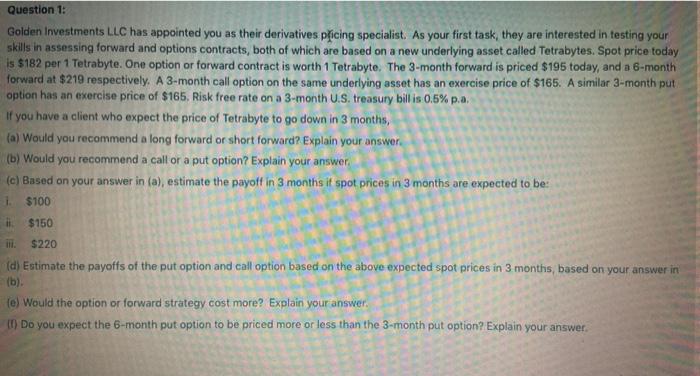

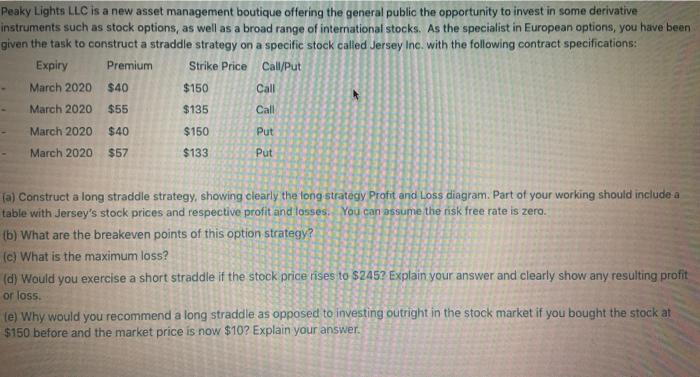

Question 1: Golden Investments LLC has appointed you as their derivatives picing specialist. As your first task, they are interested in testing your skills in assessing forward and options contracts, both of which are based on a new underlying asset called Tetrabytes. Spot price today is $182 per 1 Tetrabyte. One option or forward contract is worth 1 Tetrabyte. The 3-month forward is priced $195 today, and a 6-month forward at $219 respectively. A 3-month call option on the same underlying asset has an exercise price of $165. A similar 3-month put option has an exercise price of $165. Risk free rate on a 3-month U.S. treasury billis 0.5% p.a. If you have a client who expect the price of Tetrabyte to go down in 3 months, (a) Would you recommend a long forward or short forward? Explain your answer (b) Would you recommend a call or a put option? Explain your answer (c) Based on your answer in (a), estimate the payoff in 3 months it spot prices in 3 months are expected to be: 1. $100 $150 $220 (d) Estimate the payoffs of the put option and call option based on the above expected spot prices in 3 months, based on your answer in (b) le) Would the option or forward strategy cost more? Explain your answer. (1) Do you expect the 6-month put option to be priced more or less than the 3-month put option? Explain your answer. Peaky Lights LLC is a new asset management boutique offering the general public the opportunity to invest in some derivative instruments such as stock options, as well as a broad range of international stocks. As the specialist in European options, you have been given the task to construct a straddle strategy on a specific stock called Jersey Inc. with the following contract specifications: Expiry Strike Price Call/Put $150 Call March 2020 Premium March 2020 $40 $55 $135 Call March 2020 $40 $150 Put March 2020 $57 $133 Put Ta) Construct a long straddle strategy, showing clearly the long strategy Profit and Loss diagram. Part of your working should include a table with Jersey's stock prices and respective profit and losses. You can assume the risk free rate is zero. (b) What are the breakeven points of this option strategy? (c) What is the maximum loss? (d) Would you exercise a short straddle if the stock price rises to $245? Explain your answer and clearly show any resulting profit or loss. le) Why would you recommend a long straddle as opposed to investing outright in the stock market if you bought the stock at $150 before and the market price is now $10? Explain your