Answered step by step

Verified Expert Solution

Question

1 Approved Answer

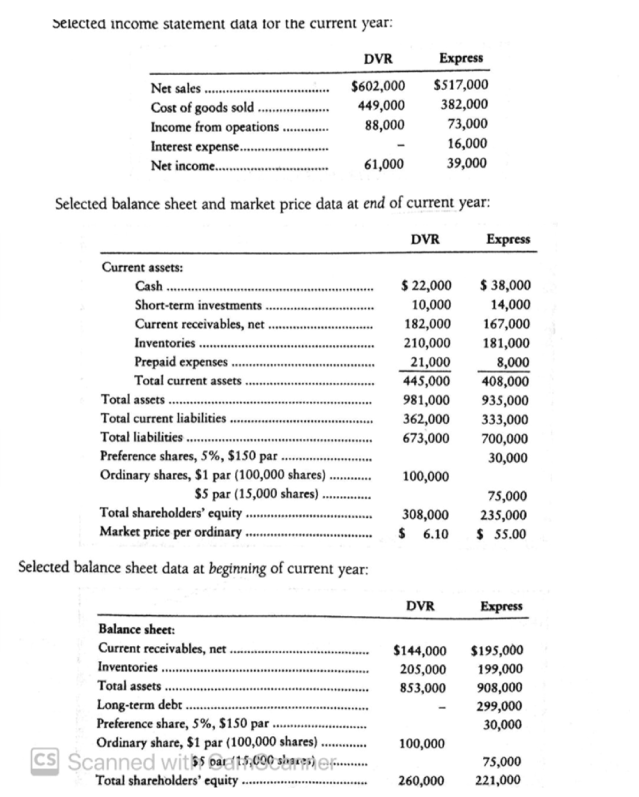

Q.2 : Assume that you are considering purchasing shares as an investment. You have narrowed the choice to DVR.com and Express Shops and have assembled

Q.2 : Assume that you are considering purchasing shares as an investment.You have narrowed the choice to DVR.com and Express Shops and have assembled the following data.

Requirements:

Compute the following ratios for both companies for the current year and decide which company's shares better fit your investment strategy.

- Acid-test ratio

- Current Ratio

- Times-interest-earned ratio

- Inventory turnover

- Number of days sales in inventory

- Return on ordinary shareholders' equity

- Earnings per ordinary share

- Debt ratio = Total Liabilities Total Assets

- Price/earnings ratio

- Assets Turnover

- Return on Total Assets

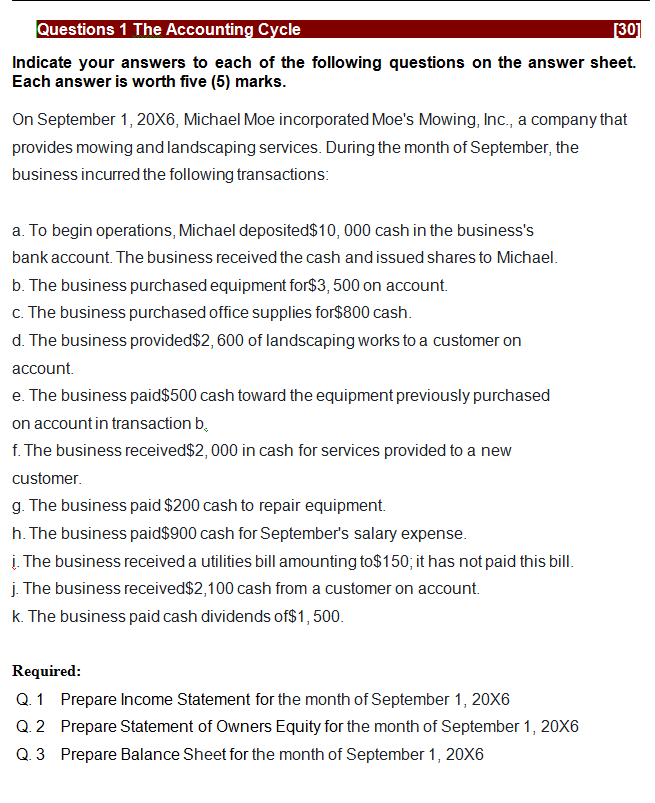

Questions 1 The Accounting Cycle [30] Indicate your answers to each of the following questions on the answer sheet. Each answer is worth five (5) marks. On September 1, 20X6, Michael Moe incorporated Moe's Mowing, Inc., a company that provides mowing and landscaping services. During the month of September, the business incurred the following transactions: a. To begin operations, Michael deposited$10,000 cash in the business's bank account. The business received the cash and issued shares to Michael. b. The business purchased equipment for$3,500 on account c. The business purchased office supplies for$800 cash. d. The business provided$2,600 of landscaping works to a customer on account e. The business paid$500 cash toward the equipment previously purchased on account in transaction be f. The business received$2,000 in cash for services provided to a new customer. g. The business paid $200 cash to repair equipment h. The business paid$900 cash for September's salary expense. . The business received a utilities bill amounting to$150; it has not paid this bill. j. The business received$2,100 cash from a customer on account. k. The business paid cash dividends of$1,500. Required: Q. 1 Prepare Income Statement for the month of September 1, 20X6 Q.2 Prepare Statement of Owners Equity for the month of September 1, 20X6 Q.3 Prepare Balance Sheet for the month of September 1, 20X6 Selected income statement data for the current year: Net sales Cost of goods sold Income from opeations Interest expense.... Net income....... DVR $602,000 449,000 88,000 Express $517,000 382,000 73,000 16,000 39,000 61,000 Selected balance sheet and market price data at end of current year: DVR Express Current assets: Cash $ 22,000 $ 38,000 Short-term investments 10,000 14,000 Current receivables, net 182,000 167,000 Inventories .. 210,000 181,000 Prepaid expenses 21,000 8,000 Total current assets 445,000 408,000 Total assets. 981,000 935,000 Total current liabilities. 362,000 333,000 Total liabilities. 673,000 700,000 Preference shares, 5%, $150 par 30,000 Ordinary shares, $1 par (100,000 shares). 100,000 $5 par (15,000 shares). 75,000 Total shareholders' equity ....... 308,000 235,000 Market price per ordinary $ 6.10 $ 55.00 Selected balance sheet data at beginning of current year: DVR Express Balance sheet: Current receivables, net $144,000 $195,000 Inventories.. 205,000 199,000 Total assets. 853,000 908,000 Long-term debe 299,000 Preference share, 5%, $150 par. 30,000 Ordinary share, $1 par (100,000 shares) 100,000 cs Scanned wit5 par 15,00 shares...... 75,000 Total shareholders' equity. 260,000 221,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started