Question 1 and 2 thanks

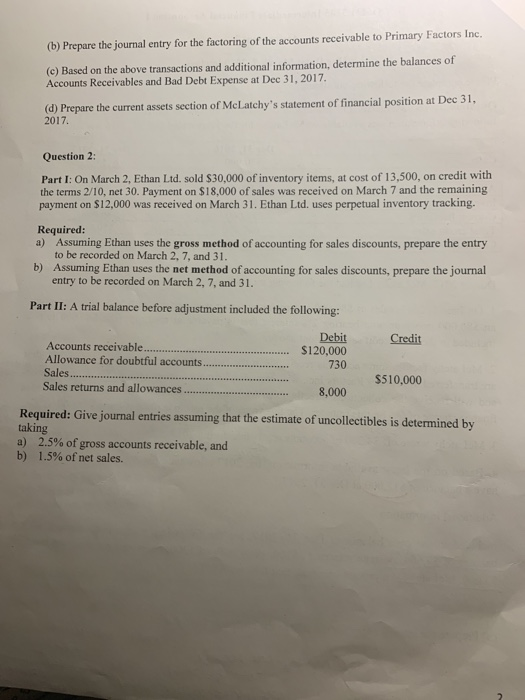

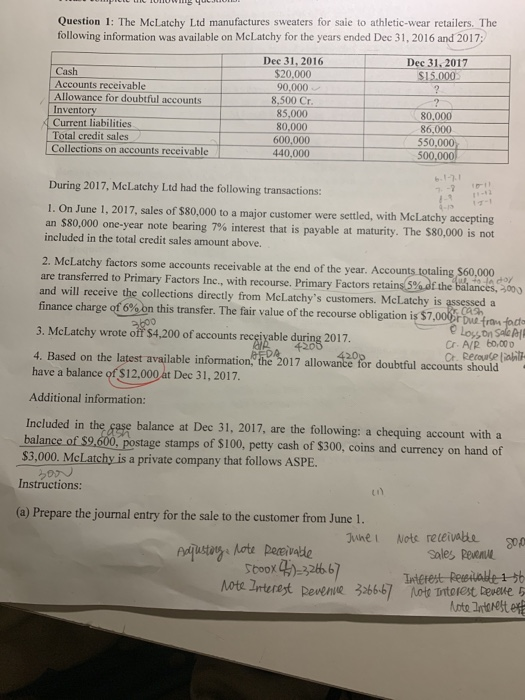

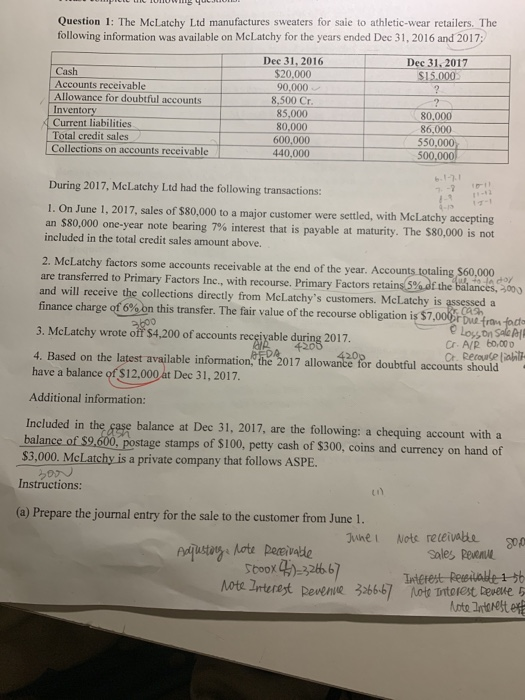

Question 1: The McLatchy Ltd manufactures sweaters for saie to athletic-wear retailers. The following information was available on McLatchy for the years ended Dec 31, 2016 and 2017 Dee 31, 2016 $20,000 90,000 8,500 Cr 85,000 80,000 600,000 440,000 Dec 31,2017 Cash Accounts receivable Allowance for doubtful accounts Inventor Current liabilities Total credit sales Collections on accounts receivable 80,000 86,000 550,000 500 b1-7.1 During 2017, McLatchy Ltd had the following transactions: 1. On June 1, 2017, sales of $80,000 to a major customer were settled, with McLatchy accepting an $80,000 one-year note bearing 7% interest that is payable at maturity. The S80.000 is not included in the total credit sales amount above. 2. McLatchy factors some accounts receivable at the end of the year. Accounts totaling $60,000 are transferred to Primary Factors Inc, with recourse. Primary Factors retains %st the and will receive the collections directly from McLatchy's customers. McLatchy is finance charge of 6% on this transfer. The fair value of the recourse obligation is 7,00 r r d 3. McLatchy wrote off $4,200 of accounts receiyable during 2017. 4. Based on the latest available information, the 2017 all have a balance of $12,000 at Dec 31, 2017. or doubtful accounts should Additional information: Included in the case balance at Dec 31, 2017, are the following: a chequing account with a $3,000. McLatchy is a private company that follows ASPE e stamps of $100, petty cash of $300, coins and currency on hand of Instructions: (a) Prepare the journal entry for the sale to the customer from June 1. Tuhei Nots reteivabe Sales Reven (b) Prepare the journal entry for the factoring of the accounts receivable to Primary Factors Inc. (c) Based on the above transactions and additional information, determine the balances of Accounts Receivables and Bad Debt Expense at Dec 31, 2017. do Prepare the current assets section of McLatchy's statement of financial position at Dec 31, 2017 Question 2: Part I: On March 2, Ethan Ltd. sold $30,000 of inventory items, at cost of 13,500, on credit with the terms 2/10, net 30. Payment on $18,000 of sales was received on March 7 and the remaining payment on $12,000 was received on March 31. Ethan Ltd. uses perpetual inventory tracking. Required: a) Assuming Ethan uses the gross method of accounting for sales discounts, prepare the entry to be recorded on March 2,7, and 31 Assuming Ethan uses the net method of accounting for sales discounts, prepare the journal entry to be recorded on March 2, 7, and 31. b) Part II: A trial balance before adjustment included the following: Debit Credit Accounts receivable.... Allowance for doubtful accounts.. Sales $120,000 730 $510,000 Sales returns and allowances. 8,000 Required: Give journal entries assuming that the estimate of uncollectibles is determined by taking a) 2.5% of gross accounts receivable, and b) 1.5% of net sales. Question 1: The McLatchy Ltd manufactures sweaters for saie to athletic-wear retailers. The following information was available on McLatchy for the years ended Dec 31, 2016 and 2017 Dee 31, 2016 $20,000 90,000 8,500 Cr 85,000 80,000 600,000 440,000 Dec 31,2017 Cash Accounts receivable Allowance for doubtful accounts Inventor Current liabilities Total credit sales Collections on accounts receivable 80,000 86,000 550,000 500 b1-7.1 During 2017, McLatchy Ltd had the following transactions: 1. On June 1, 2017, sales of $80,000 to a major customer were settled, with McLatchy accepting an $80,000 one-year note bearing 7% interest that is payable at maturity. The S80.000 is not included in the total credit sales amount above. 2. McLatchy factors some accounts receivable at the end of the year. Accounts totaling $60,000 are transferred to Primary Factors Inc, with recourse. Primary Factors retains %st the and will receive the collections directly from McLatchy's customers. McLatchy is finance charge of 6% on this transfer. The fair value of the recourse obligation is 7,00 r r d 3. McLatchy wrote off $4,200 of accounts receiyable during 2017. 4. Based on the latest available information, the 2017 all have a balance of $12,000 at Dec 31, 2017. or doubtful accounts should Additional information: Included in the case balance at Dec 31, 2017, are the following: a chequing account with a $3,000. McLatchy is a private company that follows ASPE e stamps of $100, petty cash of $300, coins and currency on hand of Instructions: (a) Prepare the journal entry for the sale to the customer from June 1. Tuhei Nots reteivabe Sales Reven (b) Prepare the journal entry for the factoring of the accounts receivable to Primary Factors Inc. (c) Based on the above transactions and additional information, determine the balances of Accounts Receivables and Bad Debt Expense at Dec 31, 2017. do Prepare the current assets section of McLatchy's statement of financial position at Dec 31, 2017 Question 2: Part I: On March 2, Ethan Ltd. sold $30,000 of inventory items, at cost of 13,500, on credit with the terms 2/10, net 30. Payment on $18,000 of sales was received on March 7 and the remaining payment on $12,000 was received on March 31. Ethan Ltd. uses perpetual inventory tracking. Required: a) Assuming Ethan uses the gross method of accounting for sales discounts, prepare the entry to be recorded on March 2,7, and 31 Assuming Ethan uses the net method of accounting for sales discounts, prepare the journal entry to be recorded on March 2, 7, and 31. b) Part II: A trial balance before adjustment included the following: Debit Credit Accounts receivable.... Allowance for doubtful accounts.. Sales $120,000 730 $510,000 Sales returns and allowances. 8,000 Required: Give journal entries assuming that the estimate of uncollectibles is determined by taking a) 2.5% of gross accounts receivable, and b) 1.5% of net sales

Question 1 and 2 thanks

Question 1 and 2 thanks