Question

Question 2: Wells Fargo: Solar Energy for Los Angeles Branch (A) (Case Study UV6566) If Wells Fargo installs solar panels on even a small fraction

Question 2: Wells Fargo: Solar Energy for Los Angeles Branch (A) (Case Study UV6566)

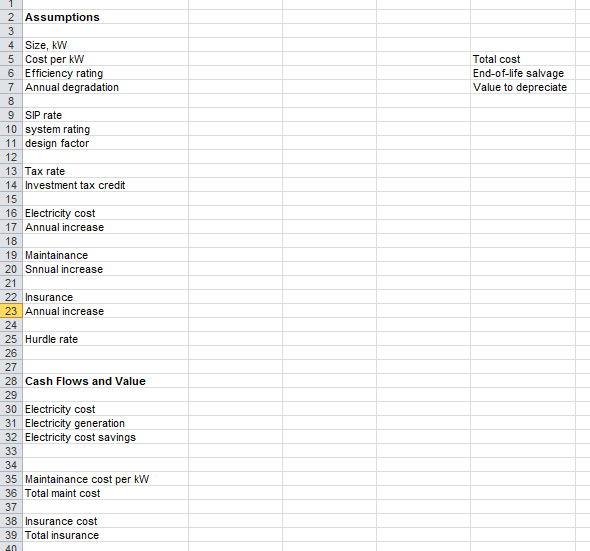

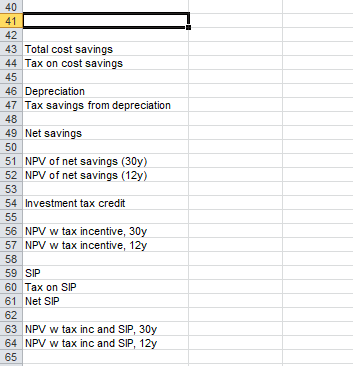

If Wells Fargo installs solar panels on even a small fraction of its more than 6000 banking branches across the United States, it can become one of the largest and most sustainable energy producers in the country. Sheri Lucas, VP and strategic finance manager at Wells Fargo, led the company's pilot installation in Denver and now is examining the possibility of a similar installation in Los Angeles. The case provides the background for the photovoltaic technology and business of solar panels and describes the base case situation that Lucas faced in 2011.

2.1. What is the value of the project without the incentives over a 12-year horizon? And over 30 years?

2.2. What is the value of the project with the ITC incentive over a 12-year horizon? And over 30 years?

2.3. What is the value of the project with the ITC incentive and the SIP for a 12-year horizon? And over 30 years?

2.4. Should Lucas go ahead with the project?

************

plz use excel to solve these questions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started