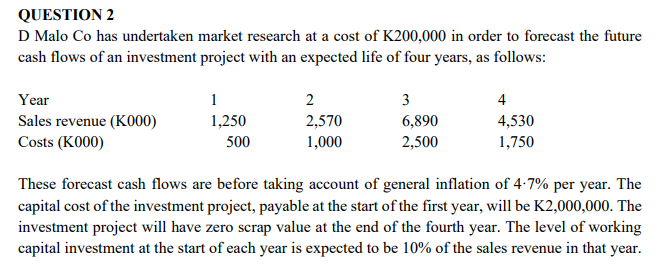

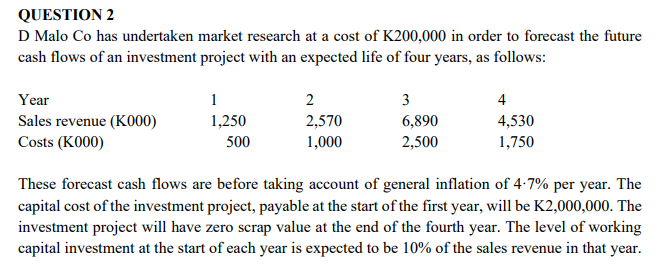

QUESTION 2 D Malo Co has undertaken market research at a cost of K200,000 in order to forecast the future cash flows of an investment project with an expected life of four years, as follows: These forecast cash flows are before taking account of general inflation of 4.7% per year. The capital cost of the investment project, payable at the start of the first year, will be K2,000,000. The investment project will have zero scrap value at the end of the fourth year. The level of working capital investment at the start of each year is expected to be 10% of the sales revenue in that year. Capital allowances would be available on the capital cost of the investment project on a 25% reducing balance basis. Darn Co pays tax on profits at an annual rate of 30% per year, with tax being paid one year in arrears. Darn Co has a nominal (money terms) after-tax cost of capital of 12% per year. Required: (a) Calculate the net present value of the investment project in nominal terms and comment on its financial acceptability. (b) Calculate the net present value of the investment project in real terms and comment on its financial acceptability. (c) List and explain three advantages and disadvantages of using Net Present Value in project appraisal QUESTION 2 D Malo Co has undertaken market research at a cost of K200,000 in order to forecast the future cash flows of an investment project with an expected life of four years, as follows: These forecast cash flows are before taking account of general inflation of 4.7% per year. The capital cost of the investment project, payable at the start of the first year, will be K2,000,000. The investment project will have zero scrap value at the end of the fourth year. The level of working capital investment at the start of each year is expected to be 10% of the sales revenue in that year. Capital allowances would be available on the capital cost of the investment project on a 25% reducing balance basis. Darn Co pays tax on profits at an annual rate of 30% per year, with tax being paid one year in arrears. Darn Co has a nominal (money terms) after-tax cost of capital of 12% per year. Required: (a) Calculate the net present value of the investment project in nominal terms and comment on its financial acceptability. (b) Calculate the net present value of the investment project in real terms and comment on its financial acceptability. (c) List and explain three advantages and disadvantages of using Net Present Value in project appraisal