Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 1 All - in - one funds offers three asset allocation funds: Aggressive, Moderate, and Conservative with means ( technically the log of

Question

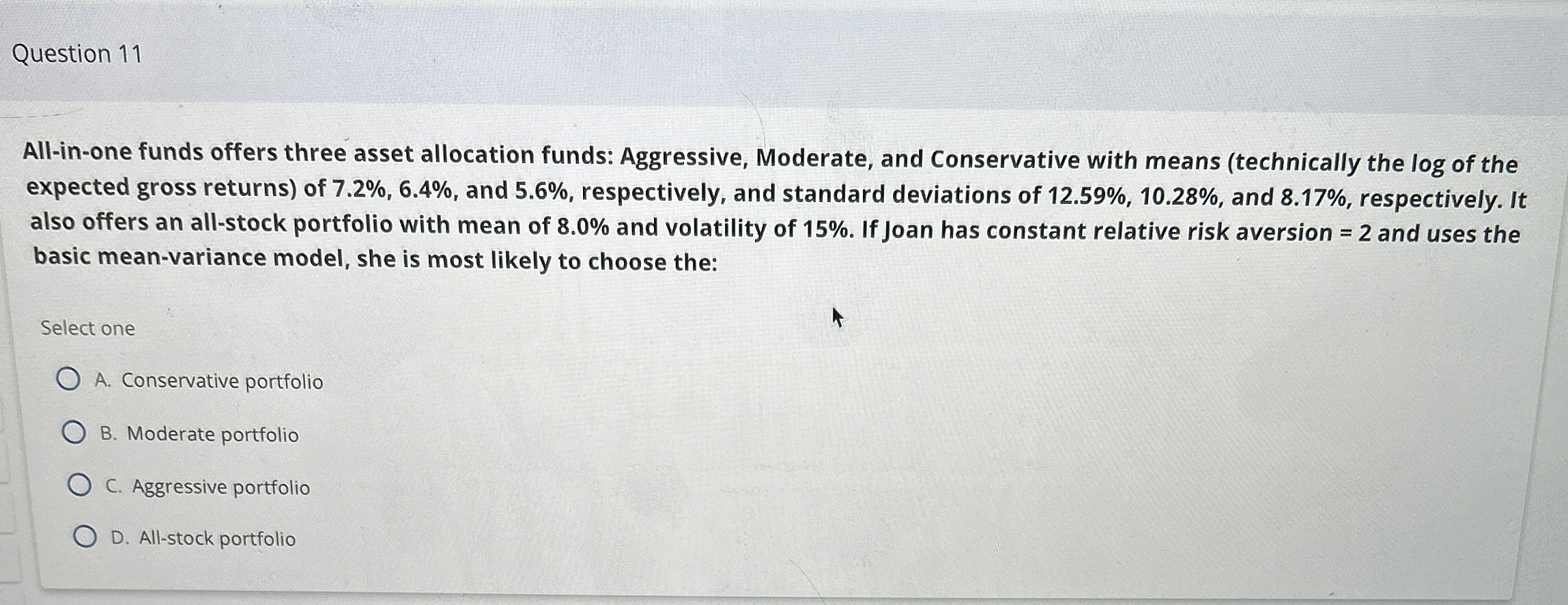

Allinone funds offers three asset allocation funds: Aggressive, Moderate, and Conservative with means technically the log of the

expected gross returns of and respectively, and standard deviations of and respectively. It

also offers an allstock portfolio with mean of and volatility of If Joan has constant relative risk aversion and uses the

basic meanvariance model, she is most likely to choose the:

Select one

A Conservative portfolio

B Moderate portfolio

C Aggressive portfolio

D Allstock portfolio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started