08 The Case Journal production was concentrated in two states in South India: Karnataka and Maharashtra, He listed Karnataka and Maharashtra as the most favoured options for setting up a vineyard in India. Nasik one of India's eight wine regions and home to most commercially important producers, is also a hub for wine tourism just 190 kilometres or 3.5 hours' drive north-east of metropolitan Mumbai. Harish and Girish were super excited on the day of the meeting. It has been years since they connected in a call. After exchanging pleasantries, Harish started the proceedings and gave the background of his initiative. He was able to address prima facie most questions asked by his friend. Harish mentioned about oak barrels which impacts the quality of wine. Girish also shared the facts that he had gathered to justify setting up of the wine business. Both Harish and Girish were now convinced that there was good potential for setting up a winery in India, a world-class set up that could provide wine, matching global wine companies. Considering that the new regulatory policies, tax incentives and the increasing spending power of the expanding affluent middle class would lead to increased acceptability of good quality wines in India, Harish was happy that his instinct was not wrong. Harish concluded the meeting by appointing Girish as his business advisor and requested him to come back with a detailed business plan in three weeks' time. Business Plan Girish started the assignment by approaching the Agricultural and Processed Food Products Export Development Authority and other agencies in Maharashtra. He got a positive response from the authorities and understood the process to get licenses and permits to start winery operations under fast-track single window clearance facility setup by the office. This permit would also allow selling of wines in the premises of wineries to promote "wine- tourism. He kept the currency unit as Euro, for ease of understanding by Harish. Page 8 of 41 BON and Read W V HPR = Ending p Holding period retum. 9 of 41 0 1 2 3 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 The Case Journal A winery set up would require at least five acres of land to grow grapes, along with plant and machinery for processing grapes, fermenting, conditioning, filtering and aging wine. As growing of grapes has longer gestation, no revenue was expected for the first five years. The initial capital estimate was around 720,000 covering the major requirements to start and run operations (see Exhibit 5). The project would be capital intensive and hence funding was most important for the successful launch of a winery. Girish deliberated on different avenues for raising the initial capital: 1. 100% self-contribution as initial capital investment to the business. 2. Partial self-contribution and borrowing the balance from friends and family, making them partners in the business.. 3. Borrowing partially from commercial banks and other financial institutions in India and meeting the rest through own funds. 4. Approaching Venture Capitalists for the entire or partial funding. Exhibit 5: Statement of Major Expenditures S. No. Major Head Amount () 5,00,000 y Land 5 acres@ 1,00,000 per acre 2 Grapevines @ 15,000 per acre 75,000 3 Oak barrels (10 units) @ 7,395 per barrel, 73,950 Labor Cost @ 2,000 per acre 10,000 5 Building Lease 10,000 6 Transportation cost of Grapevines 5,000 7 Miscellaneous Expenditures 46,050 Total 7,20,000 Source: Created by Authors Given his experience in this field, Girish believed that Option 3 would be suitable with the remaining amount coming from promoters. He approached a bank and was advised by the bank 1 The Case Journal manager to take a business loan (with a Fixed Deposit as security). The manager kept emphasizing on tax savings and increasing returns on the capital invested. The manager also offered 6%/annual interest on the amount of deposit, charging 10 % on the amount of borrowable limit utilized. 30 After getting clarity on all the legal formalities related to operating a winery, Girish started preparing the business plan, with a leased building. The lease rentals would be 10,000 per year for 10 years. The building would have an economic life of 30 years and was estimated at worth 65,000. The plan also incorporated purchase of five acres of land for growing /grapevine, 5,00,000. Besides this, purchase of special grapevines from New Zealand would cost 15,000 per acre. The order involved a total transportation cost of 5,000 for importing the grapevine from New Zealand. Once shipment of special grapevines from New Zealand was received, hiring of extra laborers to help plant the grapes would cost of 2,500 per acre. GORY BO The newly planted special imported grapes would need at least five years to mature. Initially, the grapevines may produce inadequate quantity of grapes through the initial five growing seasons since babyish vine grapes cannot be used for preparing wine or for any other business purpose. Even though the winery would not be able to generate income from the young grapes, further 2,000 per acre per year would be needed to fertilize and water the grapevines. On completion of five years, the grapevines would produce jam-packed good quality grapes. The grapevines would continue to produce high-quality grapes at the same intensity till the 75th season of growth. However, production of grapes generally, declines after the 50th season. As soon as production starts declining, replanting with new grapevines would be required. This would cost around 2,500 per acre per year for watering and fertilizing, till the grapevines start producing high quality grapes. hut exp T 5 6 7 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 Fr al Page 10 of 41 4 9 7 8 9 10 10 11 "1 12 12 13 14 15 17 " 41 12 42 15 43 ^^ 44 AE 45 46 47 48 49 20 50 21 51 57 58 59 60 The Case Journal Eticians Ione Bemen Page 2 of 41 camflow statement and cost Balance Next class Projected P&L Introduction Harish G, unlike his childhood friend Girish H, was a novice in finance and accounting. Over 20 years of work experience, Harish had always been a business development person. He had experience in scaling up businesses within the country as well as in international markets. Harish graduated in chemical engineering from a prestigious institution in India and started his career as sales executive with a brewery. He moved to Milan taking up a job in the operations department of Romaniszyn Winery in Franciacorta, situated in the Lombardy region of Milan. Girish H took a different path and completed a professional course in accountancy. He founded a management consulting firm specializing in accounting support, financial services and offering assistance in setting up businesses in India. His firm also grew in size and had offices in 20 cities in India employing 100+ employees. During his tenure in the winery business, Harish was successful in acquiring strong knowledge and understanding of the art of making wine (see Exhibit 1 for the wine-making process) and decided to venture into own wine business. Harish listed different alternatives for the new venture: 1. Buy/purchase/acquire an already established winery in Italy and give his own brand name. 2. Partner with an existing winery in Italy. 3. Purchase own land for plantation of grapevines and rent an office and building for installation of Plant and Machinery in Italy. 4. Purchase own land for plantation of grapevines and rent an office and building for installation of Plant and Machinery in India. 5. Buy a franchise. However, it would not have his brand name but he would be able to start his own business. bution and Retail 6 7 De 3 of 41 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 5 26 7 28 29 30 1 2 33 3435 6 7 8 27 31 32 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 07 08 Guruder Call 15 The Case Journal 6. Invest in Startups of other individuals as venture capitalist. Exhibit 1: Wine making process. WINE MAKING 10: Consumption PROCESS 9: Bottling/Labelling 6: Stabilizing Source: Created by Authors 7: Aging 14 8: Filtration 5: Blending 4: Fermentation 3: Crushing/Pressing STEP 6-10 STEP 1-5 Inde HPR = Holding period 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 3.3 34 35 36 37 38 39 40 42 43 44 45 46 **************** 48 50 51 52 51 54 56 57 06 13 07 14. 08 Guruder Call, 15 The Case Journal tementation. With his business sense and gut, Harish went with option 4; also, in the hindsight, this option helped him to return to India, as he had been longing for a while. Once clear about choice, Harish called in his trusted friend Girish to seek guidance about the venture. He set up a two-hour meeting with Girish to discuss the venture and the different challenges expected around the proposition. Knowing Girish as a detail-oriented person, Harish prepared well for the meeting. He referred several reports and articles to get an idea about the prospects of setting up a winery in India. Although the origin of wine in India can be traced back to the 13th century through historical and literary sources, roots of the. modern Indian wine industry were laid in the early 1980s.During this time, two pioneering entrepreneurs, Shymarao Chowgule and Kanwal Grover set themselves the challenge of making own wines on Indian soil. They created the largest winery of the time, Chowgule's Chateau Indage that was well known for its Omar Khayyam sparkling wine. Further, entry of Sula Vineyards, the largest Indian wine producer, in 2000, symbolised the hope of the times. The regulatory landscape around the winery business had been evolving. Maharashtra was the first State to adopt a wine policy in India in 2001. This led to the setting up of a large number of new wineries. Wine policies were adopted by three other States - Madhya Pradesh and Tamil Nadu in 2006, and Karnataka in 2007. After a good start, many producers were forced into bankruptcy by the financial crisis of 2007-2008, including the liquidation of Chowgule's Chateau Indage, the largest winery at the time and well known for its Omar Khayyam sparkling wine. Despite the difficulties posed by the burgeoning Indian wine industry, financial investors stepped in. The Indian Grape Processing Board was also set up in 2009 and India joined the OIV (International Organisation of Vive and Wine) in 2011. This was followed by the launch of big winery ventures over the years including Alpine Wineries, Fratelli Wines, Charosa dy vey Friday 70/10/201 Name of the Corse Mies Mi Dondur Page 4 of 41 Mal WORD AMBA Windvendas 15/N/ THE K HPR = Ending Ending price of a Holding period retum. F D P ge 5 of 41 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 42 41 44 46 48 51 1 59 58 59 06 13 14 15 07 08 Guruder Call The Case Journal Winery, Four Seasons, KRSMA Farms, Vallonn Vineyards and SDU Winery. Further, Pernod Ricard, Diageo and Mot Hennessy, global drink companies, too began to take an interest and set up shop in India. After studying the trends in the Indian context, Harish kept world statistics handy as that would be a follow up question from Girish. Among the top five countries in terms of revenue generation (2020) in the wine market (see Exhibit 2) United States was the leading nation with 44,099 million, followed by France (22,461 million), China (19,527 million), United Kingdom (18,890 million) and Italy (18,465 million). While comparing these global statistics with India, Harish found that the country was currently ranked 142 with a revenue generation of only 0.12 million. Exhibit 2: Revenue generation of top five countries of the world Revenue in million in the year 2020 50000 45000 40000 35000 30000 25000 20000 15000 ||| 10000 5000 D France United Kingdom Italy Source: Statista Report on Indian Wine Market 0.12 India Theplay Tury Walender 26/09/2007 Trady 24/07/2022 SENEM Sales Managem and tal Name of the Course Deye (5/06/222067 PHK HPR = Endi Holding period m 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 33 34 35 36 37 18 39 40 41 43 44 45 46 49 31 52 54 06 11.14 6.12 B1 12 13. 14 07 08 Guruder Call- The Case Journal Indian Wine Market - Revenue in million in 0.12 K 006 0.04 0.02 6 2014 2013 2012 2016 2015 2020 2017 2019. 2018 Source: Statista Report on Indian Wine Market Receiving Harish's email for a meeting was a pleasant surprise for Girish. He was also happy to assist his childhood friend in his entrepreneurial venture. Girish also prepared for the meeting and started gathering relevant statistics that could provide backing to the business proposition of setting up a winery in India. Girish looked at figures of wine imported by India in the past. five years. From past trends (sees Exhibit 3), he could see a rapid increase in the value of imported wines, especially after 2015-16. Another significant trend visible from the import data was a slight decline in imports in 2019-20 as compared to previous years. Exhibit 3: Value of Wine Imports (India) Wine Imports* (figures in USS Million) 12 2017 974 7.19 Wine of fresh grapes, including fortified wines; grape must, Years are depicted as financial year ending March Page 6 of 41 Today W HPR = Ending price Holding period retum. *********** 53 54 55 56 50 stops 12 13 14 15 16 17 18 10 20 21 23 23 24 25 26 27 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 07 14 The Case Journal of 4) Source Department of Commerce, Export Import Data Blank, Goverment of India accessed on 30.01 2021 Wholesale prices (wholesale price index-WPI) of wines in India and GDP per capita at prevailing prices (see Exhibit 4) showed a steady increase in prices after 2015. Further, prices looked stable in the recent past. Furthermore, the data for GDP per capita at prevailing prices also showcased significant rise in income of people, reflecting more disposable income. Exhibit 4: WPI of Wine and GDP per capita Year: WPI of Wine GDP per capita (current USS). 2012 100.2 1443.88 2013 104.7 1449.6067 2014 106 1573.881 2015 105.6 1605.605 2016 113.9 1732.564 2017 1174 1981.651 2018 118.5 2005.863 2019 117.3 2099.599 2020 117.6 NA Base Year: 2011-2012-100, As on April 2012 to April 2020, Source: Ministry of Commerce and Industry, Govt. of India., World Development Indicator, World Bank Girish also wanted to highlight the 'Make in India Initiative', launched by the Government of India, including several initiatives to promote the indigenous wine industry Limits on Foreign Direct Investment (FDI) were relaxed and up to 100% investment was allowed under the automatic route for brewing and distillation of liquor. Further, excise duty on local wines were reduced and custom duties on imported wines were increased to give impetus to the indigenous industry. Girish also collected details about the geographical climatic conditions required for wine production in the Indian subcontinent and found that bulk of wine 55 56 57 50 59 60 06 12 13 ILS THUS 15 19 THIS HILL S S HOLT tr Ending price of a Whare - By Betning HPR = Holding period retum 9 299RRRE 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 07 06 13 12 14 08 The Case Journal production was concentrated in two states in South India: Karnataka and Maharashtra, He listed Karnataka and Maharashtra as the most favoured options for setting up a vineyard in India. Nasik one of India's eight wine regions and home to most commercially important producers, is also a hub for wine tourism just 190 kilometres or 3.5 hours' drive north-east of metropolitan Mumbai. Harish and Girish were super excited on the day of the meeting. It has been years since they connected in a call. After exchanging pleasantries, Harish started the proceedings and gave the background of his initiative. He was able to address prima facie most questions asked by his friend. Harish mentioned about oak barrels which impacts the quality of wine. Girish also shared the facts that he had gathered to justify setting up of the wine business. Both Harish and Girish were now convinced that there was good potential for setting up a winery in India, a world-class set up that could provide wine, matching global wine companies. Considering that the new regulatory policies, tax incentives and the increasing spending power of the expanding affluent middle class would lead to increased acceptability of good quality wines in India, Harish was happy that his instinct was not wrong. Harish concluded the meeting by appointing Girish as his business advisor and requested him to come back with a detailed business plan in three weeks' time. Business Plan Girish started the assignment by approaching the Agricultural and Processed Food Products Export Development Authority and other agencies in Maharashtra. He got a positive response from the authorities and understood the process to get licenses and permits to start winery operations under fast-track single window clearance facility setup by the office. This permit would also allow selling of wines in the premises of wineries to promote "wine- tourism. He kept the currency unit as Euro, for ease of understanding by Harish. Page 8 of 41 BON and Read W V HPR = Ending p Holding period retum. 9 of 41 0 1 2 3 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 The Case Journal A winery set up would require at least five acres of land to grow grapes, along with plant and machinery for processing grapes, fermenting, conditioning, filtering and aging wine. As growing of grapes has longer gestation, no revenue was expected for the first five years. The initial capital estimate was around 720,000 covering the major requirements to start and run operations (see Exhibit 5). The project would be capital intensive and hence funding was most important for the successful launch of a winery. Girish deliberated on different avenues for raising the initial capital: 1. 100% self-contribution as initial capital investment to the business. 2. Partial self-contribution and borrowing the balance from friends and family, making them partners in the business.. 3. Borrowing partially from commercial banks and other financial institutions in India and meeting the rest through own funds. 4. Approaching Venture Capitalists for the entire or partial funding. Exhibit 5: Statement of Major Expenditures S. No. Major Head Amount () 5,00,000 y Land 5 acres@ 1,00,000 per acre 2 Grapevines @ 15,000 per acre 75,000 3 Oak barrels (10 units) @ 7,395 per barrel, 73,950 Labor Cost @ 2,000 per acre 10,000 5 Building Lease 10,000 6 Transportation cost of Grapevines 5,000 7 Miscellaneous Expenditures 46,050 Total 7,20,000 Source: Created by Authors Given his experience in this field, Girish believed that Option 3 would be suitable with the remaining amount coming from promoters. He approached a bank and was advised by the bank 1 The Case Journal manager to take a business loan (with a Fixed Deposit as security). The manager kept emphasizing on tax savings and increasing returns on the capital invested. The manager also offered 6%/annual interest on the amount of deposit, charging 10 % on the amount of borrowable limit utilized. 30 After getting clarity on all the legal formalities related to operating a winery, Girish started preparing the business plan, with a leased building. The lease rentals would be 10,000 per year for 10 years. The building would have an economic life of 30 years and was estimated at worth 65,000. The plan also incorporated purchase of five acres of land for growing /grapevine, 5,00,000. Besides this, purchase of special grapevines from New Zealand would cost 15,000 per acre. The order involved a total transportation cost of 5,000 for importing the grapevine from New Zealand. Once shipment of special grapevines from New Zealand was received, hiring of extra laborers to help plant the grapes would cost of 2,500 per acre. GORY BO The newly planted special imported grapes would need at least five years to mature. Initially, the grapevines may produce inadequate quantity of grapes through the initial five growing seasons since babyish vine grapes cannot be used for preparing wine or for any other business purpose. Even though the winery would not be able to generate income from the young grapes, further 2,000 per acre per year would be needed to fertilize and water the grapevines. On completion of five years, the grapevines would produce jam-packed good quality grapes. The grapevines would continue to produce high-quality grapes at the same intensity till the 75th season of growth. However, production of grapes generally, declines after the 50th season. As soon as production starts declining, replanting with new grapevines would be required. This would cost around 2,500 per acre per year for watering and fertilizing, till the grapevines start producing high quality grapes. hut exp T 5 6 7 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 Fr al Page 10 of 41Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started