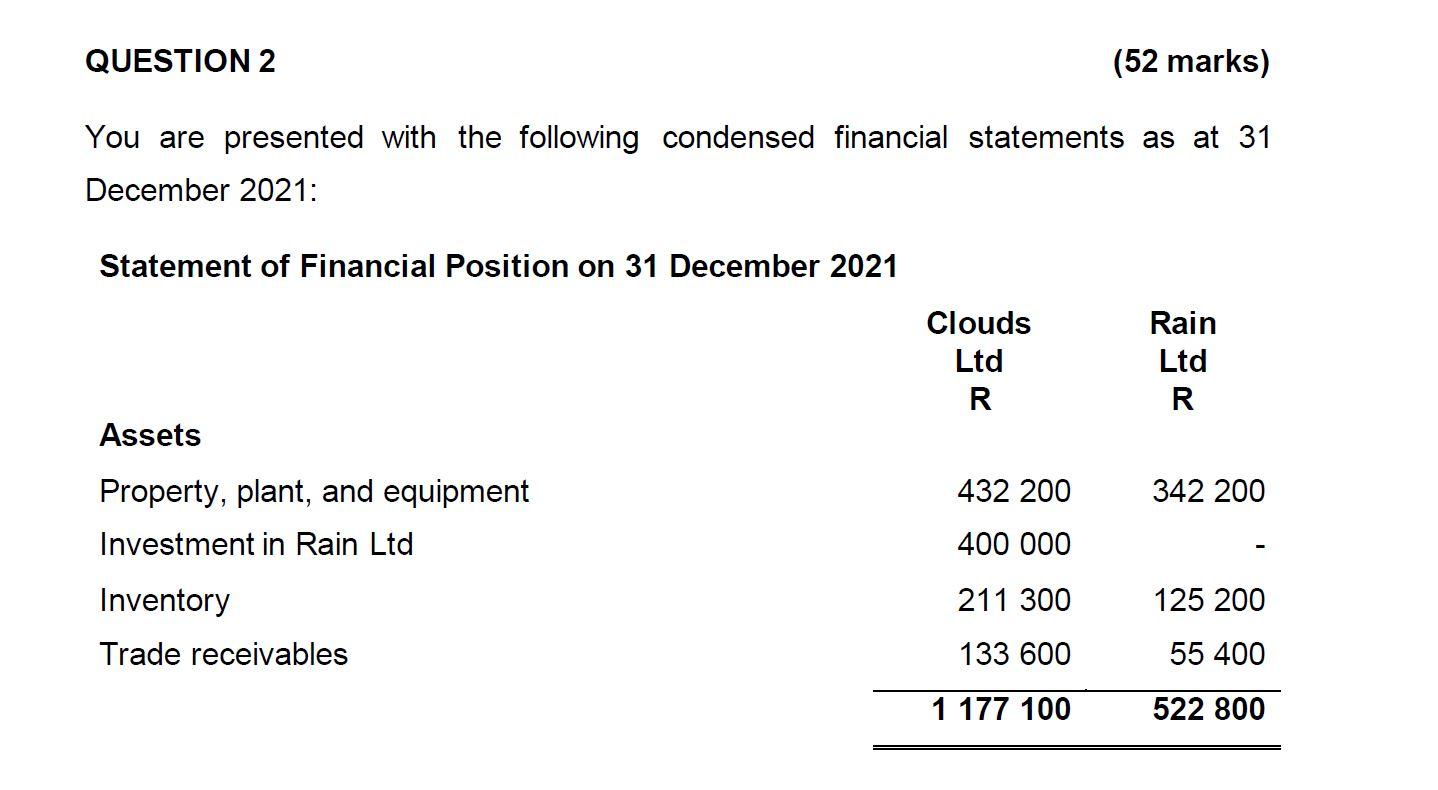

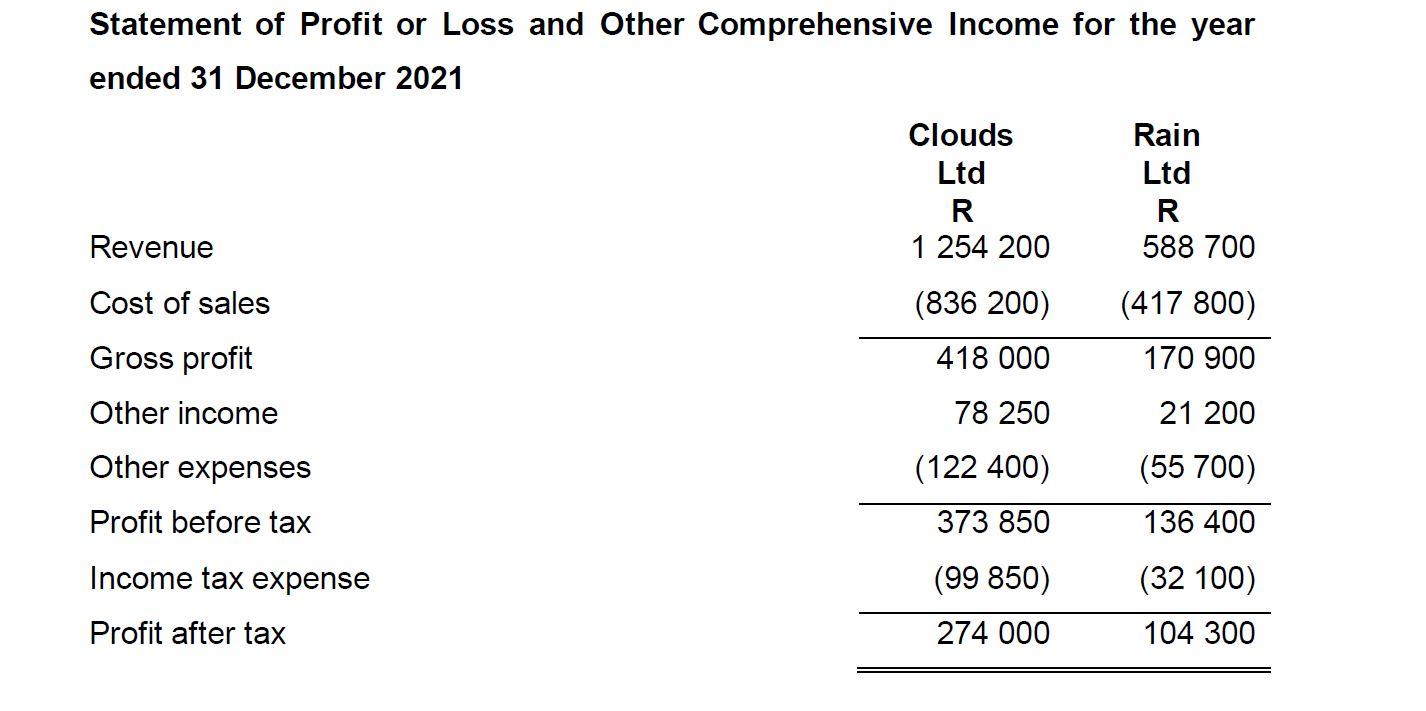

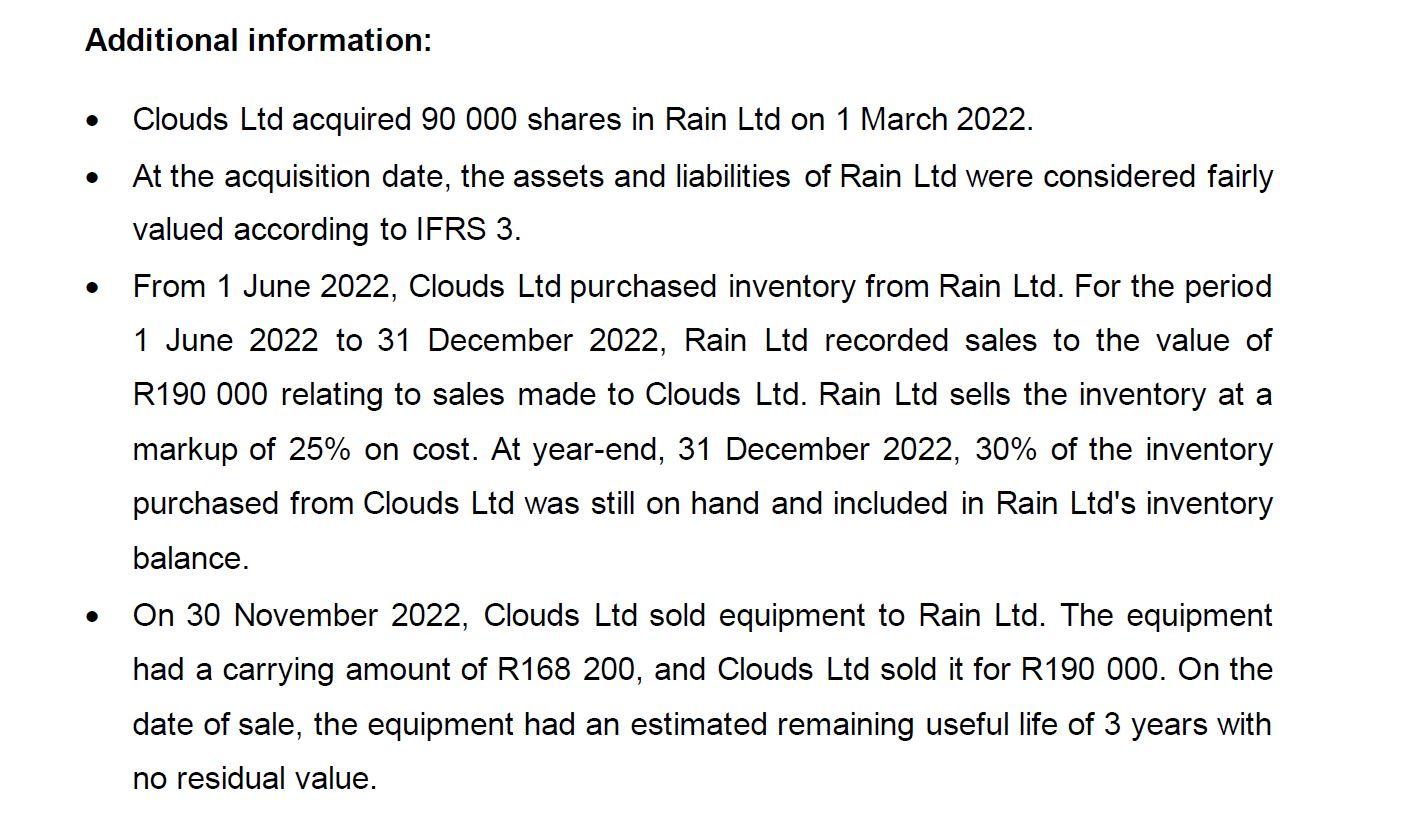

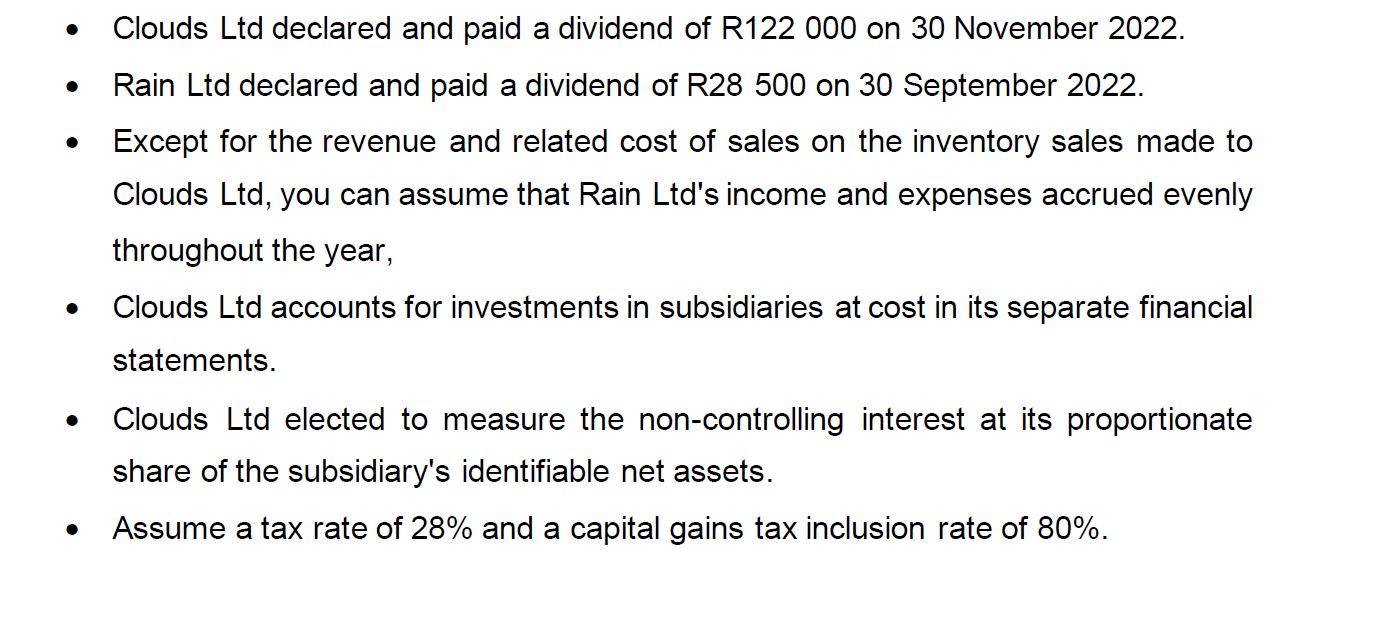

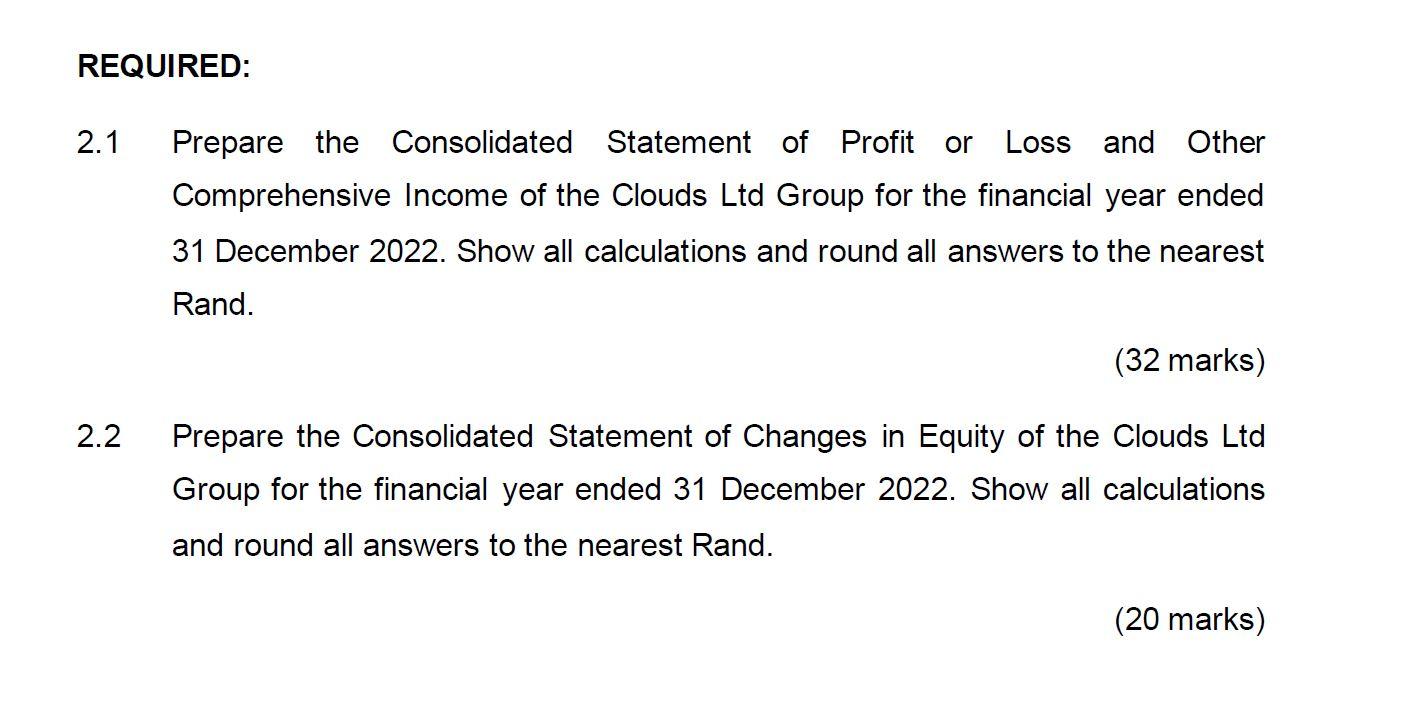

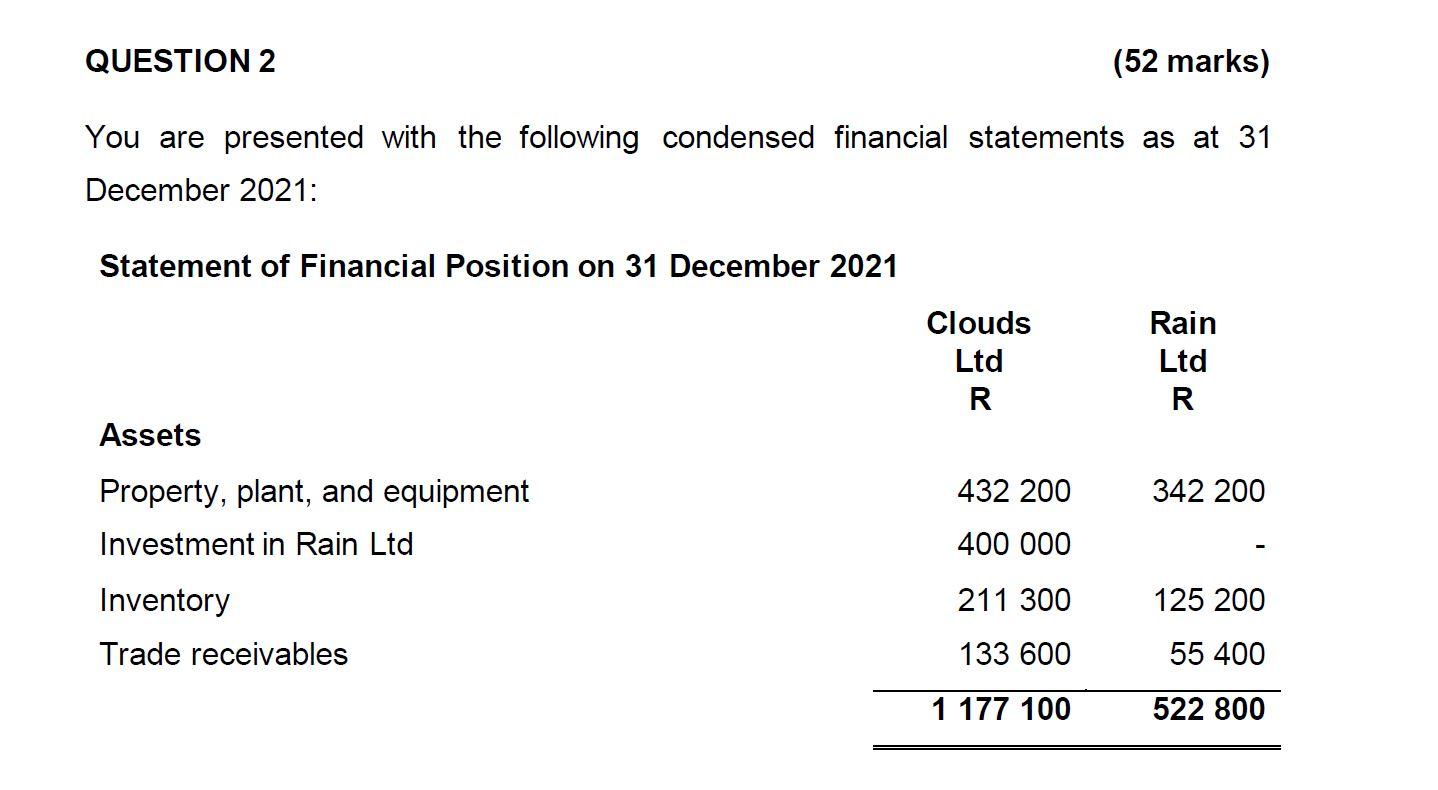

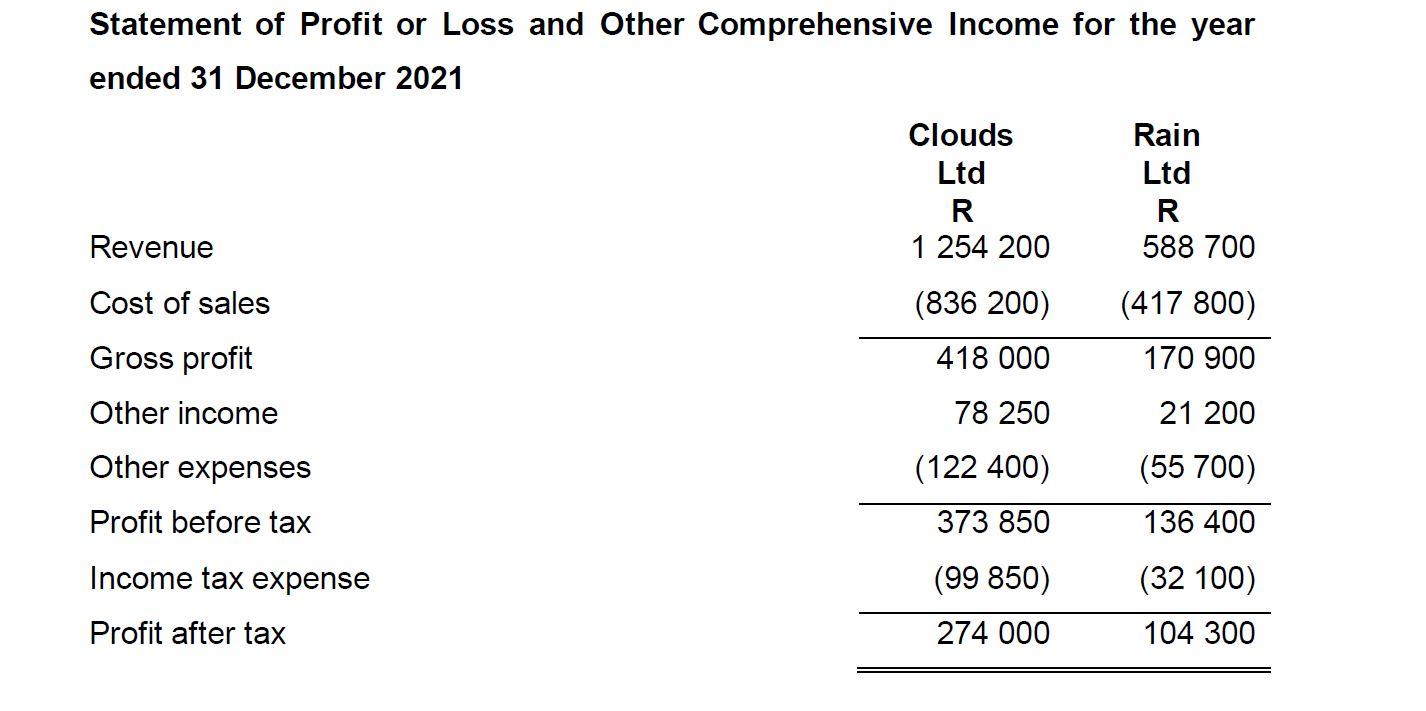

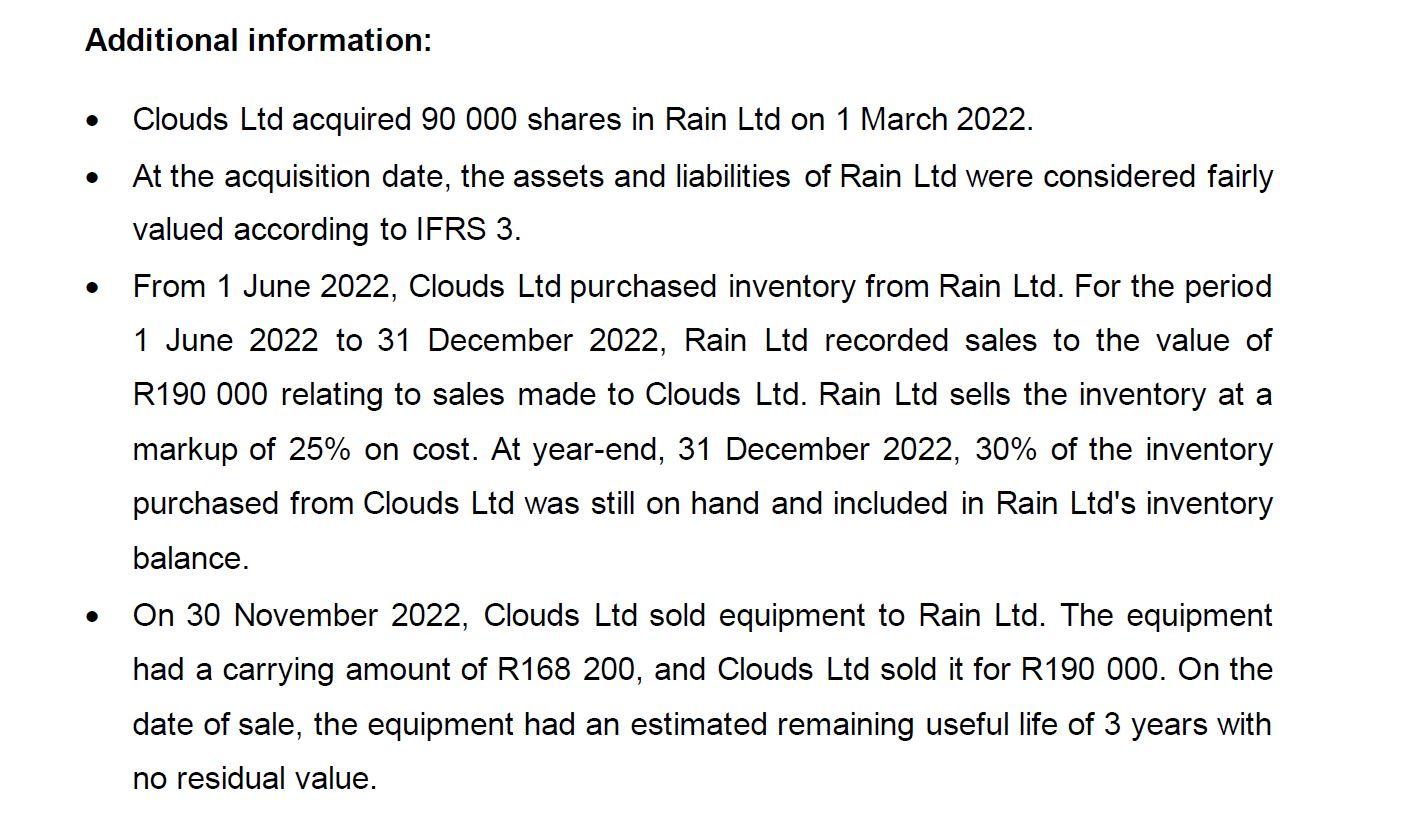

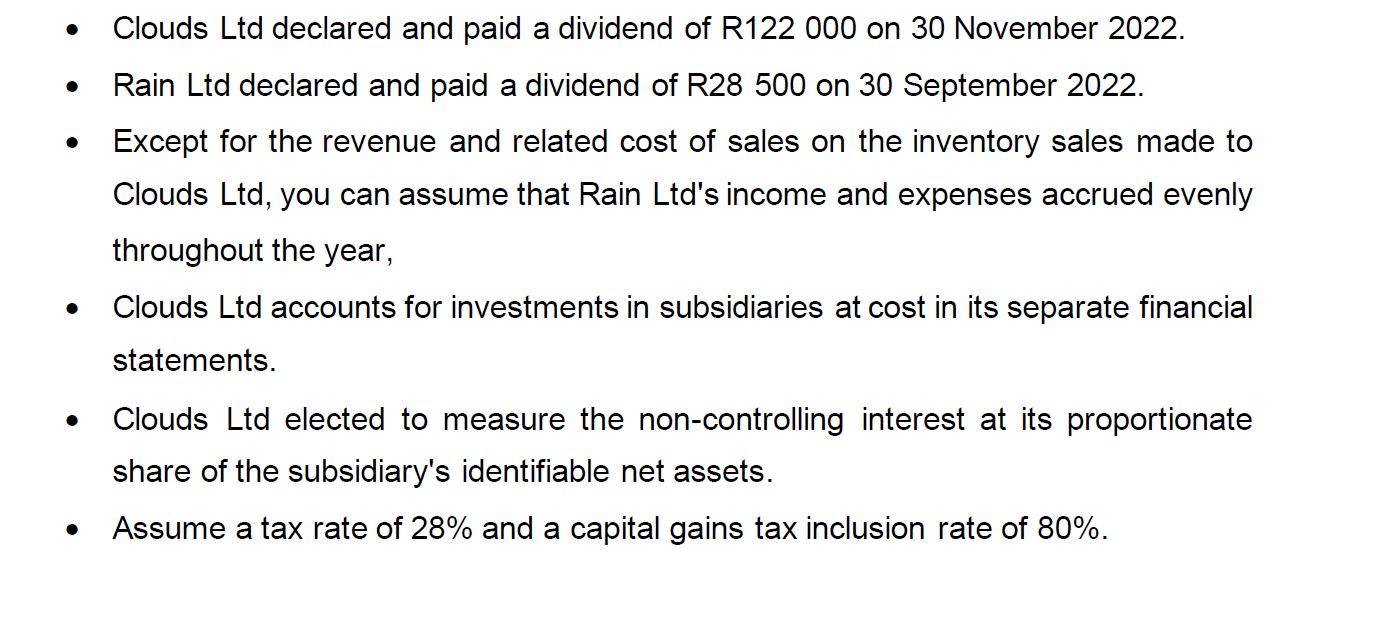

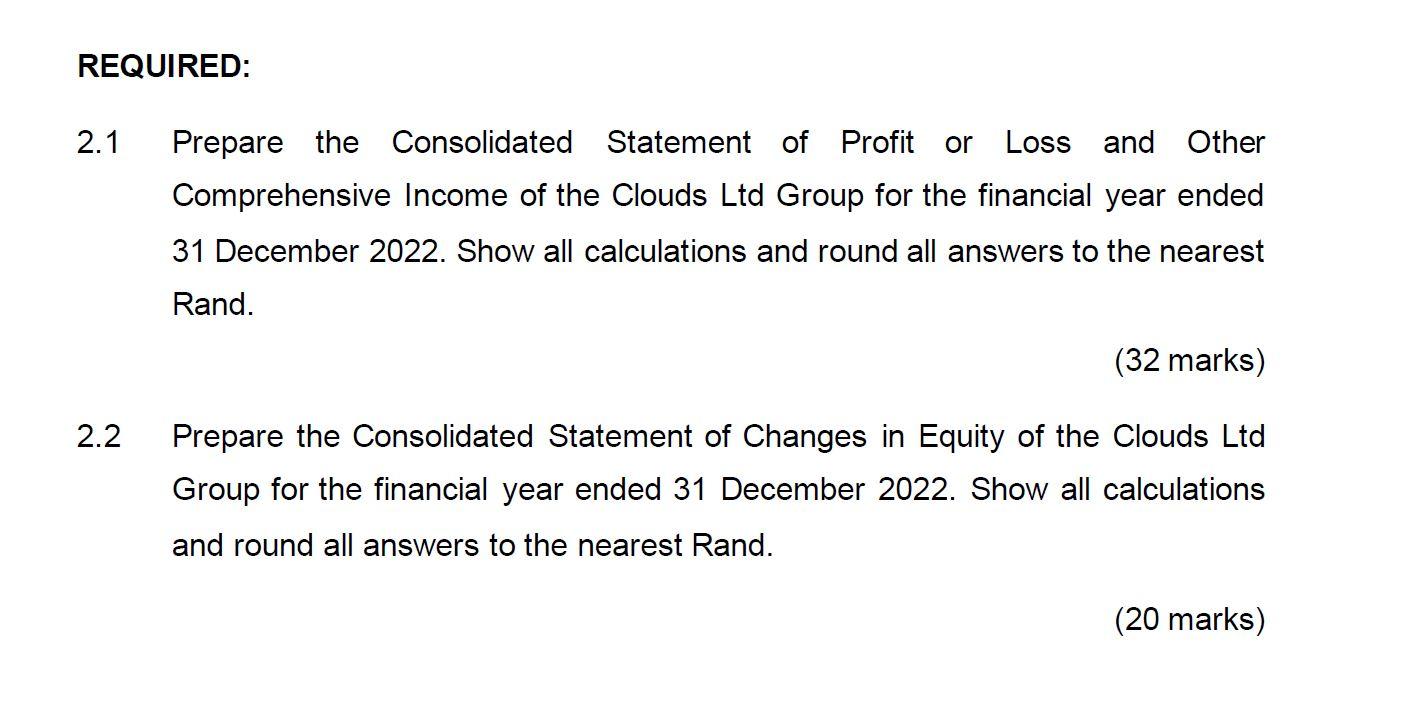

QUESTION 2 (52 marks) You are presented with the following condensed financial statements as at 31 December 2021: Statement of Financial Position on 31 December 2021 Equity and Liabilities \begin{tabular}{lrr} Ordinary share capital (200 000/100 200 shares) & 200000 & 100000 \\ Retained earnings & 878900 & 399300 \\ Trade payables & 98200 & 23500 \\ \cline { 2 - 3 } & 1177100 & 522800 \\ \hline \hline \end{tabular} Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2021 Additional information: - Clouds Ltd acquired 90000 shares in Rain Ltd on 1 March 2022. - At the acquisition date, the assets and liabilities of Rain Ltd were considered fairly valued according to IFRS 3. - From 1 June 2022, Clouds Ltd purchased inventory from Rain Ltd. For the period 1 June 2022 to 31 December 2022, Rain Ltd recorded sales to the value of R190 000 relating to sales made to Clouds Ltd. Rain Ltd sells the inventory at a markup of 25% on cost. At year-end, 31 December 2022,30% of the inventory purchased from Clouds Ltd was still on hand and included in Rain Ltd's inventory balance. - On 30 November 2022, Clouds Ltd sold equipment to Rain Ltd. The equipment had a carrying amount of R168 200, and Clouds Ltd sold it for R190 000. On the date of sale, the equipment had an estimated remaining useful life of 3 years with no residual value. - Clouds Ltd declared and paid a dividend of R122 000 on 30 November 2022. - Rain Ltd declared and paid a dividend of R28 500 on 30 September 2022. - Except for the revenue and related cost of sales on the inventory sales made to Clouds Ltd, you can assume that Rain Ltd's income and expenses accrued evenly throughout the year, - Clouds Ltd accounts for investments in subsidiaries at cost in its separate financial statements. - Clouds Ltd elected to measure the non-controlling interest at its proportionate share of the subsidiary's identifiable net assets. - Assume a tax rate of 28% and a capital gains tax inclusion rate of 80%. 2.1 Prepare the Consolidated Statement of Profit or Loss and Other Comprehensive Income of the Clouds Ltd Group for the financial year ended 31 December 2022. Show all calculations and round all answers to the nearest Rand. (32 marks) 2.2 Prepare the Consolidated Statement of Changes in Equity of the Clouds Ltd Group for the financial year ended 31 December 2022. Show all calculations and round all answers to the nearest Rand. QUESTION 2 (52 marks) You are presented with the following condensed financial statements as at 31 December 2021: Statement of Financial Position on 31 December 2021 Equity and Liabilities \begin{tabular}{lrr} Ordinary share capital (200 000/100 200 shares) & 200000 & 100000 \\ Retained earnings & 878900 & 399300 \\ Trade payables & 98200 & 23500 \\ \cline { 2 - 3 } & 1177100 & 522800 \\ \hline \hline \end{tabular} Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2021 Additional information: - Clouds Ltd acquired 90000 shares in Rain Ltd on 1 March 2022. - At the acquisition date, the assets and liabilities of Rain Ltd were considered fairly valued according to IFRS 3. - From 1 June 2022, Clouds Ltd purchased inventory from Rain Ltd. For the period 1 June 2022 to 31 December 2022, Rain Ltd recorded sales to the value of R190 000 relating to sales made to Clouds Ltd. Rain Ltd sells the inventory at a markup of 25% on cost. At year-end, 31 December 2022,30% of the inventory purchased from Clouds Ltd was still on hand and included in Rain Ltd's inventory balance. - On 30 November 2022, Clouds Ltd sold equipment to Rain Ltd. The equipment had a carrying amount of R168 200, and Clouds Ltd sold it for R190 000. On the date of sale, the equipment had an estimated remaining useful life of 3 years with no residual value. - Clouds Ltd declared and paid a dividend of R122 000 on 30 November 2022. - Rain Ltd declared and paid a dividend of R28 500 on 30 September 2022. - Except for the revenue and related cost of sales on the inventory sales made to Clouds Ltd, you can assume that Rain Ltd's income and expenses accrued evenly throughout the year, - Clouds Ltd accounts for investments in subsidiaries at cost in its separate financial statements. - Clouds Ltd elected to measure the non-controlling interest at its proportionate share of the subsidiary's identifiable net assets. - Assume a tax rate of 28% and a capital gains tax inclusion rate of 80%. 2.1 Prepare the Consolidated Statement of Profit or Loss and Other Comprehensive Income of the Clouds Ltd Group for the financial year ended 31 December 2022. Show all calculations and round all answers to the nearest Rand. (32 marks) 2.2 Prepare the Consolidated Statement of Changes in Equity of the Clouds Ltd Group for the financial year ended 31 December 2022. Show all calculations and round all answers to the nearest Rand