Question

Question 2 En, Suhaimi, a Malaysian citizen, sold a residential property on 16 April 2018 for RM306,600. He used the money to settle his mortgage

Question 2

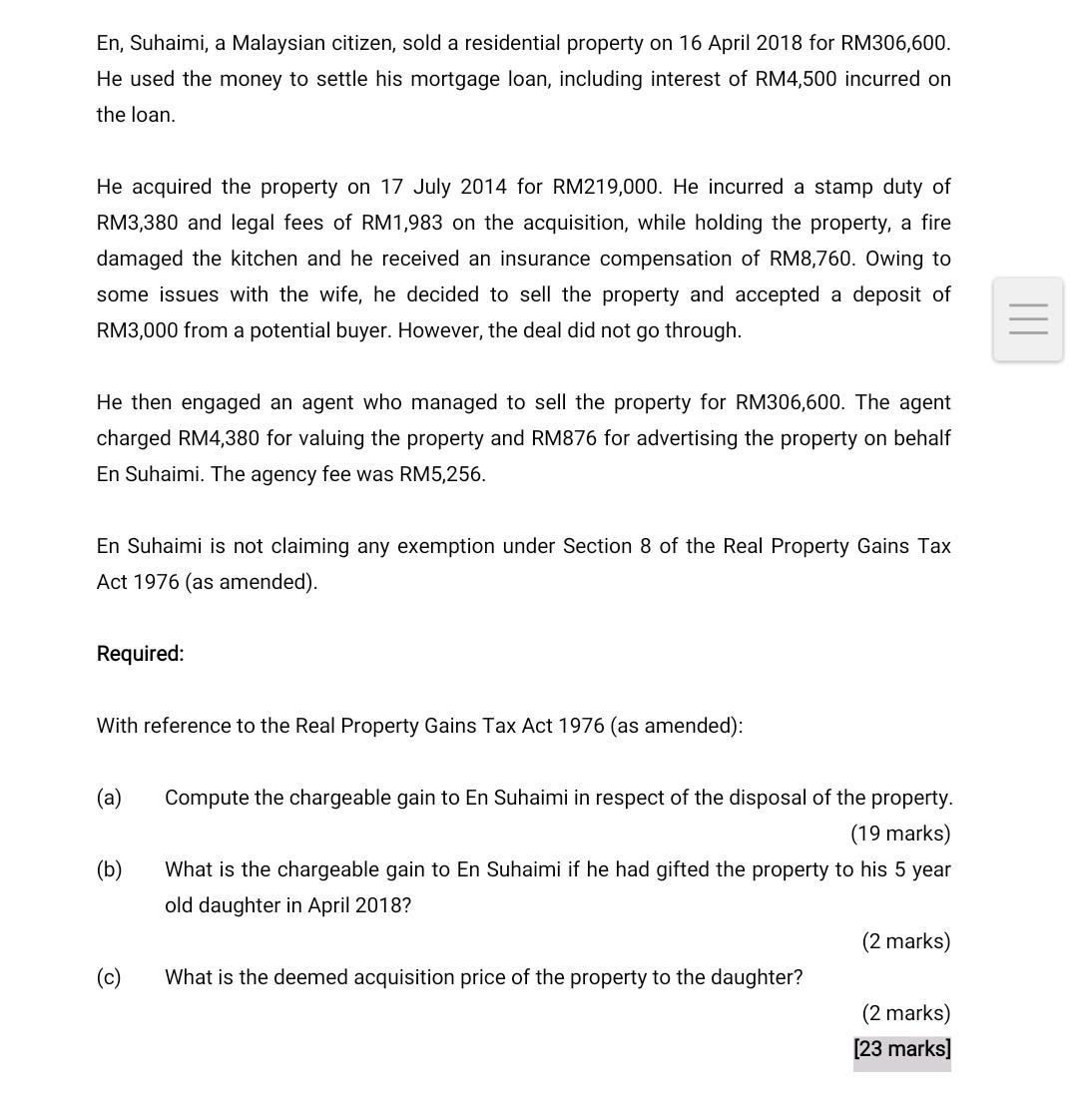

En, Suhaimi, a Malaysian citizen, sold a residential property on 16 April 2018 for RM306,600. He used the money to settle his mortgage loan, including interest of RM4,500 incurred on the loan.

He acquired the property on 17 July 2014 for RM219,000. He incurred a stamp duty of RM3,380 and legal fees of RM1,983 on the acquisition, while holding the property, a fire damaged the kitchen and he received an insurance compensation of RM8,760. Owing to some issues with the wife, he decided to sell the property and accepted a deposit of RM3,000 from a potential buyer. However, the deal did not go through.

He then engaged an agent who managed to sell the property for RM306,600. The agent charged RM4,380 for valuing the property and RM876 for advertising the property on behalf En Suhaimi. The agency fee was RM5,256.

En Suhaimi is not claiming any exemption under Section 8 of the Real Property Gains Tax Act 1976 (as amended).

Required:

With reference to the Real Property Gains Tax Act 1976 (as amended):

Compute the chargeable gain to En Suhaimi in respect of the disposal of the property. (19 marks) What is the chargeable gain to En Suhaimi if he had gifted the property to his 5 year old daughter in April 2018? (2 marks) What is the deemed acquisition price of the property to the daughter? (2 marks)

En, Suhaimi, a Malaysian citizen, sold a residential property on 16 April 2018 for RM306,600. He used the money to settle his mortgage loan, including interest of RM4,500 incurred on the loan. He acquired the property on 17 July 2014 for RM219,000. He incurred a stamp duty of RM3,380 and legal fees of RM1,983 on the acquisition, while holding the property, a fire damaged the kitchen and he received an insurance compensation of RM8,760. Owing to some issues with the wife, he decided to sell the property and accepted a deposit of RM3,000 from a potential buyer. However, the deal did not go through. He then engaged an agent who managed to sell the property for RM306,600. The agent charged RM4,380 for valuing the property and RM876 for advertising the property on behalf En Suhaimi. The agency fee was RM5,256. En Suhaimi is not claiming any exemption under Section 8 of the Real Property Gains Tax Act 1976 (as amended). Required: With reference to the Real Property Gains Tax Act 1976 (as amended): (a) (b) Compute the chargeable gain to En Suhaimi in respect of the disposal of the property. (19 marks) What is the chargeable gain to En Suhaimi if he had gifted the property to his 5 year old daughter in April 2018? marks) What is the deemed acquisition price of the property to the daughter? (2 marks) [23 marks) (c)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started