Answered step by step

Verified Expert Solution

Question

1 Approved Answer

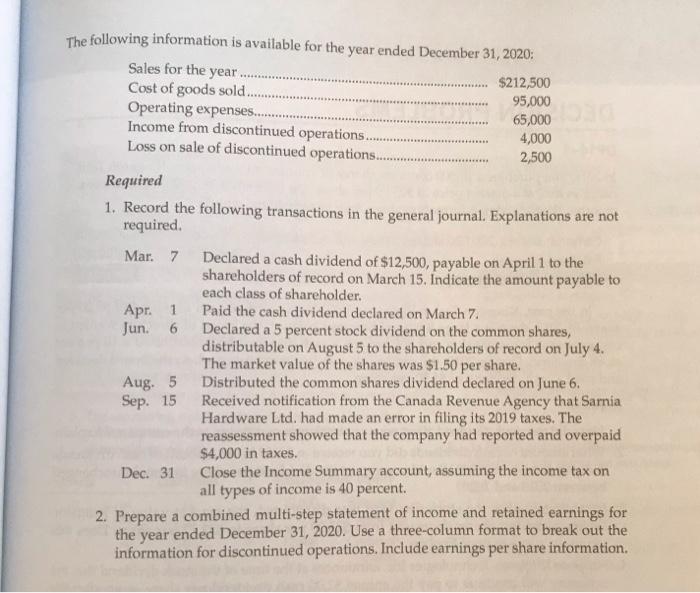

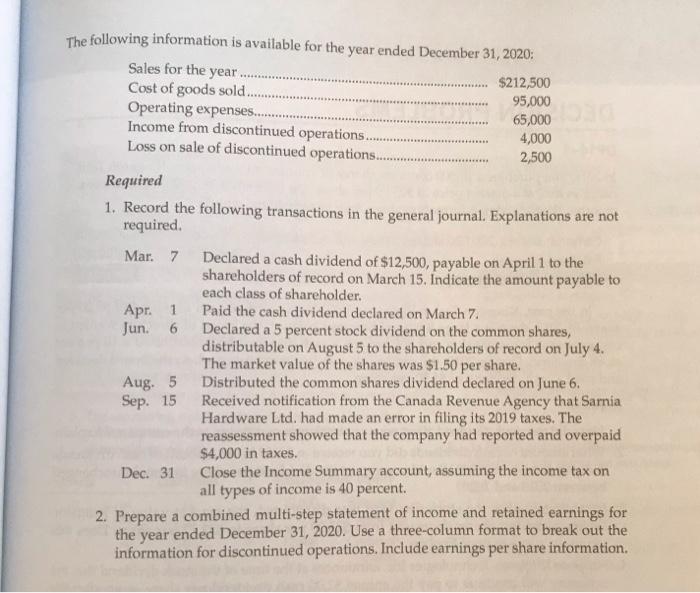

Q4 -Assign 2 financial accounting II The following information is available for the year ended December 31.2m2 : Required 1. Record the following transactions in

Q4 -Assign 2 financial accounting II

The following information is available for the year ended December 31.2m2 : Required 1. Record the following transactions in the general journal. Explanations are not required. Mar. 7 Declared a cash dividend of $12,500, payable on April 1 to the shareholders of record on March 15. Indicate the amount payable to each class of shareholder. Apr. 1 Paid the cash dividend declared on March 7. Jun. 6 Declared a 5 percent stock dividend on the common shares, distributable on August 5 to the shareholders of record on July 4. The market value of the shares was $1.50 per share. Aug. 5 Distributed the common shares dividend declared on June 6 . Sep. 15 Received notification from the Canada Revenue Agency that Sarnia Hardware Ltd. had made an error in filing its 2019 taxes. The reassessment showed that the company had reported and overpaid $4,000 in taxes. Dec. 31 Close the Income Summary account, assuming the income tax on all types of income is 40 percent. 2. Prepare a combined multi-step statement of income and retained earnings for the year ended December 31, 2020. Use a three-column format to break out the information for discontinued operations. Include earnings per share information. Q4 P14-9B (20 marks) Textbook Pages 812-813 (continued) P14-9B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started