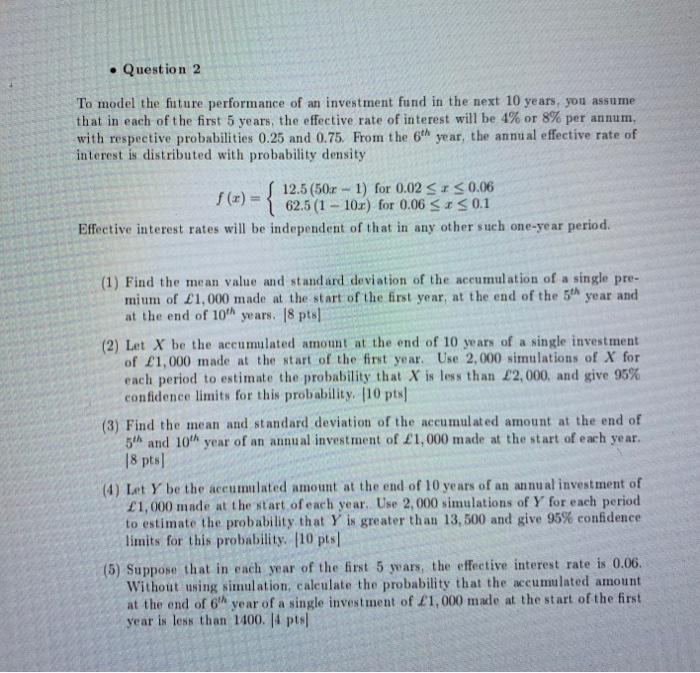

. Question 2 To model the future performance of an investment fund in the next 10 years, you assume that in each of the first 5 years, the effective rate of interest will be 4% or 8% per annum, with respective probabilities 0.25 and 0.75 From the 6th year, the annual effective rate of interest is distributed with probability density 12.5 (50x - 1) for 0.02 Sr 30.06 62.5 (1 - 10.x) for 0.06 IS0.1 Effective interest rates will be independent of that in any other such one-year period. S(x) = { (1) Find the mean value and standard deviation of the accumulation of a single pre- mium of 1,000 made at the start of the first year, at the end of the 5th year and at the end of 10 years. 18 pts) (2) Let X be the accumulated amount at the end of 10 years of a single investment of 1,000 made at the start of the first year. Use 2,000 simulations of X for each period to estimate the probability that X is less than 2,000, and give 95% confidence limits for this probability 10 pts (3) Find the mean and standard deviation of the accumulated amount at the end of 5th and 10 year of an annual investment of 1,000 made at the start of each year. 18 pts] (4) Let Y be the accumulated amount at the end of 10 years of an annual investment of 1,000 made at the start of each year. Use 2,000 simulations of Y for each period to estimate the probability that Y is greater than 13,500 and give 95% confidence limits for this probability. [10 pts (5) Suppose that in each year of the first 5 years, the effective interest rate is 0.06. Without using simulation, calculate the probability that the accumulated amount at the end of 6 year of a single investment of 1,000 made at the start of the first year is less than 1400 14 pts . Question 2 To model the future performance of an investment fund in the next 10 years, you assume that in each of the first 5 years, the effective rate of interest will be 4% or 8% per annum, with respective probabilities 0.25 and 0.75 From the 6th year, the annual effective rate of interest is distributed with probability density 12.5 (50x - 1) for 0.02 Sr 30.06 62.5 (1 - 10.x) for 0.06 IS0.1 Effective interest rates will be independent of that in any other such one-year period. S(x) = { (1) Find the mean value and standard deviation of the accumulation of a single pre- mium of 1,000 made at the start of the first year, at the end of the 5th year and at the end of 10 years. 18 pts) (2) Let X be the accumulated amount at the end of 10 years of a single investment of 1,000 made at the start of the first year. Use 2,000 simulations of X for each period to estimate the probability that X is less than 2,000, and give 95% confidence limits for this probability 10 pts (3) Find the mean and standard deviation of the accumulated amount at the end of 5th and 10 year of an annual investment of 1,000 made at the start of each year. 18 pts] (4) Let Y be the accumulated amount at the end of 10 years of an annual investment of 1,000 made at the start of each year. Use 2,000 simulations of Y for each period to estimate the probability that Y is greater than 13,500 and give 95% confidence limits for this probability. [10 pts (5) Suppose that in each year of the first 5 years, the effective interest rate is 0.06. Without using simulation, calculate the probability that the accumulated amount at the end of 6 year of a single investment of 1,000 made at the start of the first year is less than 1400 14 pts