Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 1, 2,3,4 together will upvote thanks :) Suppose you purchase a home for $350,000. After making a down payment of $50,000, you borrow the

question 1, 2,3,4 together

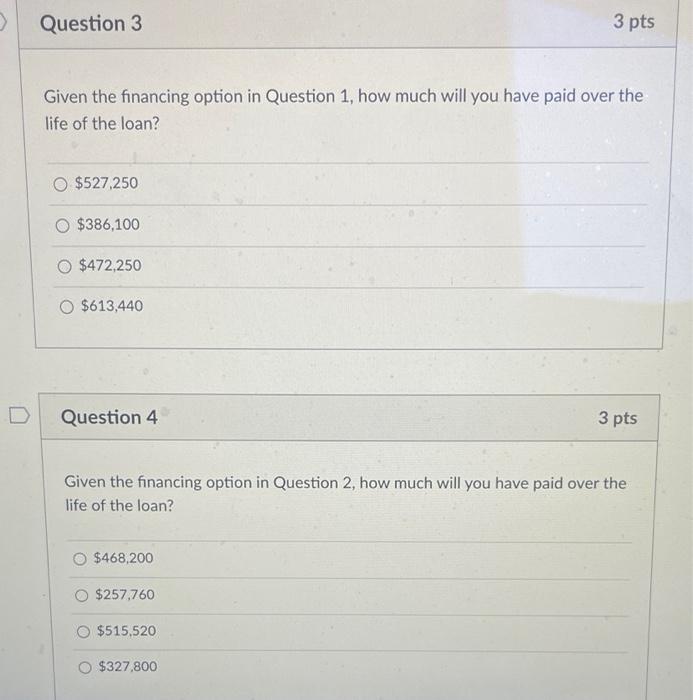

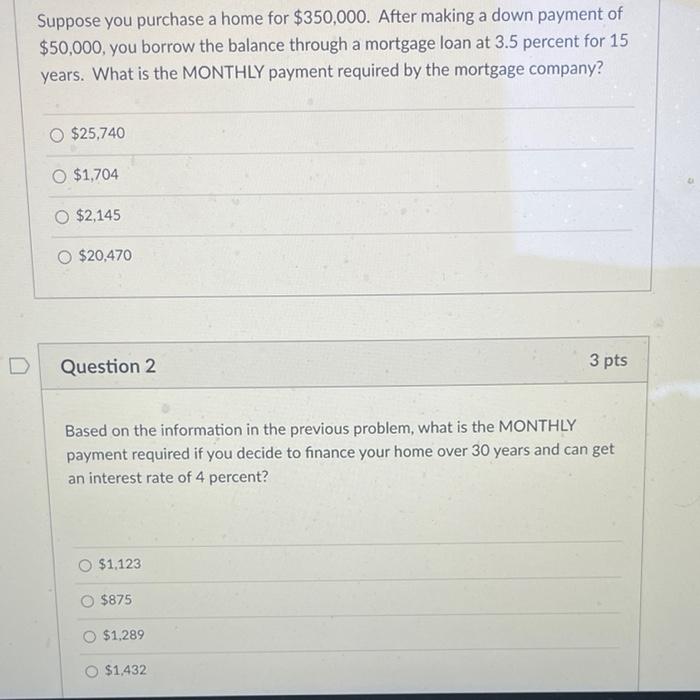

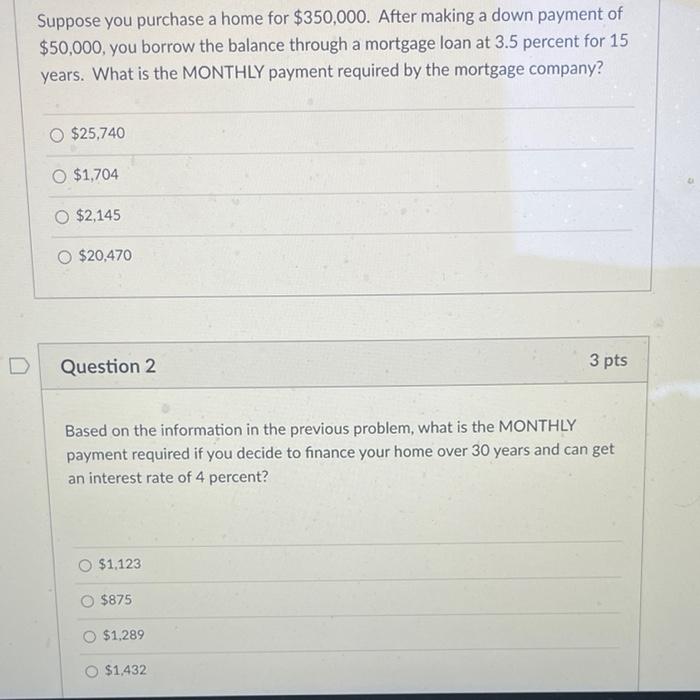

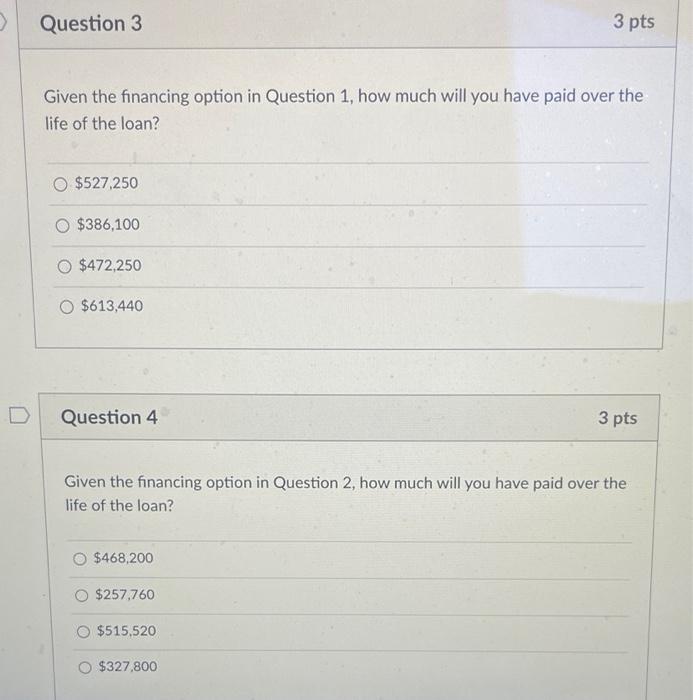

Suppose you purchase a home for $350,000. After making a down payment of $50,000, you borrow the balance through a mortgage loan at 3.5 percent for 15 years. What is the MONTHLY payment required by the mortgage company? $25,740 O $1,704 $2,145 $20,470 D Question 2 3 pts Based on the information in the previous problem, what is the MONTHLY payment required if you decide to finance your home over 30 years and can get an interest rate of 4 percent? $1,123 O $875 $1,289 O $1.432 > Question 3 3 pts Given the financing option in Question 1, how much will you have paid over the life of the loan? $527,250 O $386,100 $472,250 $613,440 Question 4 3 pts Given the financing option in Question 2, how much will you have paid over the life of the loan? $468,200 $257,760 $515,520 $327,800 will upvote thanks :)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started