Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 1 question 2 question 3 Take me to the text Capital City Hotel's restaurant is open for breakfast, lunch and dinner. The accountants prepared

question 1

question 2

question 3

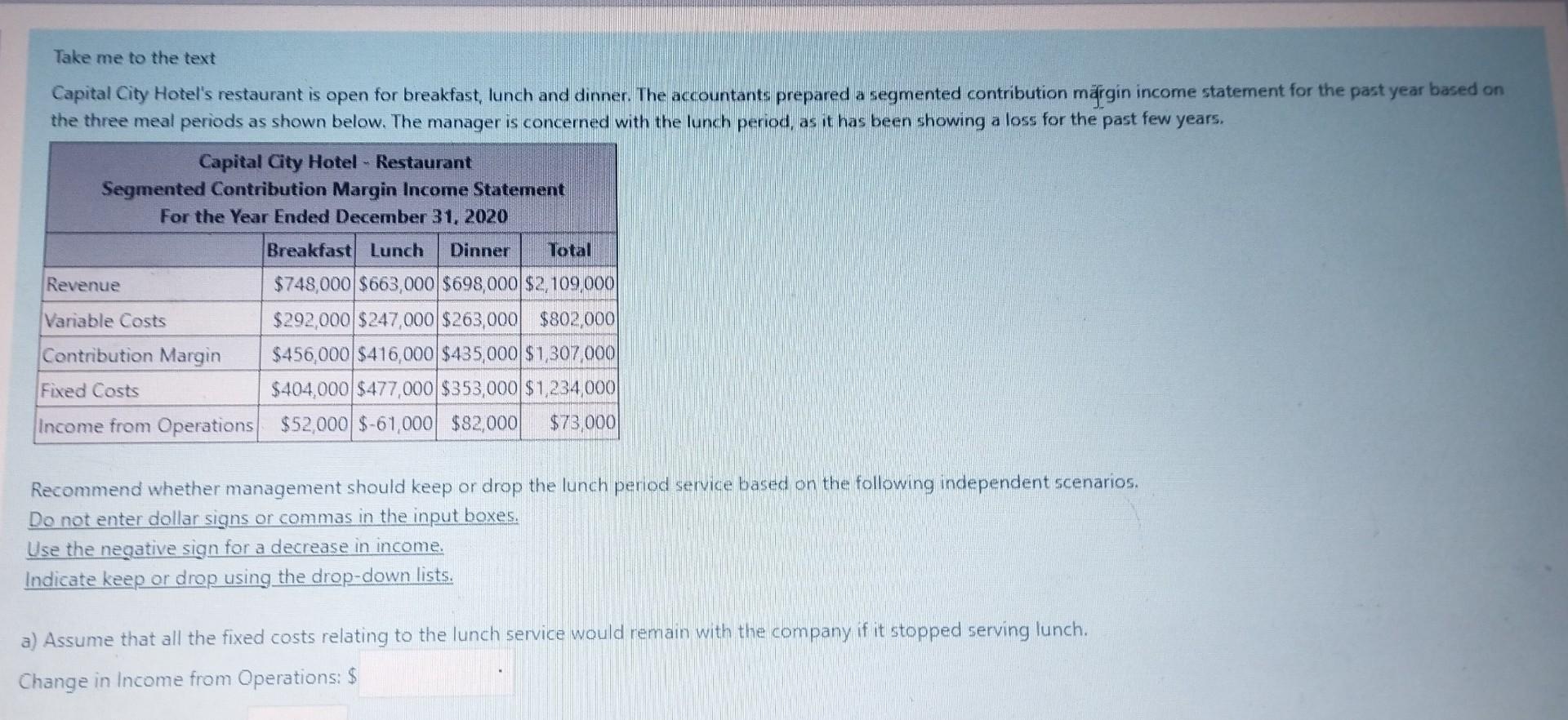

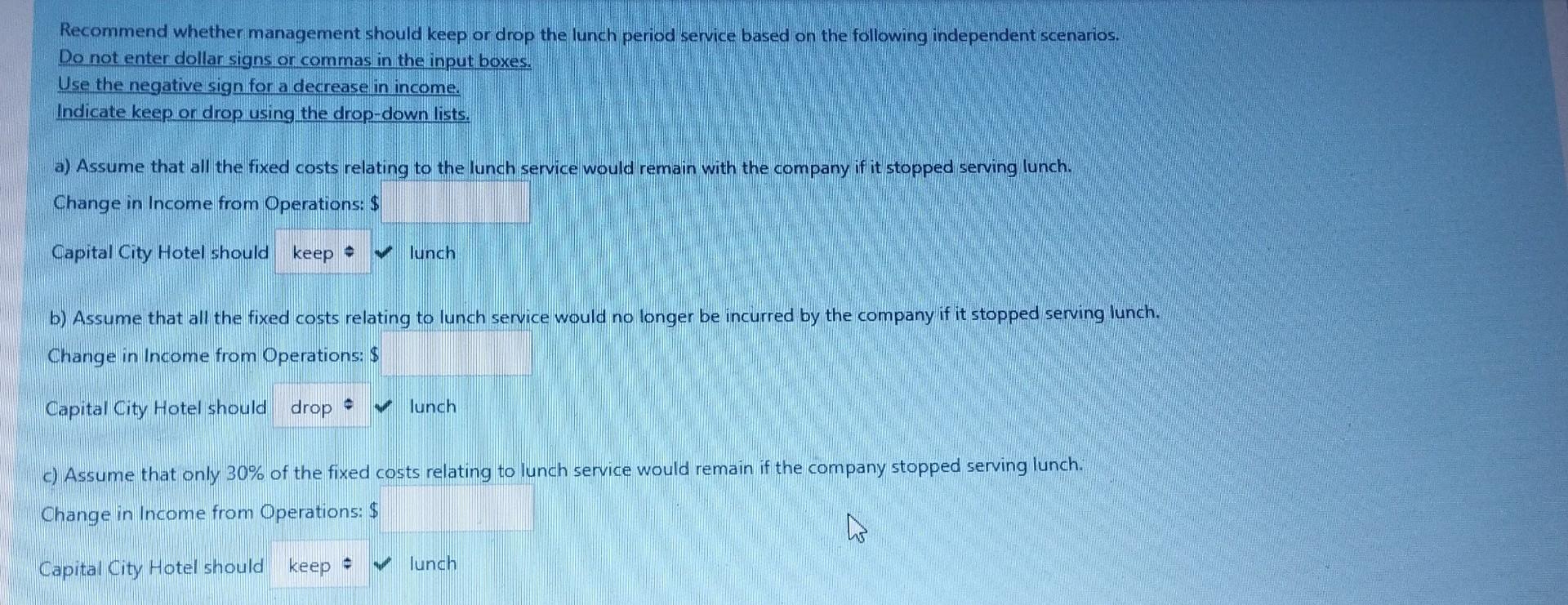

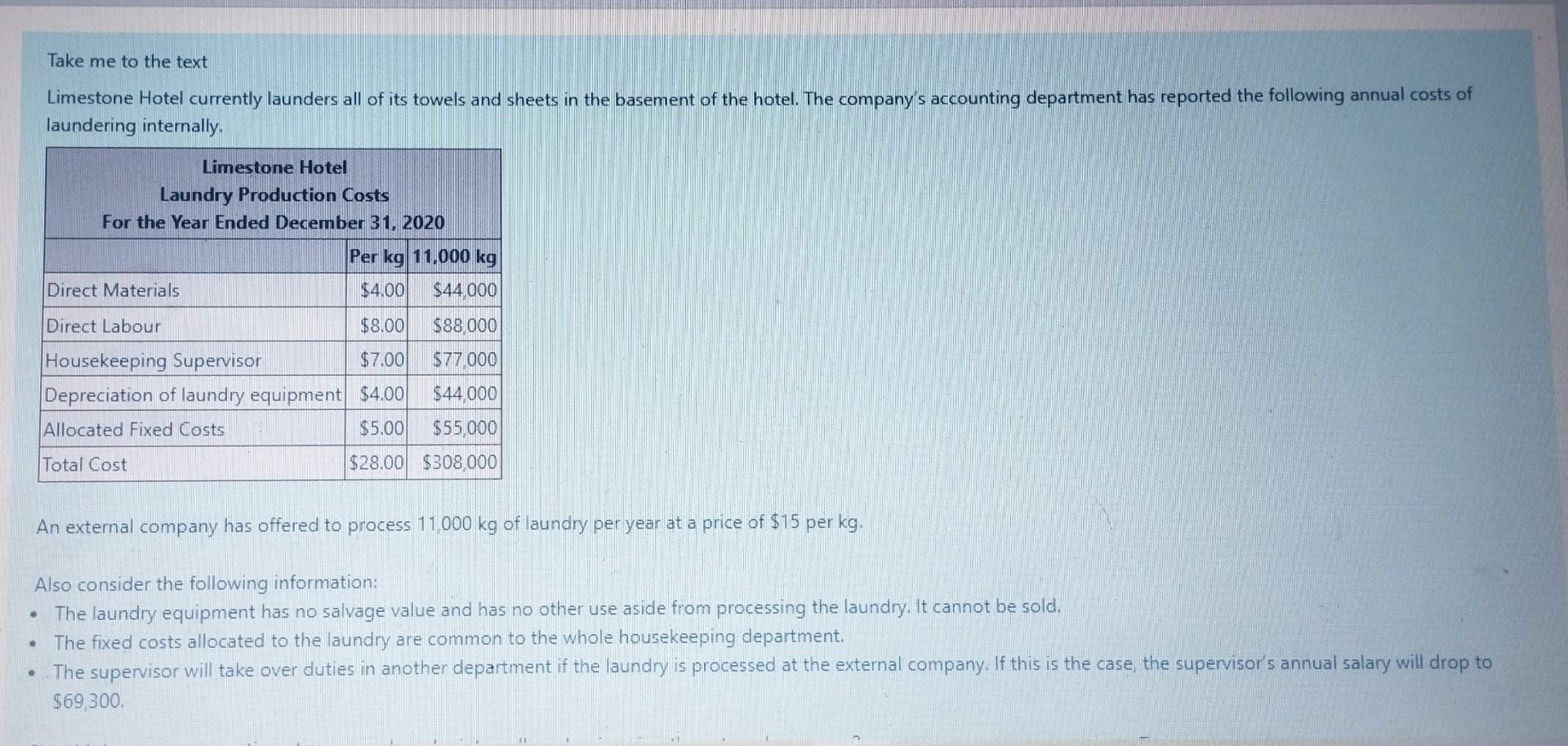

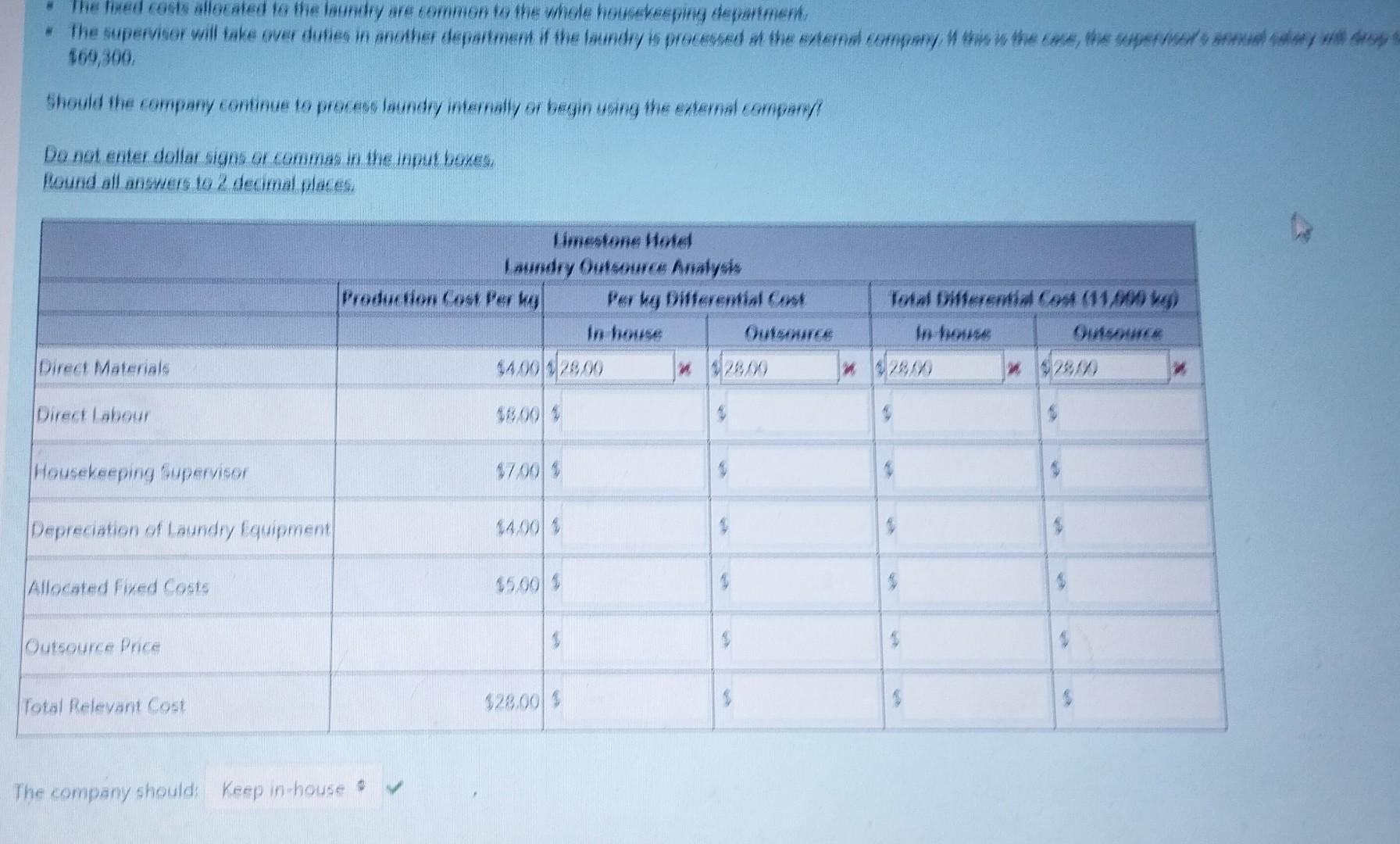

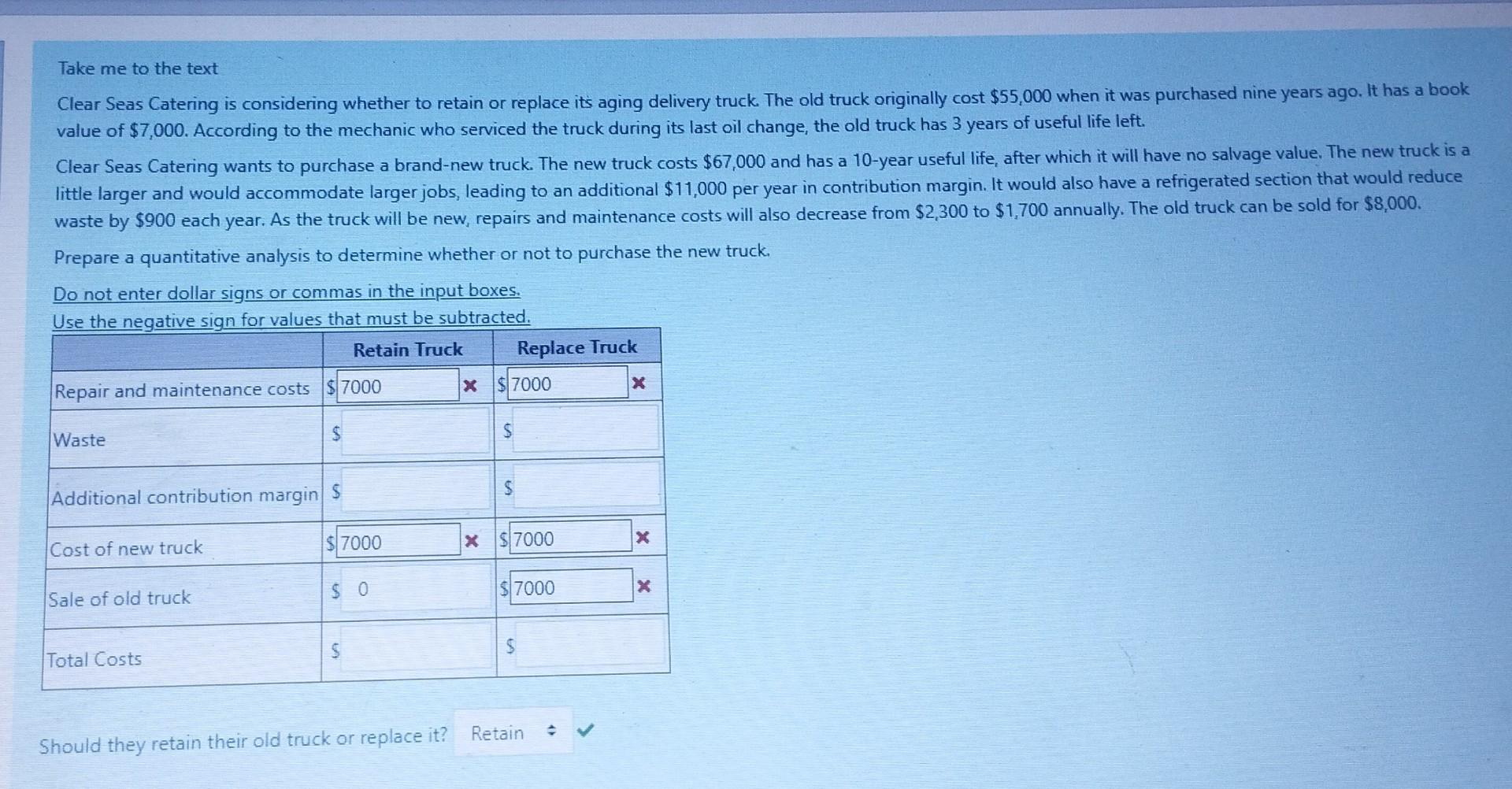

Take me to the text Capital City Hotel's restaurant is open for breakfast, lunch and dinner. The accountants prepared a segmented contribution mrgin income statement for the past year based on the three meal periods as shown below. The manager is concerned with the lunch period, as it has been showing a loss for the past few years. Recommend whether management should keep or drop the lunch period service based on the following independent scenarios. Do not enter dollar signs or commas in the input boxes. Use the negative sign for a decrease in income. Indicate keep or drop using the drop-down lists. a) Assume that all the fixed costs relating to the lunch service would remain with the company if it stopped serving lunch. Change in Income from Operations: $ Recommend whether management should keep or drop the lunch period service based on the following independent scenarios. Do not enter dollar signs or commas in the input boxes. Use the negative sign for a decrease in income. Indicate keep or drop using the drop-down lists. a) Assume that all the fixed costs relatina to the lunch service would remain with the company if it stopped serving lunch. Change in Income from Operations: $ Capital City Hotel should lunch b) Assume that all the fixed costs relatina to lunch senvice would no longer be incurred by the company if it stopped serving lunch. Change in Income from Operations: \$ Capital City Hotel should lunch c) Assume that only 30% of the fixed costs relating to lunch service would remain if the company stopped serving lunch. Change in Income from Operations: $ Capital City Hotel should lunch Take me to the text Limestone Hotel currently launders all of its towels and sheets in the basement of the hotel. The company's accounting department has reported the following annual costs of laundering internally. An external company has offered to process 11,000kg of laundry per year at a price of $15 per kg. Also consider the following information: - The laundry equipment has no salvage value and has no other use aside from processing the laundry. It cannot be sold. - The fixed costs allocated to the laundry are common to the whole housekeeping department. - The supervisor will take over duties in another department if the laundry is processed at the external company. If this is the case, the supervisor's annual salary will drop to $69,300. 369,309 Should the company combutie to process laundry intemally or begin using the exAmal compary? Do not enter dollar signs or cammas in the input bokes. Take me to the text Clear Seas Catering is considering whether to retain or replace its aging delivery truck. The old truck originally cost $55,000 when it was purchased nine years ago. It has a book value of $7,000. According to the mechanic who serviced the truck during its last oil change, the old truck has 3 years of useful life left. Clear Seas Catering wants to purchase a brand-new truck. The new truck costs $67,000 and has a 10 -year useful life, after which it will have no salvage value. The new truck is a little larger and would accommodate larger jobs, leading to an additional $11,000 per year in contribution margin. It would also have a refrigerated section that would reduce waste by $900 each year. As the truck will be new, repairs and maintenance costs will also decrease from $2,300 to $1,700 annually. The old truck can be sold for $8,000. Prepare a quantitative analysis to determine whether or not to purchase the new truck. Do not enter dollar signs or commas in the input boxes. Ilse the neative sian for values that must be subtracted. Should they retain their old truck or replace it? Take me to the text Capital City Hotel's restaurant is open for breakfast, lunch and dinner. The accountants prepared a segmented contribution mrgin income statement for the past year based on the three meal periods as shown below. The manager is concerned with the lunch period, as it has been showing a loss for the past few years. Recommend whether management should keep or drop the lunch period service based on the following independent scenarios. Do not enter dollar signs or commas in the input boxes. Use the negative sign for a decrease in income. Indicate keep or drop using the drop-down lists. a) Assume that all the fixed costs relating to the lunch service would remain with the company if it stopped serving lunch. Change in Income from Operations: $ Recommend whether management should keep or drop the lunch period service based on the following independent scenarios. Do not enter dollar signs or commas in the input boxes. Use the negative sign for a decrease in income. Indicate keep or drop using the drop-down lists. a) Assume that all the fixed costs relatina to the lunch service would remain with the company if it stopped serving lunch. Change in Income from Operations: $ Capital City Hotel should lunch b) Assume that all the fixed costs relatina to lunch senvice would no longer be incurred by the company if it stopped serving lunch. Change in Income from Operations: \$ Capital City Hotel should lunch c) Assume that only 30% of the fixed costs relating to lunch service would remain if the company stopped serving lunch. Change in Income from Operations: $ Capital City Hotel should lunch Take me to the text Limestone Hotel currently launders all of its towels and sheets in the basement of the hotel. The company's accounting department has reported the following annual costs of laundering internally. An external company has offered to process 11,000kg of laundry per year at a price of $15 per kg. Also consider the following information: - The laundry equipment has no salvage value and has no other use aside from processing the laundry. It cannot be sold. - The fixed costs allocated to the laundry are common to the whole housekeeping department. - The supervisor will take over duties in another department if the laundry is processed at the external company. If this is the case, the supervisor's annual salary will drop to $69,300. 369,309 Should the company combutie to process laundry intemally or begin using the exAmal compary? Do not enter dollar signs or cammas in the input bokes. Take me to the text Clear Seas Catering is considering whether to retain or replace its aging delivery truck. The old truck originally cost $55,000 when it was purchased nine years ago. It has a book value of $7,000. According to the mechanic who serviced the truck during its last oil change, the old truck has 3 years of useful life left. Clear Seas Catering wants to purchase a brand-new truck. The new truck costs $67,000 and has a 10 -year useful life, after which it will have no salvage value. The new truck is a little larger and would accommodate larger jobs, leading to an additional $11,000 per year in contribution margin. It would also have a refrigerated section that would reduce waste by $900 each year. As the truck will be new, repairs and maintenance costs will also decrease from $2,300 to $1,700 annually. The old truck can be sold for $8,000. Prepare a quantitative analysis to determine whether or not to purchase the new truck. Do not enter dollar signs or commas in the input boxes. Ilse the neative sian for values that must be subtracted. Should they retain their old truck or replace it

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started