Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 - This question has 1 part (3 marks) Piggie Champ is a small caf in Burwood, VIC. It was established in 1998,

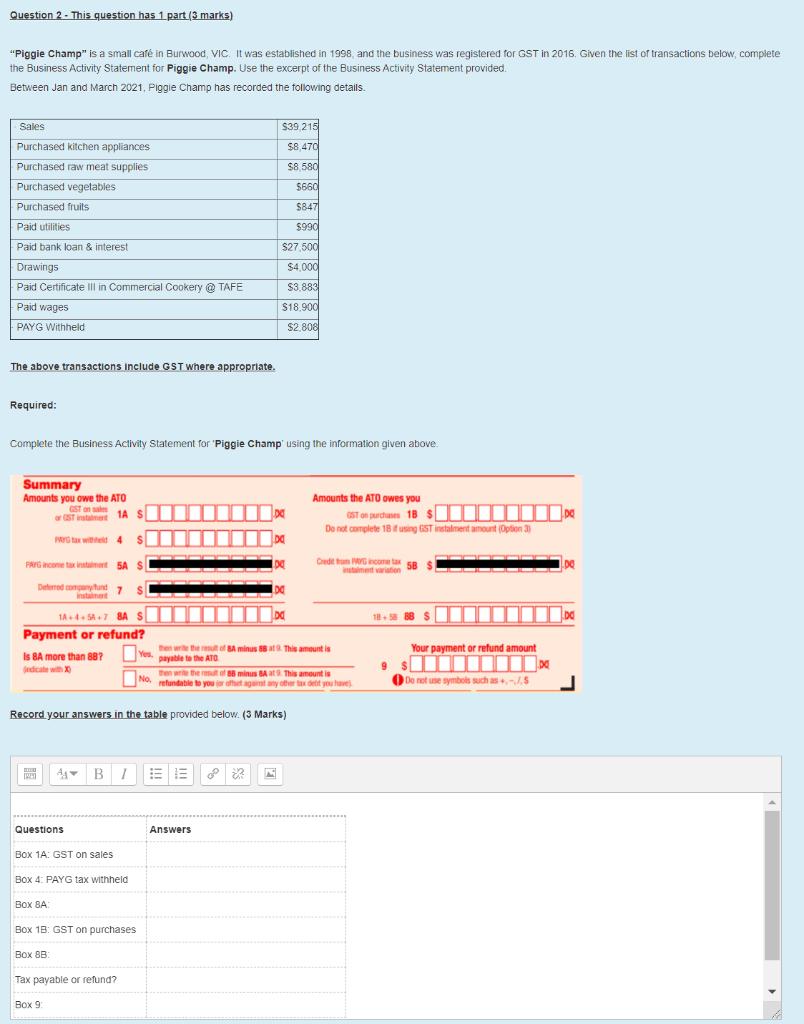

Question 2 - This question has 1 part (3 marks) "Piggie Champ" is a small caf in Burwood, VIC. It was established in 1998, and the business was registered for GST in 2016. Given the list of transactions below, complete the Business Activity Statement for Piggie Champ. Use the excerpt of the Business Activity Statement provided. Between Jan and March 2021, Piggie Champ has recorded the following details. Sales $39,215 Purchased kitchen appliances $8,470 Purchased raw meat supplies $8.580 Purchased vegetables $660 Purchased fruits $847 Paid utilities $990 Paid bank loan & interest $27,500 Drawings $4,000 Paid Certificate III in Commercial Cookery @ TAFE S3.883 Paid wages $18,900 PAYG Withheld $2,808 The above transactions include GST where appropriate. Required: Complete the Business Activity Statement for 'Piggie Champ' using the information given above. Summary Amounts you owe the ATO Amounts the ATO owes you eST on sa or ST instame 1A S OST on purchases 18 Do not complete 18ifusing ST instalment amount (Option 3) PRYG ta withet 4 PAYG cone ta instament SA Cedittum Gcome tax intament variation 58 $ Deterred conpanytund instaimet 17 1A4. SA7 8A S 18. 88 S Payment or refund? then write the rutof BA minus 8at This amount is Yes payable te the ATO Your payment or refund amount Is BA more than 88? edicate with X 1 then wrte the mut of 8 minus 8A at This amount is No refundable to you r ofhet againt any other tax detit you havej O De ret use symbols such as .S Record your answers in the table provided below. (3 Marks) BI !! Questions Answers Box 1A: GST on sales Box 4: PAYG tax withheld Box BA Box 18: GST on purchases Box 8B Tax payable or refund? 9.

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Our business activity statem...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started