Question

Question 2 Your superior at the Money Management Company you work for has just analyzed your portfolio. He instructs you to reduce cash holdings

Question 2 Your superior at the Money Management Company you work for has just analyzed your portfolio. He instructs you to reduce cash holdings and to reduce the overall portfolio beta. In order to perform both, you just long a huge position in Public Bank’s equity. Given the equity’s stable nature, it has very low beta. Now you are worried that this new investment could reduce the overall portfolio returns. You want to have the defensive stock in your portfolio but need to have higher returns than a passive buy and hold strategy. Assuming options on Public Bank’s stock is available, outline an appropriate strategy. (Graph the strategy, show the overall payoff, use assumed stock and exercise prices).

Question 3 The price of an equity is RM5. Call and put options are available for this equity. The maturity of the options is at time Y. The stock price will change 3 times until maturity. The chance of the stock price going up is 70% while going down is 30%. The annualised risk-free rate between now and time Y is 5% and the equity risk is 15%. Required: (a)Draw a statistical diagramme showing the path of the stock prices and their terminal prices for a call option worth RM5.00 maturing at time Y. Calculate the value of the call option based upon the Binomial Options Pricing Model (BOPM).(6 marks) (b)If it is a put option with the same characteristics, what would be its value based upon BOPM ? Explain why the put option value is higher or smaller compared to the call option.

Question 4 Khazanah Bhd shares are currently at RM15.00. 3-month call and put options with RM15.00 exercise price are being quoted at RM0.75 and RM0.19 respectively. The R f rate is 12% per annum. (a)Using put-call parity model, prove that there is mispricing and identify the security that is mispriced relative to the others.(3 marks) (b)Outline the arbitrage strategy and show the arbitrage assuming you invested in one lot/contract.(2 marks) (c)Graph the overall position

Question 5 Choose a United States equity whereby its options are listed on the Chicago Board Options Exchange (CBOE). The data for prices is in the “delayed quotes” menu of www.cboe.com. Key in a ticker symbol for your equity preference and extract the data on option prices. Utilising daily stock price data from finance.yahoo.com, calculate the annualised standard deviation of the daily percentage change in the equity price. Generate a Black-Scholes option pricing model in a spreadsheet. Using thestandarddeviationandarisk-freeratefoundat https://www.bloomberg.com/markets/rates-bonds/government-bonds/us , calculate the value of the call options. How do the calculated values compare to the market prices of the options ? On the basis of the difference between the price you calculated.

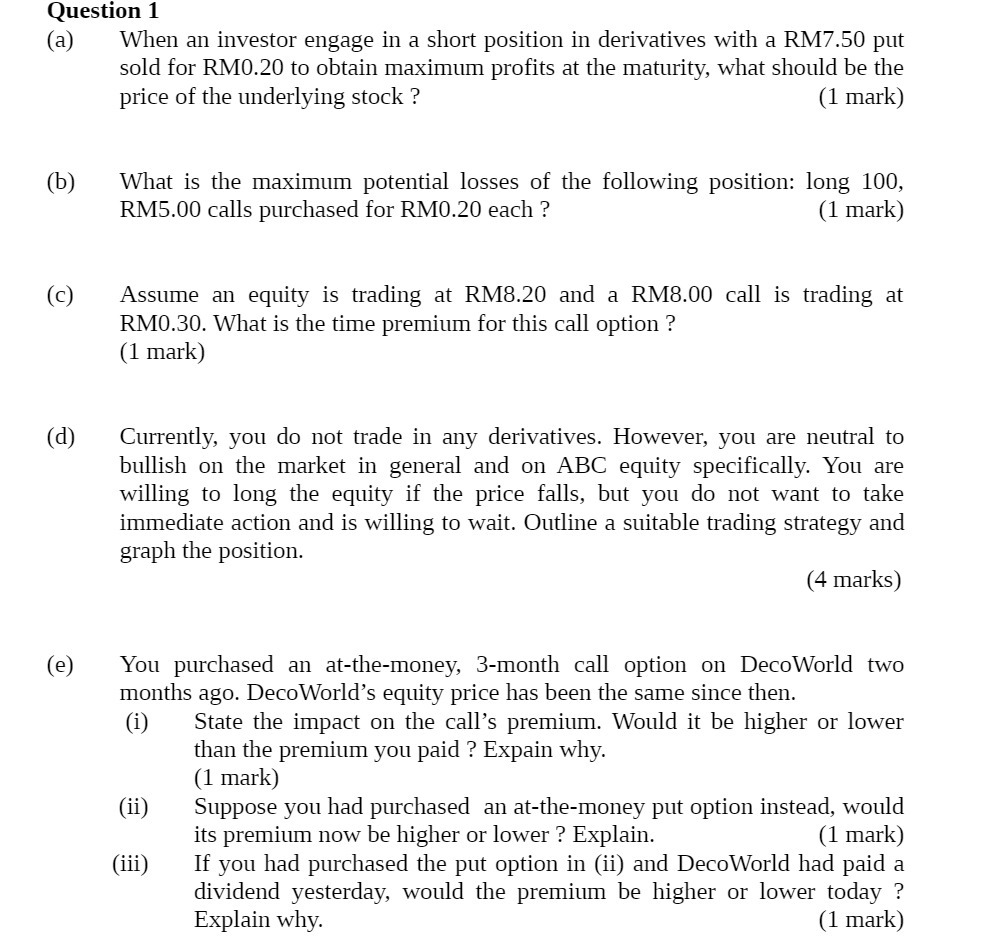

Question 1 (a) When an investor engage in a short position in derivatives with a RM7.50 put sold for RM0.20 to obtain maximum profits at the maturity, what should be the price of the underlying stock? (1 mark) (b) (c) (d) (e) What is the maximum potential losses of the following position: long 100, RM5.00 calls purchased for RM0.20 each ? (1 mark) Assume an equity is trading at RM8.20 and a RM8.00 call is trading at RM0.30. What is the time premium for this call option ? (1 mark) Currently, you do not trade in any derivatives. However, you are neutral to bullish on the market in general and on ABC equity specifically. You are willing to long the equity if the price falls, but you do not want to take immediate action and is willing to wait. Outline a suitable trading strategy and graph the position. (4 marks) You purchased an at-the-money, 3-month call option on Deco World two months ago. DecoWorld's equity price has been the same since then. (i) State the impact on the call's premium. Would it be higher or lower than the premium you paid? Expain why. (1 mark) (ii) (iii) Suppose you had purchased an at-the-money put option instead, would its premium now be higher or lower ? Explain. (1 mark) If you had purchased the put option in (ii) and DecoWorld had paid a dividend yesterday, would the premium be higher or lower today? Explain why. (1 mark)

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Question 1 a The price of the underlying stock should be RM750 When an investor sells a put option with a strike price of RM750 for RM020 the maximum profit they can obtain at maturity is RM020 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started