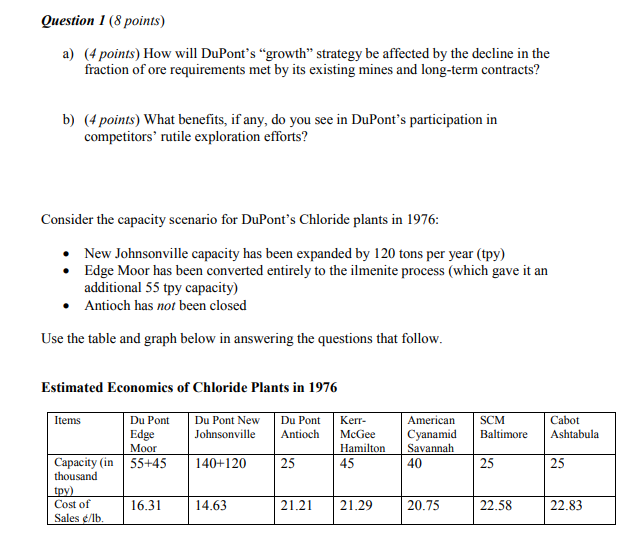

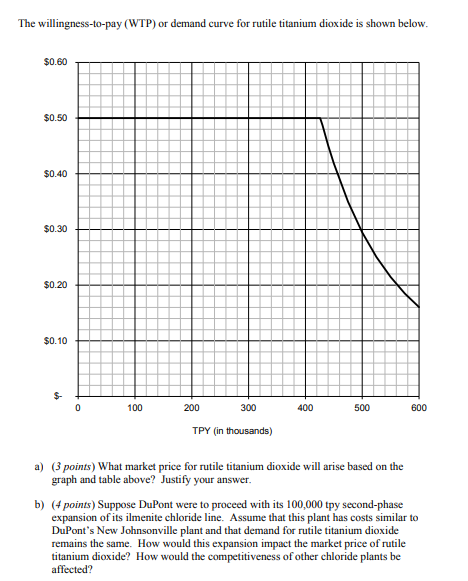

Question 1 (8 points) a) (4 points) How will DuPont's "growth strategy be affected by the decline in the fraction of ore requirements met by its existing mines and long-term contracts? b) (4 points) What benefits, if any, do you see in DuPont's participation in competitors' rutile exploration efforts? Consider the capacity scenario for DuPont's Chloride plants in 1976: New Johnsonville capacity has been expanded by 120 tons per year (tpy) Edge Moor has been converted entirely to the ilmenite process (which gave it an additional 55 tpy capacity) Antioch has not been closed Use the table and graph below in answering the questions that follow. Estimated Economics of Chloride Plants in 1976 Du Pont New Johnsonville Du Pont Antioch American Cyanamid Savannah 40 SCM Baltimore Cabot Ashtabula Kerr- McGee Hamilton 45 Items Du Pont Edge Moor Capacity (in 55+45 thousand tpy) Cost of 16.31 Sales 140+120 25 25 25 14.63 21.21 21.29 20.75 22.58 22.83 The willingness-to-pay (WTP) or demand curve for rutile titanium dioxide is shown below. $0.60 $0.50 $0.40 $0.30 $0.20 $0.10 $ 0 100 200 300 400 500 600 TPY (in thousands) a) (3 points) What market price for rutile titanium dioxide will arise based on the graph and table above? Justify your answer. b) (4 points) Suppose DuPont were to proceed with its 100,000 tpy second-phase expansion of its ilmenite chloride line. Assume that this plant has costs similar to DuPont's New Johnsonville plant and that demand for rutile titanium dioxide remains the same. How would this expansion impact the market price of rutile titanium dioxide? How would the competitiveness of other chloride plants be affected? Question 1 (8 points) a) (4 points) How will DuPont's "growth strategy be affected by the decline in the fraction of ore requirements met by its existing mines and long-term contracts? b) (4 points) What benefits, if any, do you see in DuPont's participation in competitors' rutile exploration efforts? Consider the capacity scenario for DuPont's Chloride plants in 1976: New Johnsonville capacity has been expanded by 120 tons per year (tpy) Edge Moor has been converted entirely to the ilmenite process (which gave it an additional 55 tpy capacity) Antioch has not been closed Use the table and graph below in answering the questions that follow. Estimated Economics of Chloride Plants in 1976 Du Pont New Johnsonville Du Pont Antioch American Cyanamid Savannah 40 SCM Baltimore Cabot Ashtabula Kerr- McGee Hamilton 45 Items Du Pont Edge Moor Capacity (in 55+45 thousand tpy) Cost of 16.31 Sales 140+120 25 25 25 14.63 21.21 21.29 20.75 22.58 22.83 The willingness-to-pay (WTP) or demand curve for rutile titanium dioxide is shown below. $0.60 $0.50 $0.40 $0.30 $0.20 $0.10 $ 0 100 200 300 400 500 600 TPY (in thousands) a) (3 points) What market price for rutile titanium dioxide will arise based on the graph and table above? Justify your answer. b) (4 points) Suppose DuPont were to proceed with its 100,000 tpy second-phase expansion of its ilmenite chloride line. Assume that this plant has costs similar to DuPont's New Johnsonville plant and that demand for rutile titanium dioxide remains the same. How would this expansion impact the market price of rutile titanium dioxide? How would the competitiveness of other chloride plants be affected