Answered step by step

Verified Expert Solution

Question

1 Approved Answer

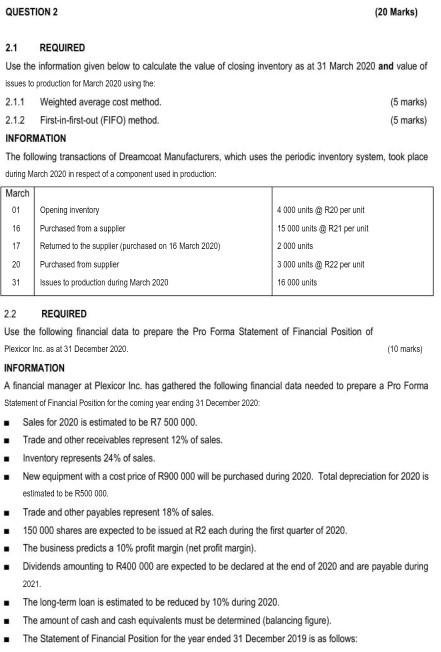

QUESTION 2 (20 Marks) 2.1 REQUIRED Use the information given below to calculate the value of closing inventory as at 31 March 2020 and value

QUESTION 2 (20 Marks) 2.1 REQUIRED Use the information given below to calculate the value of closing inventory as at 31 March 2020 and value of issues to production for March 2020 using the 2.1.1 Weighted average cost method (5 marks) 2.1.2 First-in-first-out (FIFO) method. (5 marks) INFORMATION The following transactions of Dreamcoat Manufacturers, which uses the periodic inventory system, took place during March 2020 in respect of a component used in production: March 01 16 17 Opening inventory Purchased from a supplier Retumed to the supplier (purchased on 16 March 2020) Purchased from supplier Issues to production during March 2020 4 000 units @ R20 per unit 15 000 units @ R21 per unit 2 000 units 3000 units R22 per unit 16 000 units 20 31 22 (10 marks) REQUIRED Use the following financial data to prepare the Pro Forma Statement of Financial Position of Plexicor Inc. as at 31 December 2020. INFORMATION A financial manager at Plexicor Inc. has gathered the following financial data needed to prepare a Pro Forma Statement of Financial Position for the coming year ending 31 December 2020 Sales for 2020 is estimated to be R7 500 000 Trade and other receivables represent 12% of sales. Inventory represents 24% of sales. New equipment with a cost price of R900 000 will be purchased during 2020. Total depreciation for 2020 is estimated to be R500 000 Trade and other payables represent 18% of sales. 150 000 shares are expected to be issued at R2 each during the first quarter of 2020. The business predicts a 10% profit margin (net profit margin). Dividends amounting to R400 000 are expected to be declared at the end of 2020 and are payable during 2021 The long-term loan is estimated to be reduced by 10% during 2020. The amount of cash and cash equivalents must be determined (balancing figure). The Statement of Financial Position for the year ended 31 December 2019 is as follows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started