Answered step by step

Verified Expert Solution

Question

1 Approved Answer

questins needed 5-7-8-9 and 21-31-32-33 you can pick what you prefer 1. Which of the following capital budgeting techniques ignore the time value of money?

questins needed 5-7-8-9 and 21-31-32-33 you can pick what you prefer

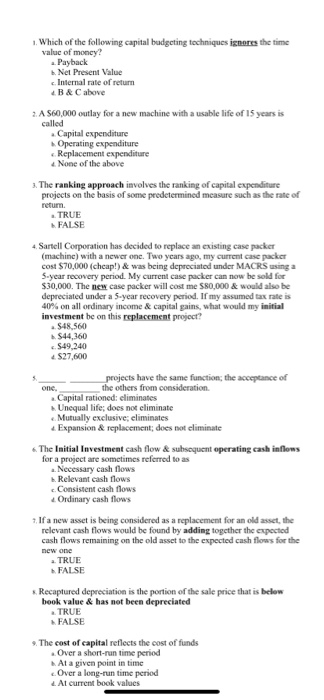

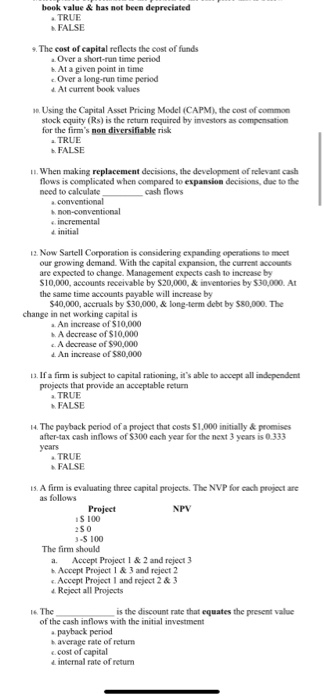

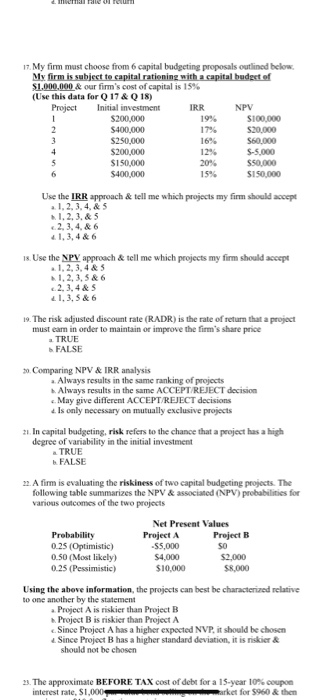

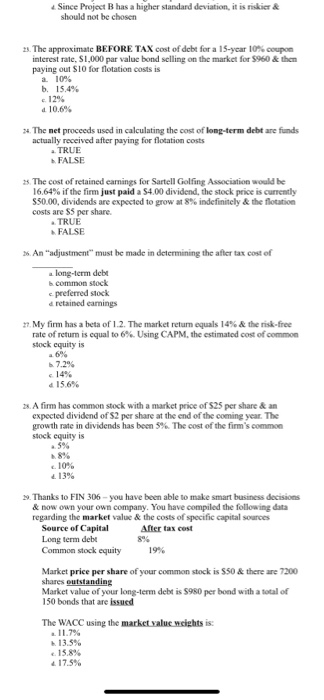

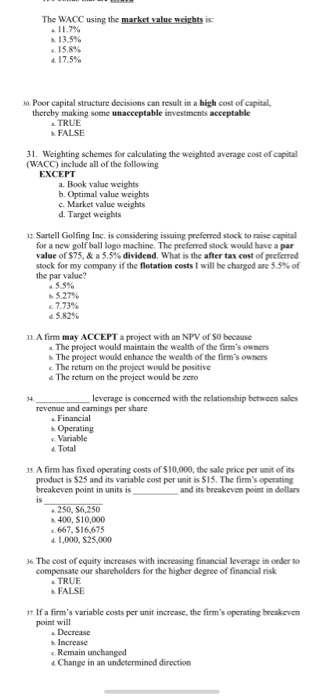

1. Which of the following capital budgeting techniques ignore the time value of money? a. Payback Net Present Value Internal rate of return B& C above 2. A $60,000 outlay for a new machine with a usable life of 15 years is called Capital expenditure Operating expenditure Replacement expenditure None of the above 3. The ranking approach involves the ranking of capital expenditure projects on the basis of some predetermined measure such as the rate of retum. TRUE FALSE 4. Sartell Corporation has decided to replace an existing case packer (machine) with a newer one. Two years ago, my current case packer cost $70,000 (cheap!) & was being depreciated under MACRS using a 5-year recovery period. My current case packer can now be sold for $30,000. The new case packer will cost me S80,000 & would also be depreciated under a 5-year recovery period. If my assumed tax rate is 40% on all ordinary income & capital gains, what would my initial investment be on this replacement project? S48560 $44,360 $49.240 S27,600 one. projects have the same function, the acceptance of the others from consideration a Capital rationed: eliminates Unequal life; does not eliminate Mutually exclusive: eliminates 4 Expansion & replacement does not climinate The Initial Investment cash flow & subsequent operating cash inflows for a project are sometimes referred to as a. Necessary cash flows Relevant cash flows c. Consistent cash flows Ordinary cash flows 7. If a new asset is being considered as a replacement for an old asset, the relevant cash flows would be found by adding together the expected cash flows remaining on the old asset to the expected cash flows for the new one a. TRUE FALSE Recaptured depreciation is the portion of the sale price that is below book value & has not been depreciated TRUE FALSE The cost of capital reflects the cost of funds Over a short-run time period At a given point in time Over a long-run time period . Al current book values book value & has not been depreciated TRUE FALSE 9. The cost of capital reflects the cost of funds Over a short-run time period At a given point in time Over a long-run time period At current book values Using the Capital Asset Pricing Model (CAPM), the cost of common stock cquity (Rs) is the return required by investors as compensation for the firm's non diversifiable risk TRUE FALSE 11. When making replacement decisions, the development of relevant cash flows is complicated when compared to expansion decisions, due to the need to calculate cash flows a conventional non-conventional incremental 12. Now Sartell Corporation is considering expanding operations to meet our growing demand. With the capital expansion, the current accounts are expected to change Management expects cash to increase by S10,000, accounts receivable by $20,000, & inventories by $30,000. At the same time accounts payable will increase by $40,000, accruals by $30,000, & long-term debt by $80,000. The change in networking capital is An increase of $10,000 A decrease of S10,000 A decrease of $90,000 d. An increase of $80,000 13. If a firm is subject to capital rationing, it's able to accept all independent projects that provide an acceptable retum TRUE FALSE 14. The payback period of a project that costs $1.000 initially & promises after-tax cash inflows of $300 each year for the next 3 years is 0.333 years TRUE FALSE is. A firm is evaluating three capital projects. The NVP for cach project are as follows Project NPV IS 100 2SO J-S100 The firm should a. Accept Project 1 & 2 and reject 3 Accept Project 1 & 3 and reject 2 Accept Project and reject 2 & 3 Reject all Projects 16 The is the discount rate that equates the present value of the cash inflows with the initial investment payback period average rate of return c. cost of capital internal rate of return 17. My firm must choose from 6 capital budgeting proposals outlined below My firm is subject to capital rationing with a capital budget of $1,000,000 & our firm's cost of capital is 15% (Use this data for 17 & 018) Project Initial investment IRR NPV $200,000 SI00.000 $400,000 17% $20.000 $250.000 16 550.000 $200,000 12 S-5.000 SI 50.000 2016 S50.000 $400,000 SI50.000 19% Use the IRR approach & tell me which projects my firm should accept 1. 2. 3. 4. & 5 1.2.3. & 5 2,3,4,&6 41.3.4&6 18. Use the NPV approach & tell me which projects my firm should accept 1,2,3,463 1, 2, 3, 5&6 2.3.4& s 2.1.3. 5& 6 19. The risk adjusted discount rate (RADR) is the rate of return that a project must earn in order to maintain or improve the firm's share price TRUE FALSE 30 Comparing NPV & IRR analysis Always results in the same ranking of projects Always results in the same ACCEPT REJECT decision .. May give different ACCEPT REJECT decisions Is only necessary on mutually exclusive projects In capital budgeting, risk refers to the chance that a project has a high degree of variability in the initial investment TRUE FALSE 22. A firm is evaluating the riskiness of two capital budgeting projects. The following table summarizes the NPV & associated (NPV) probabilities for various outcomes of the two projects Probability 0.25 (Optimistic) 0.50 (Most likely) 0.25 (Pessimistic) Net Present Values Project A Project B -S5,000 SO $4,000 $2,000 $10,000 $8.000 Using the above information, the projects can best be characterized relative to one another by the statement a Project A is riskier than Project B Project Bis riskier than Project A Since Project A has a higher expected NVP. it should be chosen Since Project B has a higher standard deviation, it is riskier & should not be chosen 23. The approximate BEFORE TAX cost of debt for a 15-year 10% coupon interest rate, S1,000 market for $960 & then Since Project B has a higher standard deviation, it is riskier & should not be chosen 23. The approximate BEFORE TAX cost of debt for a 15-year 10% coupon interest rate, S1,000 par value bond selling on the market for $960 & them paying out SIO for flotation costs is a 10% b. 15.4% 12 a 10.6% 24. The net proceeds used in calculating the cost of long-term debt are funds actually received after paying for flotation costs TRUE FALSE 2. The cost of retained earnings for Sartell Golfing Association would be 16,64% if the firm just paid a 54.00 dividend, the stock price is currently $50.00, dividends are expected to grow at 8% indefinitely & the flotation costs are 85 per share. TRUE FALSE 36. An adjustment" must be made in determining the after tax cost of a long-term debt b.common stock preferred stock a retained earnings 22. My firm has a beta of 1.2. The market retum equals 14% & the risk-free rate of return is equal to 6%. Using CAPM, the estimated cost of common stock equity is a 6% 7.296 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started