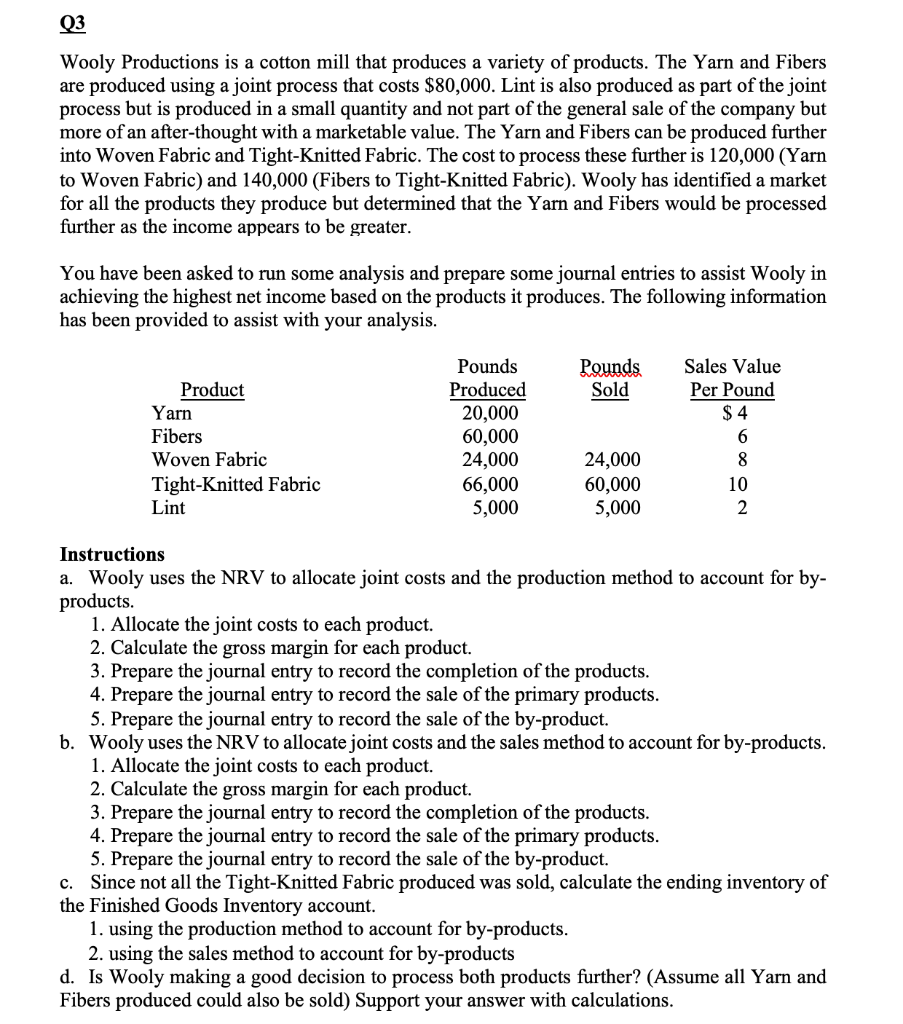

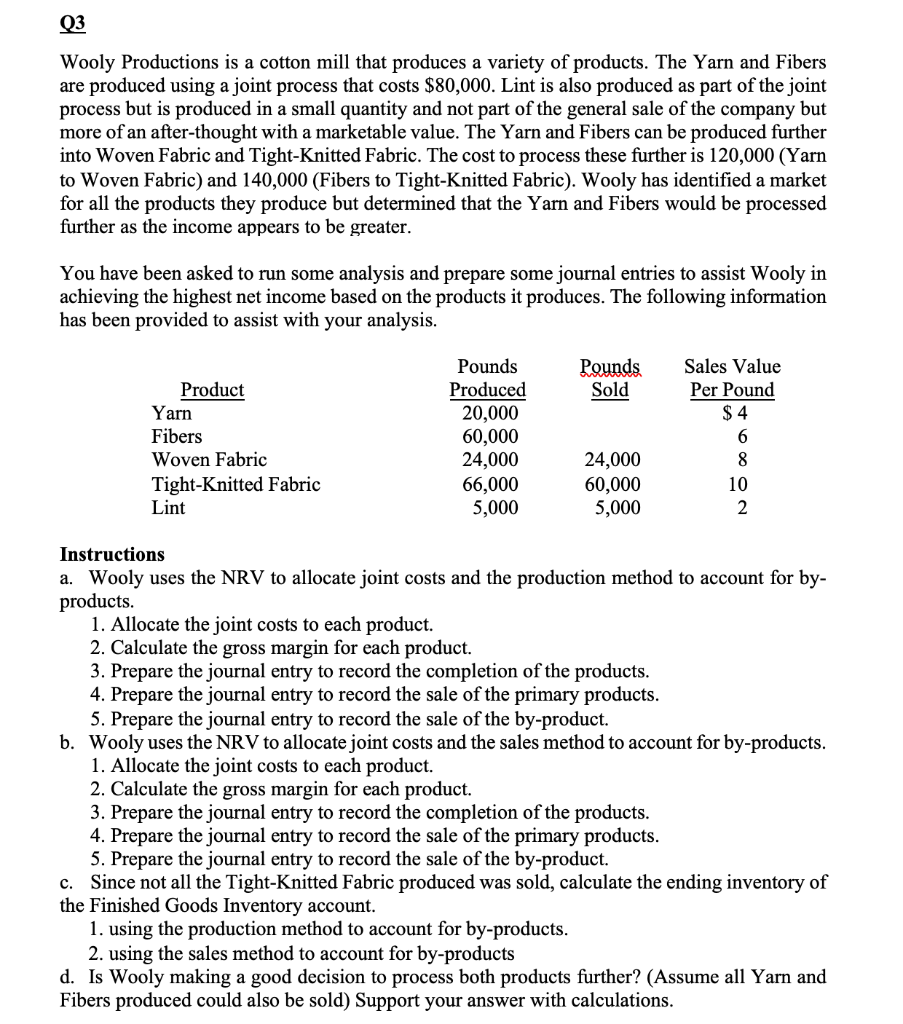

Q3 Wooly Productions is a cotton mill that produces a variety of products. The Yarn and Fibers are produced using a joint process that costs $80,000. Lint is also produced as part of the joint process but is produced in a small quantity and not part of the general sale of the company but more of an after-thought with a marketable value. The Yarn and Fibers can be produced further into Woven Fabric and Tight-Knitted Fabric. The cost to process these further is 120,000 (Yarn to Woven Fabric) and 140,000 (Fibers to Tight-Knitted Fabric). Wooly has identified a market for all the products they produce but determined that the Yarn and Fibers would be processed further as the income appears to be greater. You have been asked to run some analysis and prepare some journal entries to assist Wooly in achieving the highest net income based on the products it produces. The following information has been provided to assist with your analysis. Instructions a. Wooly uses the NRV to allocate joint costs and the production method to account for byproducts. 1. Allocate the joint costs to each product. 2. Calculate the gross margin for each product. 3. Prepare the journal entry to record the completion of the products. 4. Prepare the journal entry to record the sale of the primary products. 5. Prepare the journal entry to record the sale of the by-product. b. Wooly uses the NRV to allocate joint costs and the sales method to account for by-products. 1. Allocate the joint costs to each product. 2. Calculate the gross margin for each product. 3. Prepare the journal entry to record the completion of the products. 4. Prepare the journal entry to record the sale of the primary products. 5. Prepare the journal entry to record the sale of the by-product. c. Since not all the Tight-Knitted Fabric produced was sold, calculate the ending inventory of the Finished Goods Inventory account. 1. using the production method to account for by-products. 2. using the sales method to account for by-products d. Is Wooly making a good decision to process both products further? (Assume all Yarn and Fibers produced could also be sold) Support your answer with calculations