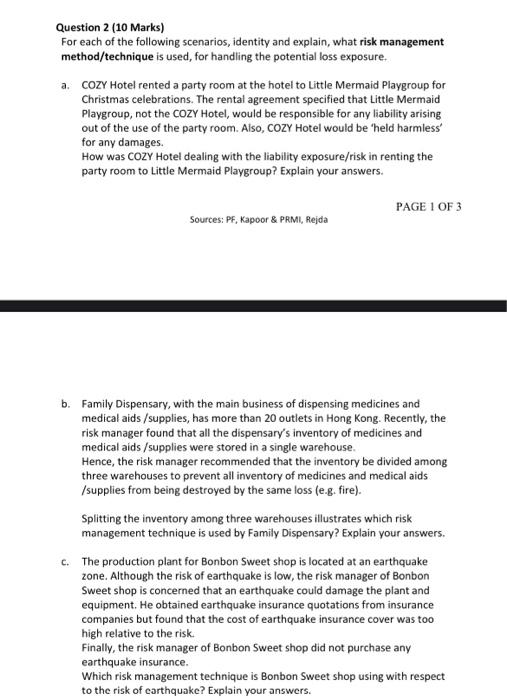

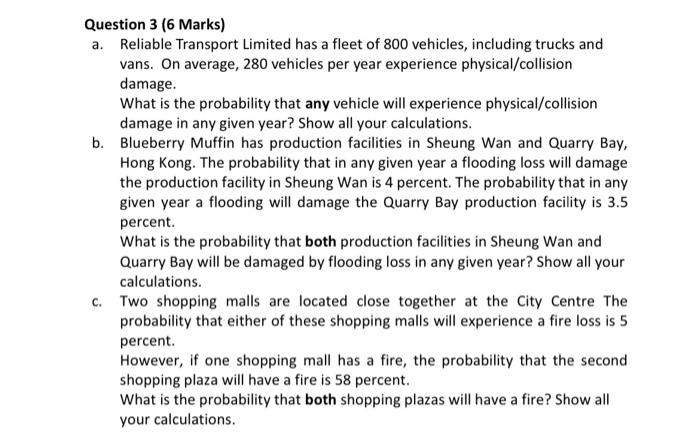

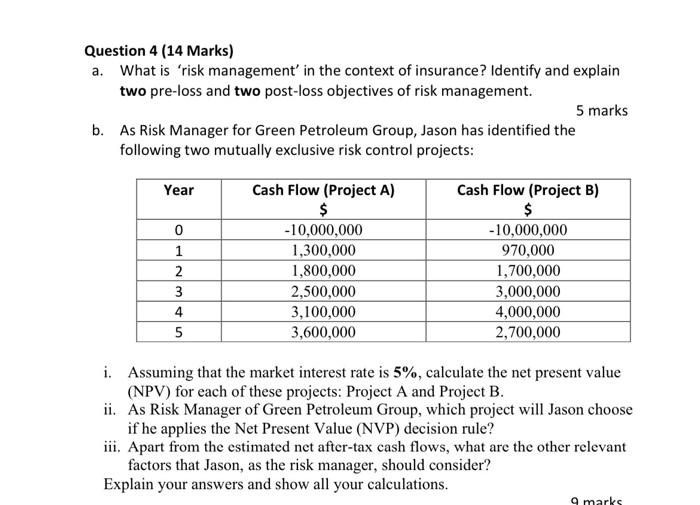

Question 2 (10 Marks) For each of the following scenarios, identity and explain, what risk management method/technique is used, for handling the potential loss exposure. a. COZY Hotel rented a party room at the hotel to Little Mermaid Playgroup for Christmas celebrations. The rental agreement specified that Little Mermaid Playgroup, not the COZY Hotel, would be responsible for any liability arising out of the use of the party room. Also, COZY Hotel would be held harmless for any damages. How was COZY Hotel dealing with the liability exposure/risk in renting the party room to Little Mermaid Playgroup? Explain your answers. PAGE 1 OF 3 Sources: PF, Kapoor & PAMI, Rejda b. Family Dispensary, with the main business of dispensing medicines and medical aids / supplies, has more than 20 outlets in Hong Kong. Recently, the risk manager found that all the dispensary's inventory of medicines and medical aids / supplies were stored in a single warehouse Hence, the risk manager recommended that the inventory be divided among three warehouses to prevent all inventory of medicines and medical aids supplies from being destroyed by the same loss (e.g. fire). Splitting the inventory among three warehouses illustrates which risk management technique is used by Family Dispensary? Explain your answers. c. The production plant for Bonbon Sweet shop is located at an earthquake zone. Although the risk of earthquake is low, the risk manager of Bonbon Sweet shop is concerned that an earthquake could damage the plant and equipment. He obtained earthquake insurance quotations from insurance companies but found that the cost of earthquake insurance cover was too high relative to the risk Finally, the risk manager of Bonbon Sweet shop did not purchase any earthquake insurance. Which risk management technique is Bonbon Sweet shop using with respect to the risk of carthquake? Explain your answers. Question 3 (6 Marks) a. Reliable Transport Limited has a fleet of 800 vehicles, including trucks and vans. On average, 280 vehicles per year experience physical/collision damage. What is the probability that any vehicle will experience physical/collision damage in any given year? Show all your calculations. b. Blueberry Muffin has production facilities in Sheung Wan and Quarry Bay, Hong Kong. The probability that in any given year a flooding loss will damage the production facility in Sheung Wan is 4 percent. The probability that in any given year a flooding will damage the Quarry Bay production facility is 3.5 percent. What is the probability that both production facilities in Sheung Wan and Quarry Bay will be damaged by flooding loss in any given year? Show all your calculations. C. Two shopping malls are located close together at the City Centre The probability that either of these shopping malls will experience a fire loss is 5 percent. However, if one shopping mall has a fire, the probability that the second shopping plaza will have a fire is 58 percent. What is the probability that both shopping plazas will have a fire? Show all your calculations. Question 4 (14 Marks) a. What is risk management' in the context of insurance? Identify and explain two pre-loss and two post-loss objectives of risk management. 5 marks b. As Risk Manager for Green Petroleum Group, Jason has identified the following two mutually exclusive risk control projects: Year 0 1 2 3 4 5 Cash Flow (Project A) $ -10,000,000 1,300,000 1,800,000 2,500,000 3,100,000 3,600,000 Cash Flow (Project B) $ -10,000,000 970,000 1,700,000 3,000,000 4,000,000 2,700,000 i. Assuming that the market interest rate is 5%, calculate the net present value (NPV) for each of these projects: Project A and Project B. ii. As Risk Manager of Green Petroleum Group, which project will Jason choose if he applies the Net Present Value (NVP) decision rule? iii. Apart from the estimated net after-tax cash flows, what are the other relevant factors that Jason, as the risk manager, should consider? Explain your answers and show all your calculations. 9 marks Question 2 (10 Marks) For each of the following scenarios, identity and explain, what risk management method/technique is used, for handling the potential loss exposure. a. COZY Hotel rented a party room at the hotel to Little Mermaid Playgroup for Christmas celebrations. The rental agreement specified that Little Mermaid Playgroup, not the COZY Hotel, would be responsible for any liability arising out of the use of the party room. Also, COZY Hotel would be held harmless for any damages. How was COZY Hotel dealing with the liability exposure/risk in renting the party room to Little Mermaid Playgroup? Explain your answers. PAGE 1 OF 3 Sources: PF, Kapoor & PAMI, Rejda b. Family Dispensary, with the main business of dispensing medicines and medical aids / supplies, has more than 20 outlets in Hong Kong. Recently, the risk manager found that all the dispensary's inventory of medicines and medical aids / supplies were stored in a single warehouse Hence, the risk manager recommended that the inventory be divided among three warehouses to prevent all inventory of medicines and medical aids supplies from being destroyed by the same loss (e.g. fire). Splitting the inventory among three warehouses illustrates which risk management technique is used by Family Dispensary? Explain your answers. c. The production plant for Bonbon Sweet shop is located at an earthquake zone. Although the risk of earthquake is low, the risk manager of Bonbon Sweet shop is concerned that an earthquake could damage the plant and equipment. He obtained earthquake insurance quotations from insurance companies but found that the cost of earthquake insurance cover was too high relative to the risk Finally, the risk manager of Bonbon Sweet shop did not purchase any earthquake insurance. Which risk management technique is Bonbon Sweet shop using with respect to the risk of carthquake? Explain your answers. Question 3 (6 Marks) a. Reliable Transport Limited has a fleet of 800 vehicles, including trucks and vans. On average, 280 vehicles per year experience physical/collision damage. What is the probability that any vehicle will experience physical/collision damage in any given year? Show all your calculations. b. Blueberry Muffin has production facilities in Sheung Wan and Quarry Bay, Hong Kong. The probability that in any given year a flooding loss will damage the production facility in Sheung Wan is 4 percent. The probability that in any given year a flooding will damage the Quarry Bay production facility is 3.5 percent. What is the probability that both production facilities in Sheung Wan and Quarry Bay will be damaged by flooding loss in any given year? Show all your calculations. C. Two shopping malls are located close together at the City Centre The probability that either of these shopping malls will experience a fire loss is 5 percent. However, if one shopping mall has a fire, the probability that the second shopping plaza will have a fire is 58 percent. What is the probability that both shopping plazas will have a fire? Show all your calculations. Question 4 (14 Marks) a. What is risk management' in the context of insurance? Identify and explain two pre-loss and two post-loss objectives of risk management. 5 marks b. As Risk Manager for Green Petroleum Group, Jason has identified the following two mutually exclusive risk control projects: Year 0 1 2 3 4 5 Cash Flow (Project A) $ -10,000,000 1,300,000 1,800,000 2,500,000 3,100,000 3,600,000 Cash Flow (Project B) $ -10,000,000 970,000 1,700,000 3,000,000 4,000,000 2,700,000 i. Assuming that the market interest rate is 5%, calculate the net present value (NPV) for each of these projects: Project A and Project B. ii. As Risk Manager of Green Petroleum Group, which project will Jason choose if he applies the Net Present Value (NVP) decision rule? iii. Apart from the estimated net after-tax cash flows, what are the other relevant factors that Jason, as the risk manager, should consider? Explain your answers and show all your calculations. 9 marks