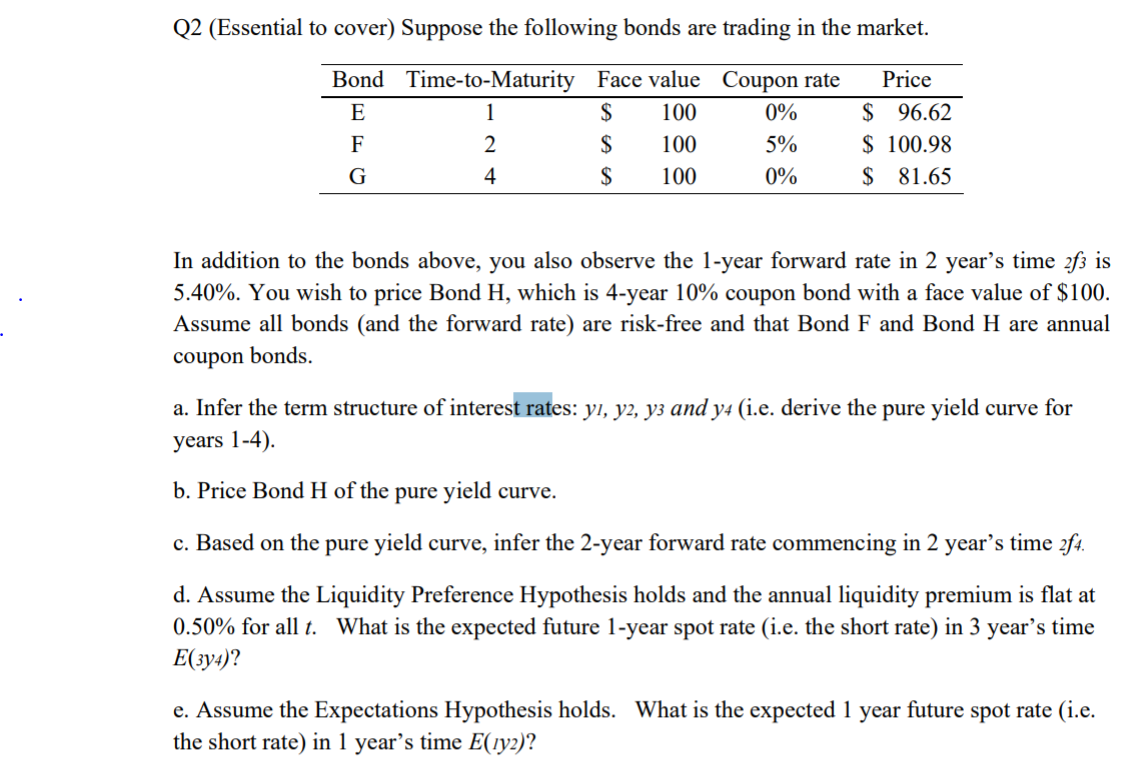

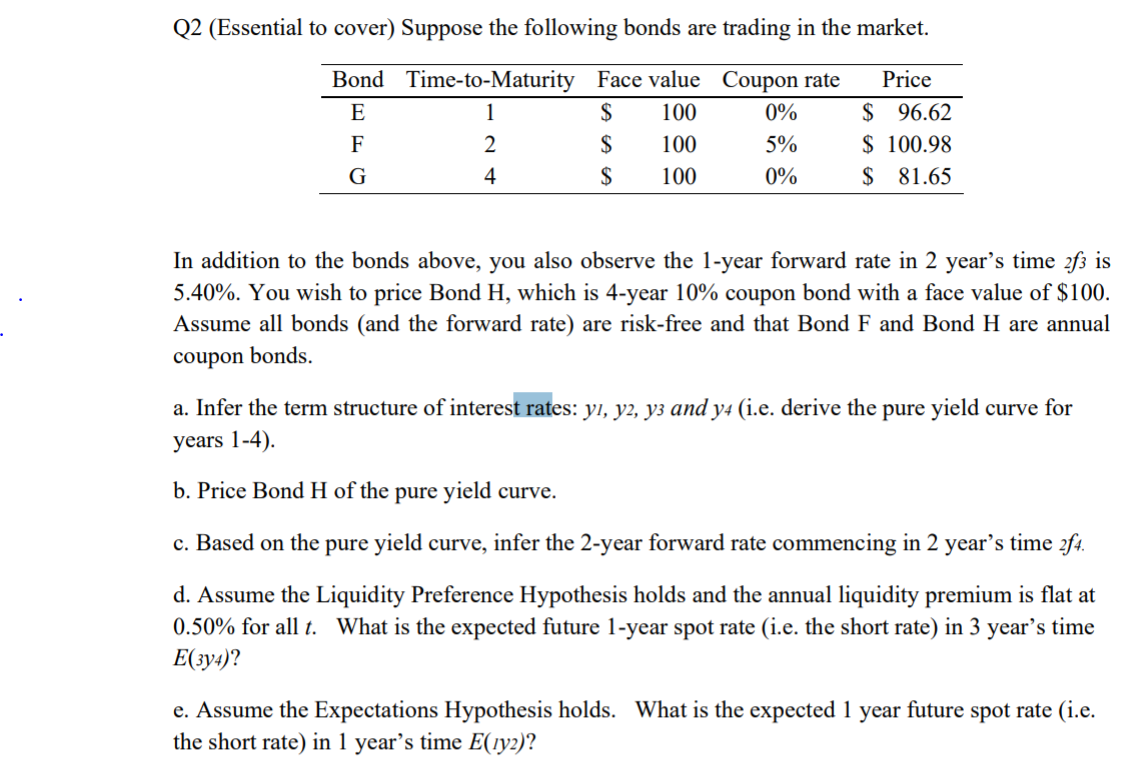

Q2 (Essential to cover) Suppose the following bonds are trading in the market. Bond Time-to-Maturity Face value Coupon rate $ 100 0% 100 5% $ 100 0% Price $ 96.62 $ 100.98 $ 81.65 100 0S S In addition to the bonds above, you also observe the 1-year forward rate in 2 year's time 2f3 is 5.40%. You wish to price Bond H, which is 4-year 10% coupon bond with a face value of $100. Assume all bonds (and the forward rate) are risk-free and that Bond F and Bond H are annual coupon bonds. a. Infer the term structure of interest rates: yi, ya, y3 and y4 (i.e. derive the pure yield curve for years 1-4). b. Price Bond H of the pure yield curve. c. Based on the pure yield curve, infer the 2-year forward rate commencing in 2 year's time 24. d. Assume the Liquidity Preference Hypothesis holds and the annual liquidity premium is flat at 0.50% for all t. What is the expected future 1-year spot rate (i.e. the short rate) in 3 year's time E(394)? e. Assume the Expectations Hypothesis holds. What is the expected 1 year future spot rate (i.e. the short rate) in 1 year's time E(162)? Q2 (Essential to cover) Suppose the following bonds are trading in the market. Bond Time-to-Maturity Face value Coupon rate $ 100 0% 100 5% $ 100 0% Price $ 96.62 $ 100.98 $ 81.65 100 0S S In addition to the bonds above, you also observe the 1-year forward rate in 2 year's time 2f3 is 5.40%. You wish to price Bond H, which is 4-year 10% coupon bond with a face value of $100. Assume all bonds (and the forward rate) are risk-free and that Bond F and Bond H are annual coupon bonds. a. Infer the term structure of interest rates: yi, ya, y3 and y4 (i.e. derive the pure yield curve for years 1-4). b. Price Bond H of the pure yield curve. c. Based on the pure yield curve, infer the 2-year forward rate commencing in 2 year's time 24. d. Assume the Liquidity Preference Hypothesis holds and the annual liquidity premium is flat at 0.50% for all t. What is the expected future 1-year spot rate (i.e. the short rate) in 3 year's time E(394)? e. Assume the Expectations Hypothesis holds. What is the expected 1 year future spot rate (i.e. the short rate) in 1 year's time E(162)