Question

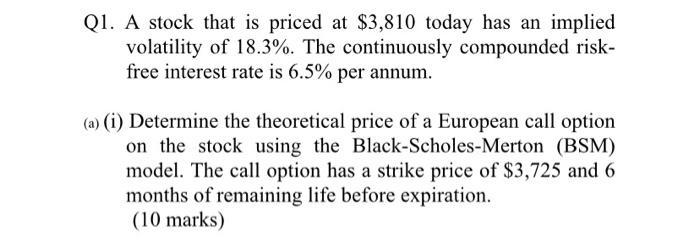

Q1. A stock that is priced at $3,810 today has an implied volatility of 18.3%. The continuously compounded risk- free interest rate is 6.5%

Q1. A stock that is priced at $3,810 today has an implied volatility of 18.3%. The continuously compounded risk- free interest rate is 6.5% per annum. (a) (i) Determine the theoretical price of a European call option on the stock using the Black-Scholes-Merton (BSM) model. The call option has a strike price of $3,725 and 6 months of remaining life before expiration. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Gather the parameters Spot price S03810 Strike price K3725 Time to expiration T6 months c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Derivatives Markets

Authors: Rober L. Macdonald

4th edition

321543084, 978-0321543080

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App