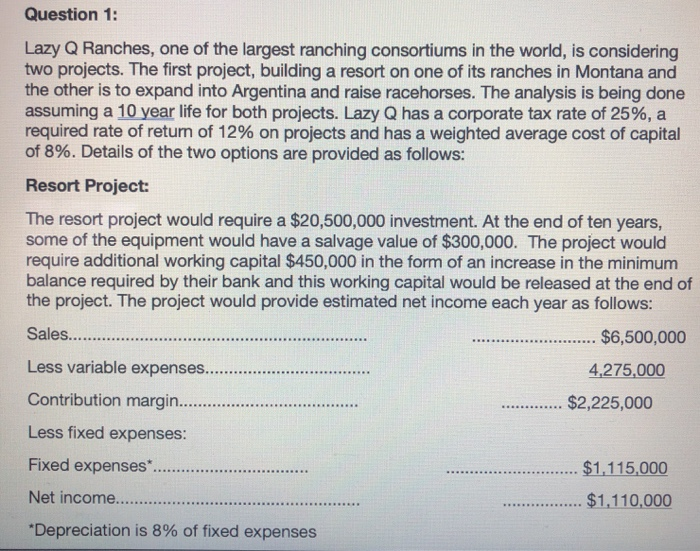

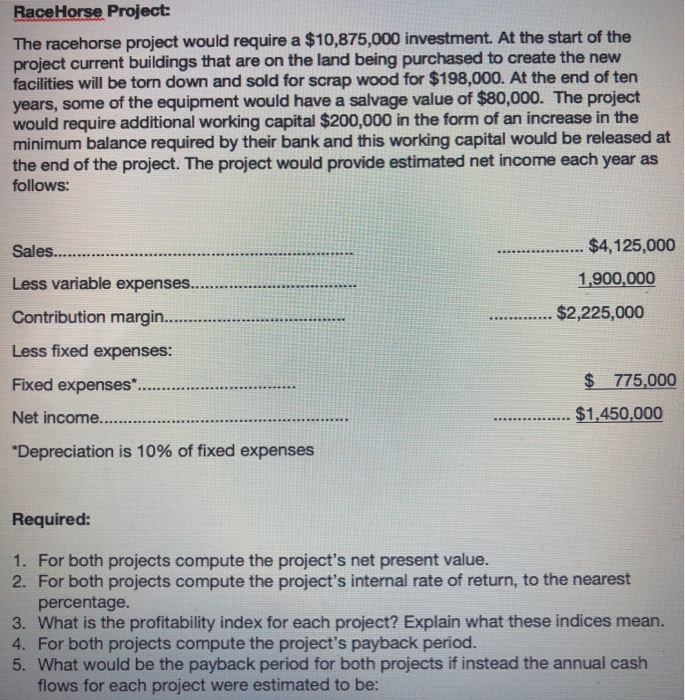

Question 1: Lazy Q Ranches, one of the largest ranching consortiums in the world, is considering two projects. The first project, building a resort on one of its ranches in Montana and the other is to expand into Argentina and raise racehorses. The analysis is being done assuming a 10 year life for both projects. Lazy Q has a corporate tax rate of 25%, a required rate of retum of 12% on projects and has a weighted average cost of capital of 8%. Details of the two options are provided as follows: Resort Project: The resort project would require a $20,500,000 investment. At the end of ten years, some of the equipment would have a salvage value of $300,000. The project would require additional working capital $450,000 in the form of an increase in the minimum balance required by their bank and this working capital would be released at the end of the project. The project would provide estimated net income each year as follows: Sales.. .. $6,500,000 Less variable expenses.. 4,275,000 Contribution margin... $2,225,000 Less fixed expenses: Fixed expenses. Net income. *Depreciation is 8% of fixed expenses $1,115,000 $1,110,000 RaceHorse Project: The racehorse project would require a $10,875,000 investment. At the start of the project current buildings that are on the land being purchased to create the new facilities will be torn down and sold for scrap wood for $198,000. At the end of ten years, some of the equipment would have a salvage value of $80,000. The project would require additional working capital $200,000 in the form of an increase in the minimum balance required by their bank and this working capital would be released at the end of the project. The project would provide estimated net income each year as follows: .. $4, 125,000 1,900,000 - $2,225,000 Sales......... Less variable expenses. Contribution margin... Less fixed expenses: Fixed expenses... Net income....... *Depreciation is 10% of fixed expenses $ 775,000 $1,450,000 Required: 1. For both projects compute the project's net present value. 2. For both projects compute the project's internal rate of return, to the nearest percentage. 3. What is the profitability index for each project? Explain what these indices mean. 4. For both projects compute the project's payback period. 5. What would be the payback period for both projects if instead the annual cash flows for each project were estimated to be