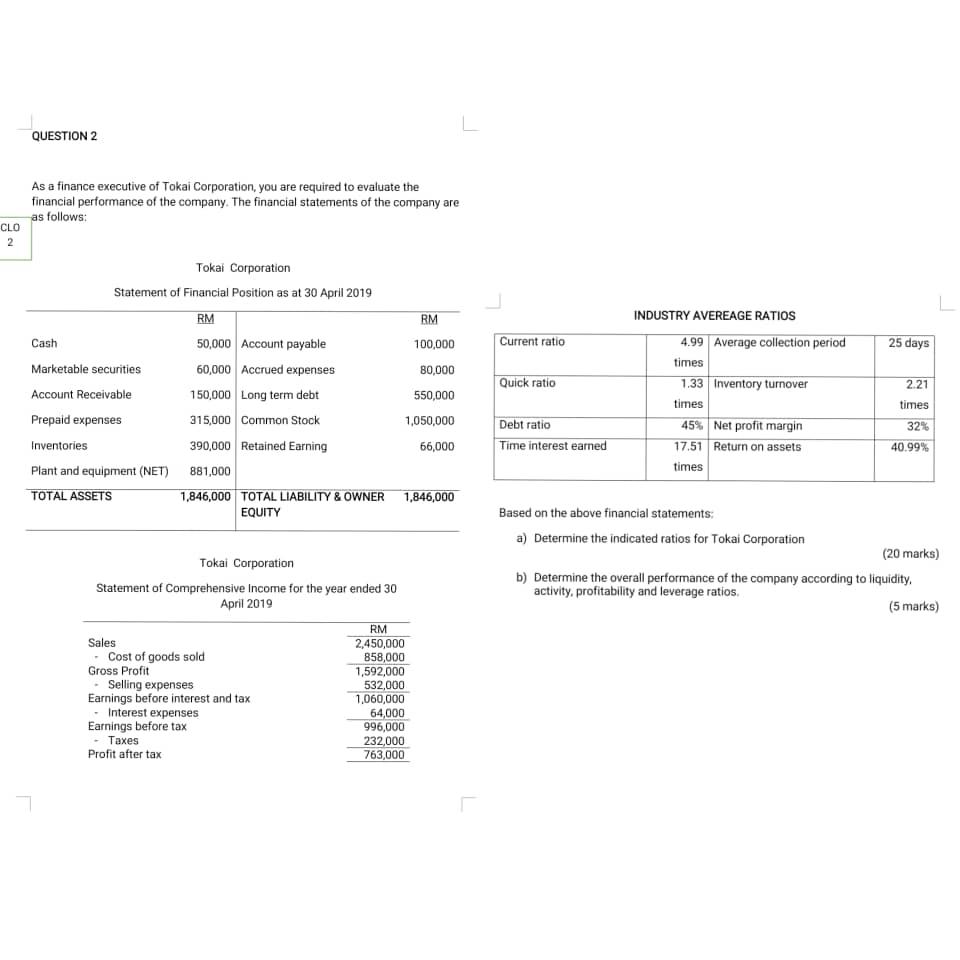

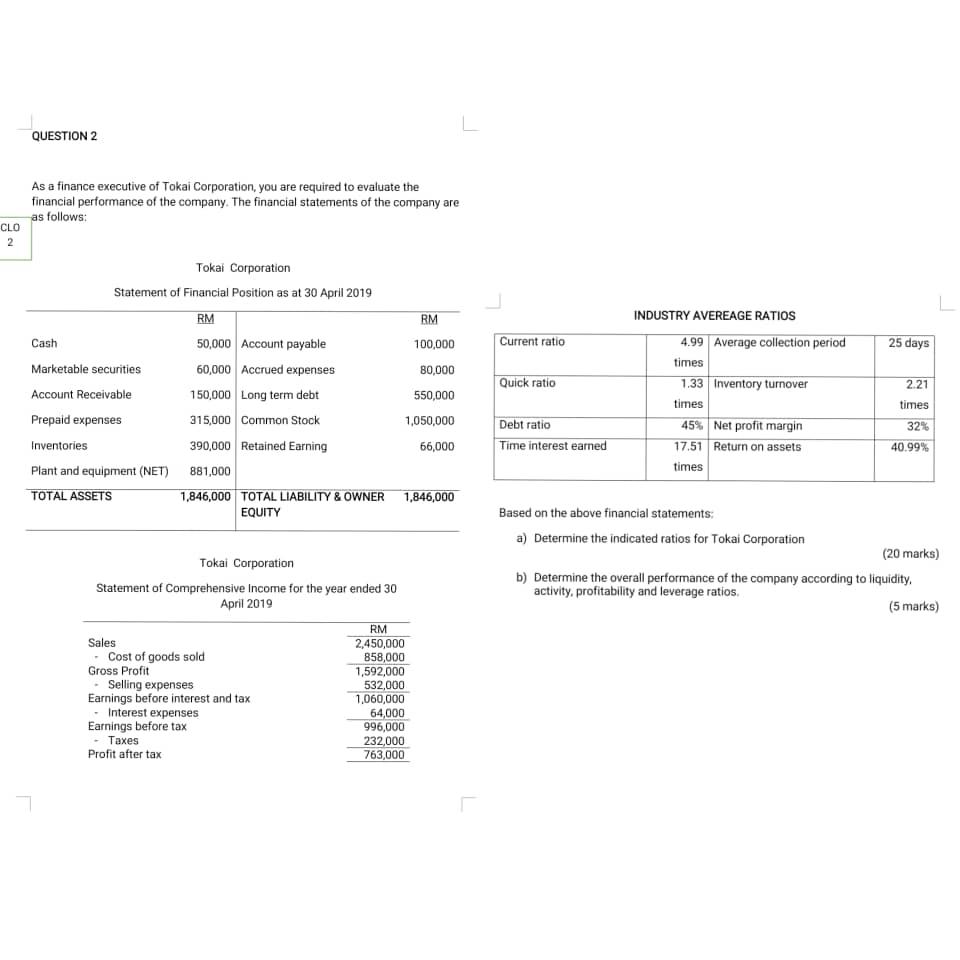

QUESTION 2 As a finance executive of Tokai Corporation, you are required to evaluate the financial performance of the company. The financial statements of the company are as follows: CLO 2 Current ratio 25 days Tokal Corporation Statement of Financial Position as at 30 April 2019 RM RM Cash 50,000 Account payable 100,000 Marketable securities 60,000 Accrued expenses 80,000 Account Receivable 150,000 Long term debt 550,000 Prepaid expenses 315,000 Common Stock 1,050,000 Inventories 390,000 Retained Earning 66,000 Plant and equipment (NET) 881,000 TOTAL ASSETS 1,846,000 TOTAL LIABILITY & OWNER 1,846,000 EQUITY Quick ratio INDUSTRY AVEREAGE RATIOS 4.99 Average collection period times 1.33 Inventory turnover times 45% Net profit margin 17.51 Return on assets times 2.21 times Debt ratio Time interest earned 32% 40.99% Based on the above financial statements: a) Determine the indicated ratios for Tokai Corporation (20 marks) b) Determine the overall performance of the company according to liquidity. activity, profitability and leverage ratios. (5 marks) Tokai Corporation Statement of Comprehensive Income for the year ended 30 April 2019 RM Sales 2.450,000 Cost of goods sold 858,000 Gross Profit 1,592,000 Selling expenses 532,000 Earnings before interest and tax 1,060,000 Interest expenses 64,000 Earnings before tax 996,000 Taxes 232,000 Profit after tax 763,000 QUESTION 2 As a finance executive of Tokai Corporation, you are required to evaluate the financial performance of the company. The financial statements of the company are as follows: CLO 2 Current ratio 25 days Tokal Corporation Statement of Financial Position as at 30 April 2019 RM RM Cash 50,000 Account payable 100,000 Marketable securities 60,000 Accrued expenses 80,000 Account Receivable 150,000 Long term debt 550,000 Prepaid expenses 315,000 Common Stock 1,050,000 Inventories 390,000 Retained Earning 66,000 Plant and equipment (NET) 881,000 TOTAL ASSETS 1,846,000 TOTAL LIABILITY & OWNER 1,846,000 EQUITY Quick ratio INDUSTRY AVEREAGE RATIOS 4.99 Average collection period times 1.33 Inventory turnover times 45% Net profit margin 17.51 Return on assets times 2.21 times Debt ratio Time interest earned 32% 40.99% Based on the above financial statements: a) Determine the indicated ratios for Tokai Corporation (20 marks) b) Determine the overall performance of the company according to liquidity. activity, profitability and leverage ratios. (5 marks) Tokai Corporation Statement of Comprehensive Income for the year ended 30 April 2019 RM Sales 2.450,000 Cost of goods sold 858,000 Gross Profit 1,592,000 Selling expenses 532,000 Earnings before interest and tax 1,060,000 Interest expenses 64,000 Earnings before tax 996,000 Taxes 232,000 Profit after tax 763,000