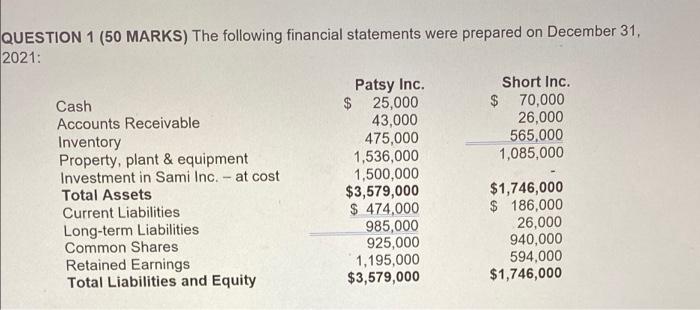

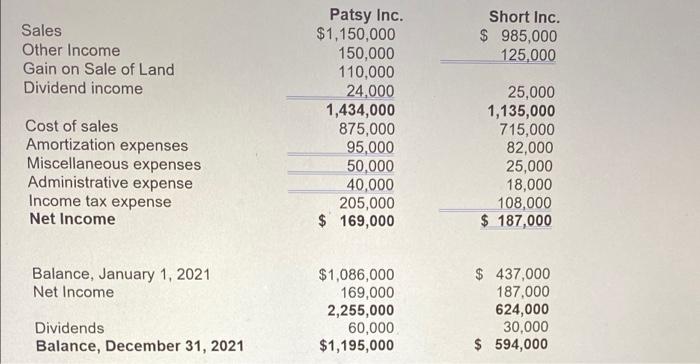

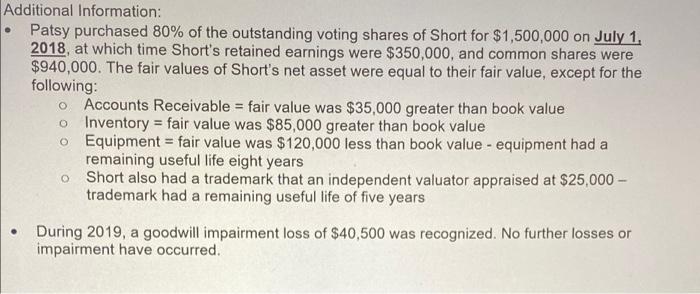

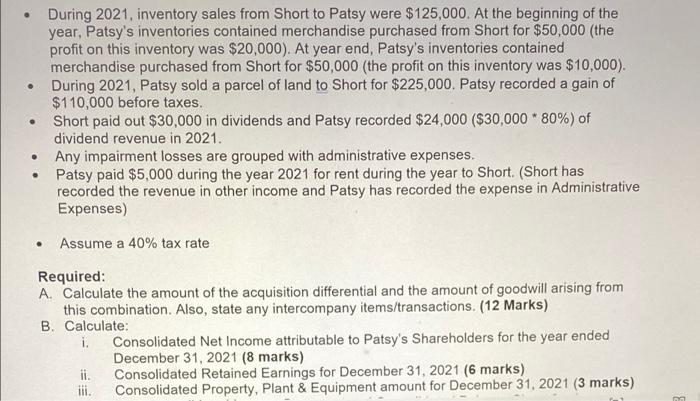

QUESTION 1 (50 MARKS) The following financial statements were prepared on December 31, 2021: Short Inc. $ 70,000 26,000 565,000 1,085,000 Cash Accounts Receivable Inventory Property, plant & equipment Investment in Sami Inc. - at cost Total Assets Current Liabilities Long-term Liabilities Common Shares Retained Earnings Total Liabilities and Equity Patsy Inc. $ 25,000 43,000 475,000 1,536,000 1,500,000 $3,579,000 $ 474,000 985,000 925,000 1,195,000 $3,579,000 $1,746,000 $ 186,000 26,000 940,000 594,000 $1,746,000 Sales Other Income Gain on Sale of Land Dividend income Short Inc. $ 985,000 125,000 Cost of sales Amortization expenses Miscellaneous expenses Administrative expense Income tax expense Net Income Patsy Inc. $1,150,000 150,000 110,000 24,000 1,434,000 875,000 95,000 50,000 40,000 205,000 $ 169,000 25,000 1,135,000 715,000 82,000 25,000 18,000 108,000 $ 187,000 Balance, January 1, 2021 Net Income $1,086,000 169,000 2,255,000 60,000 $1,195,000 $ 437,000 187,000 624,000 30,000 $ 594,000 Dividends Balance, December 31, 2021 Additional Information: Patsy purchased 80% of the outstanding voting shares of Short for $1,500,000 on July 1, 2018, at which time Short's retained earnings were $350,000, and common shares were $940,000. The fair values of Short's net asset were equal to their fair value, except for the following: Accounts Receivable = fair value was $35,000 greater than book value o Inventory = fair value was $85,000 greater than book value o Equipment = fair value was $120,000 less than book value - equipment had a remaining useful life eight years o Short also had a trademark that an independent valuator appraised at $25,000 - trademark had a remaining useful life of five years During 2019, a goodwill impairment loss of $40,500 was recognized. No further losses or impairment have occurred. During 2021, inventory sales from Short to Patsy were $125,000. At the beginning of the year, Patsy's inventories contained merchandise purchased from Short for $50,000 (the profit on this inventory was $20,000). At year end, Patsy's inventories contained merchandise purchased from Short for $50,000 (the profit on this inventory was $10,000). . During 2021, Patsy sold a parcel of land to Short for $225,000. Patsy recorded a gain of $110,000 before taxes. Short paid out $30,000 in dividends and Patsy recorded $24,000 ($30,000 * 80%) of dividend revenue in 2021. Any impairment losses are grouped with administrative expenses. Patsy paid $5,000 during the year 2021 for rent during the year to Short. (Short has recorded the revenue in other income and Patsy has recorded the expense in Administrative Expenses) . Assume a 40% tax rate Required: A. Calculate the amount of the acquisition differential and the amount of goodwill arising from this combination. Also, state any intercompany items/transactions. (12 Marks) B. Calculate: i. Consolidated Net Income attributable to Patsy's Shareholders for the year ended December 31, 2021 (8 marks) ii. Consolidated Retained Earnings for December 31, 2021 (6 marks) iii. Consolidated Property, Plant & Equipment amount for December 31, 2021