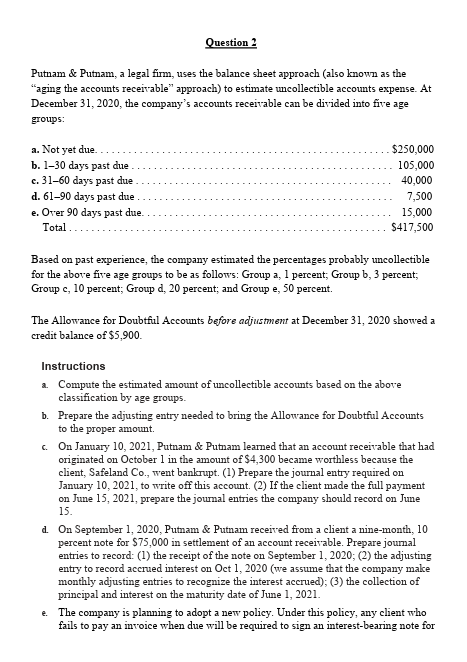

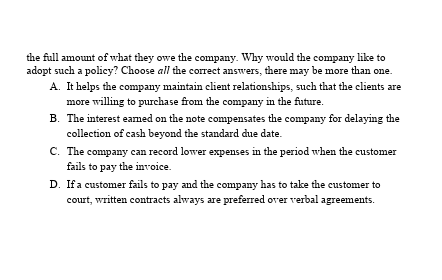

Question 2 Putnam \& Putnam, a legal firm, uses the balance sheet approach (also known as the "aging the accounts receivable" approach) to estimate uncollectible accounts expense. At December 31,2020 , the company's accounts receivable can be divided into five age groups: Based on past experience, the company estimated the percentages probably uncollectible for the above five age groups to be as follows: Group a, 1 percent; Group b, 3 percent; Group c, 10 percent; Group d, 20 percent; and Group e, 50 percent. The Allowance for Doubtful Accounts before adjustment at December 31, 2020 showed a credit balance of $5,900. Instructions a. Compute the estimated amount of uncollectible accounts based on the above classification by age groups. b. Prepare the adjusting entry needed to bring the Allowance for Doubtful Accounts to the proper amount. c. On January 10, 2021, Putnam \& Putnam learned that an account receivable that had originated on October 1 in the amount of $4,300 became worthless because the client, Safeland Co., went bankrupt. (1) Prepare the journal entry required on January 10,2021 , to write off this account. (2) If the client made the full payment on June 15, 2021, prepare the journal entries the company should record on June 15. d. On September 1, 2020, Putnam \& Putnam received from a client a nine-month, 10 percent note for $75,000 in settlement of an account receivable. Prepare journal entries to record: (1) the receipt of the note on September 1, 2020; (2) the adjusting entry to record accrued interest on Oct 1, 2020 (we assume that the company make monthly adjusting entries to recognize the interest accrued); (3) the collection of principal and interest on the maturity date of June 1, 2021. e. The company is planning to adopt a new policy. Under this policy, any client who fails to pay an invoice when due will be required to sign an interest-bearing note for the full amount of what they owe the company. Why would the company like to adopt such a policy? Choose all the correct answers, there may be more than one. A. It helps the company maintain client relationships, such that the clients are more willing to purchase from the company in the future. B. The interest eamed on the note compensates the company for delaying the collection of cash beyond the standard due date. C. The company can record lower expenses in the period when the customer fails to pay the invoice. D. If a customer fails to pay and the company has to take the customer to court, written contracts always are preferred over verbal agreements