Answered step by step

Verified Expert Solution

Question

1 Approved Answer

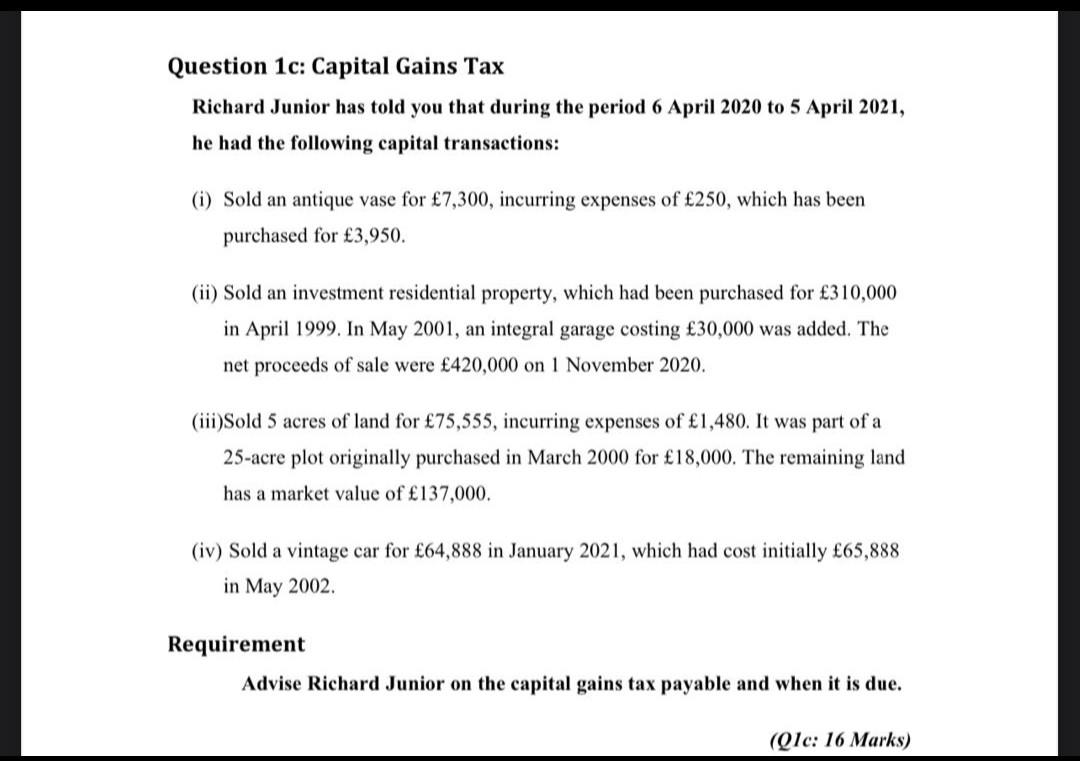

Question 1c: Capital Gains Tax Richard Junior has told you that during the period 6 April 2020 to 5 April 2021, he had the following

Question 1c: Capital Gains Tax Richard Junior has told you that during the period 6 April 2020 to 5 April 2021, he had the following capital transactions: (i) Sold an antique vase for 7,300, incurring expenses of 250, which has been purchased for 3,950. (ii) Sold an investment residential property, which had been purchased for 310,000 in April 1999. In May 2001, an integral garage costing 30,000 was added. The net proceeds of sale were 420,000 on 1 November 2020. (iii)Sold 5 acres of land for 75,555, incurring expenses of 1,480. It was part of a 25-acre plot originally purchased in March 2000 for 18,000. The remaining land has a market value of 137,000. (iv) Sold a vintage car for 64,888 in January 2021, which had cost initially 65,888 in May 2002 Requirement Advise Richard Junior on the capital gains tax payable and when it is due. (Qlc: 16 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started