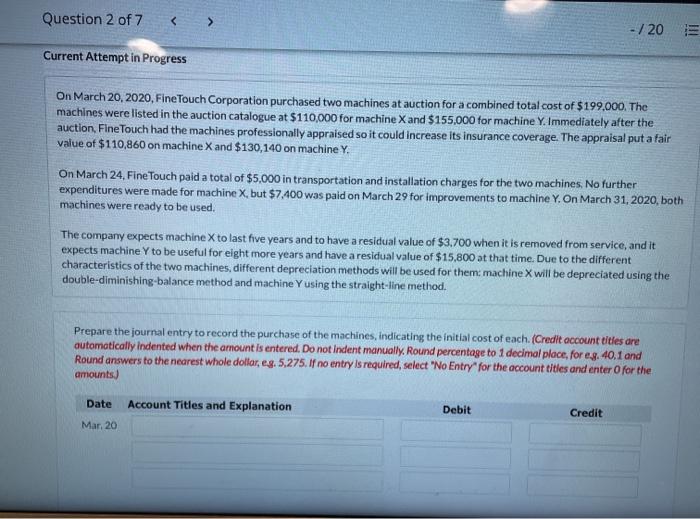

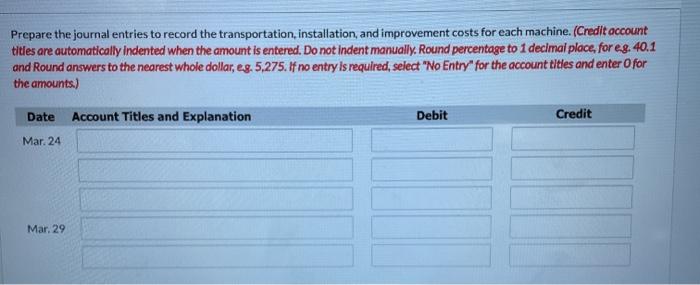

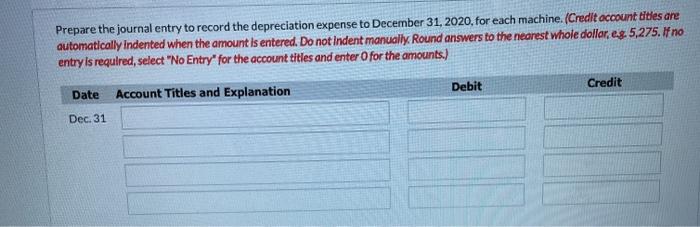

Question 2 of 7 - /20 Current Attempt in Progress On March 20, 2020, Fine Touch Corporation purchased two machines at auction for a combined total cost of $199,000. The machines were listed in the auction catalogue at $110,000 for machine X and $155,000 for machine Y. Immediately after the auction, Fine Touch had the machines professionally appraised so it could increase its insurance coverage. The appraisal put a fair value of $110,860 on machine X and $130,140 on machine Y. On March 24, Fine Touch paid a total of $5,000 in transportation and installation charges for the two machines, No further expenditures were made for machine X, but $7,400 was paid on March 29 for improvements to machine Y. On March 31, 2020, both machines were ready to be used. The company expects machine X to last five years and to have a residual value of $3.700 when it is removed from service, and it expects machine Y to be useful for eight more years and have a residual value of $15,800 at that time. Due to the different characteristics of the two machines, different depreciation methods will be used for them: machine X will be depreciated using the double-diminishing-balance method and machine Y using the straight-line method. Prepare the journal entry to record the purchase of the machines, indicating the initial cost of each. (Credit account titles are automatically indented when the amount is entered. Do not Indent manually. Round percentage to 1 decimal place, for eg. 40.1 and Round answers to the nearest whole dollar, eg. 5,275. If no entry is required, select "No Entry for the account titles and enter for the amounts) Date Account Titles and Explanation Debit Credit Mar. 20 Prepare the journal entries to record the transportation, installation, and improvement costs for each machine. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round percentage to 1 decimal place, for eg. 40.1 and Round answers to the nearest whole dollar, eg. 5,275. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Mar. 24 Mar. 29 Prepare the journal entry to record the depreciation expense to December 31, 2020, for each machine. (Credit account tities are automatically indented when the amount is entered. Do not Indent manually. Round answers to the nearest whole dollar eg. 5,275. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation Dec. 31