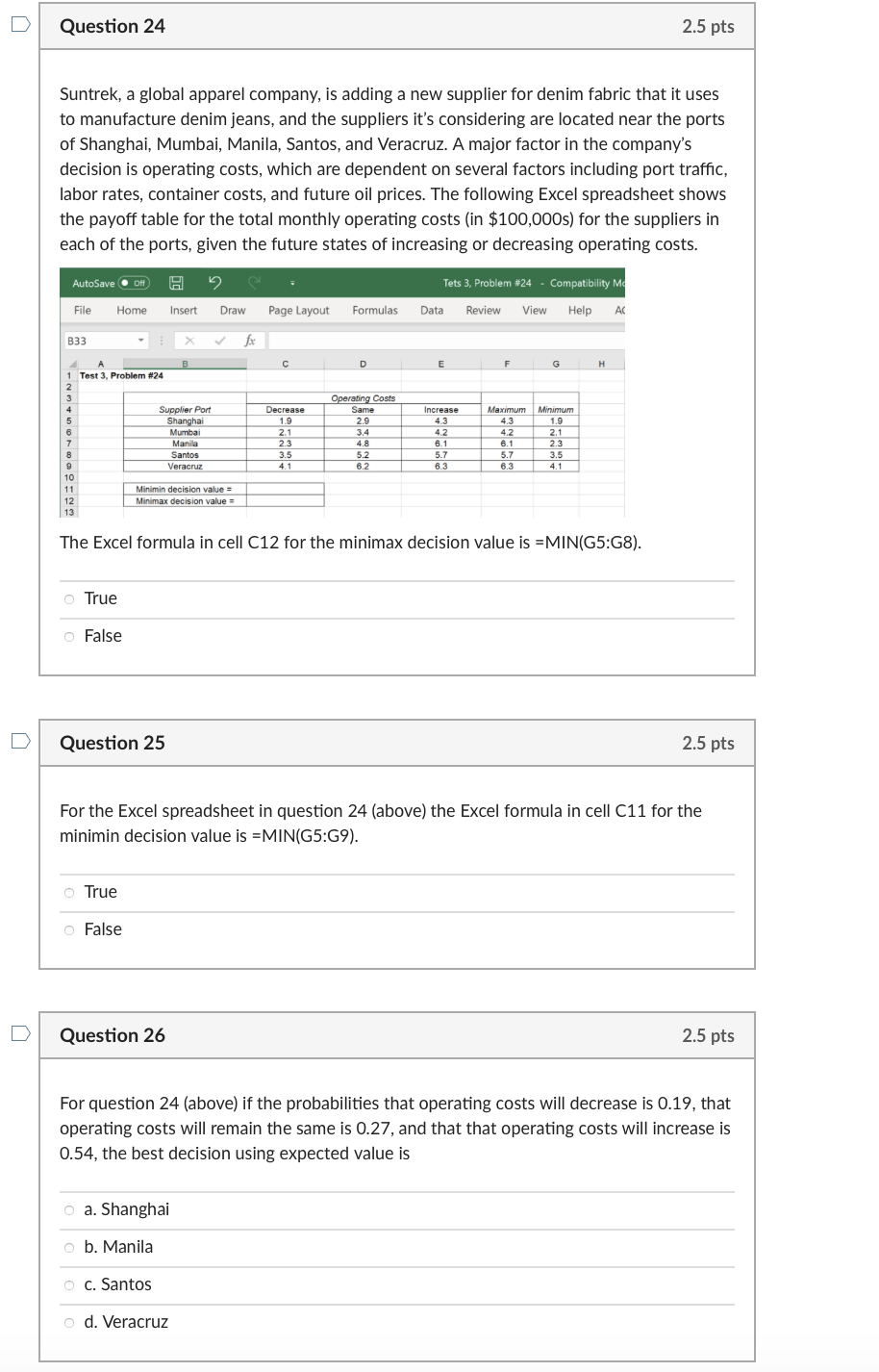

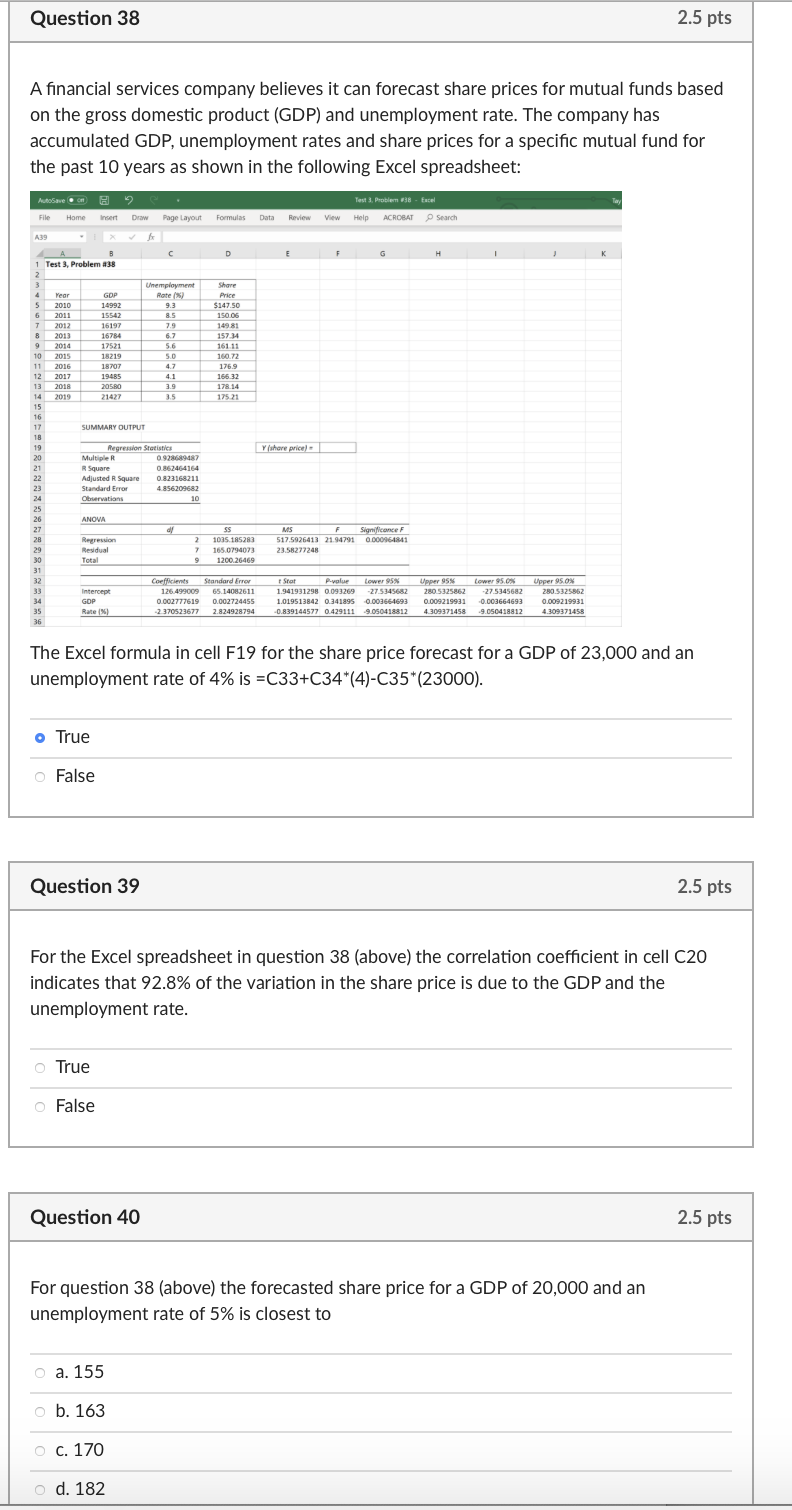

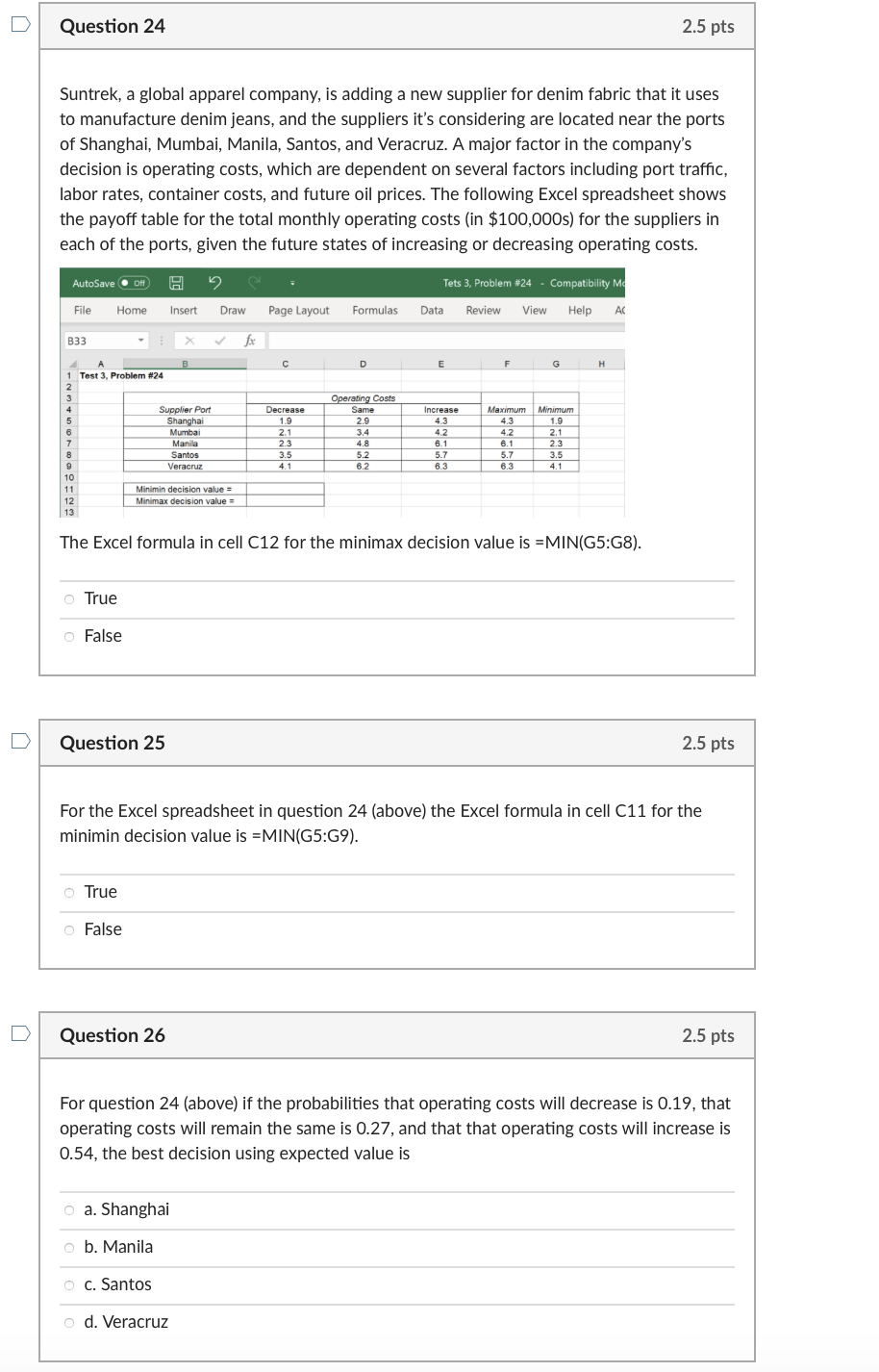

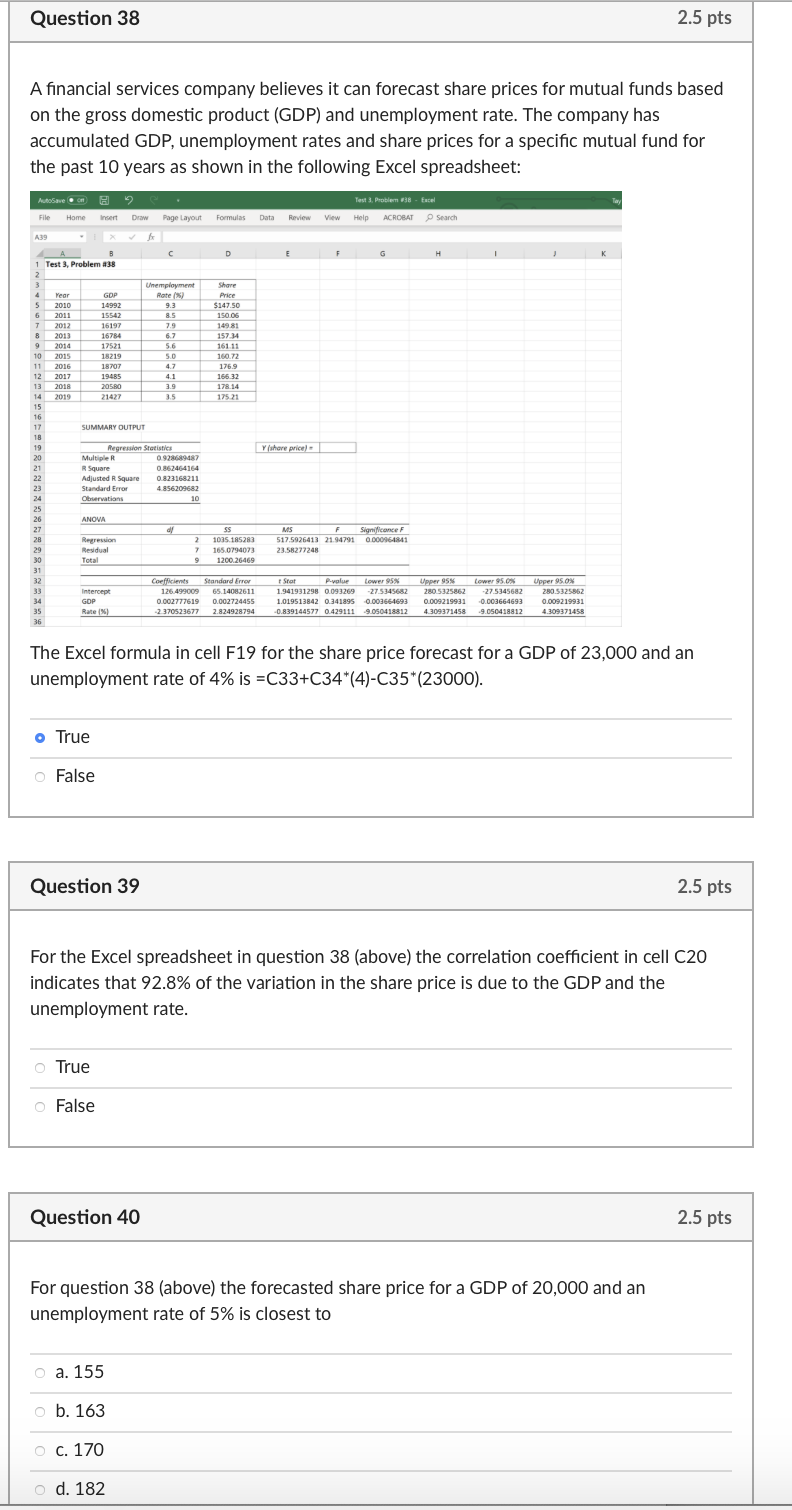

Question 24 2.5 pts Suntrek, a global apparel company, is adding a new supplier for denim fabric that it uses to manufacture denim jeans, and the suppliers it's considering are located near the ports of Shanghai, Mumbai, Manila, Santos, and Veracruz. A major factor in the company's decision is operating costs, which are dependent on several factors including port traffic, labor rates, container costs, and future oil prices. The following Excel spreadsheet shows the payoff table for the total monthly operating costs in $100,000s) for the suppliers in each of the ports, given the future states of increasing or decreasing operating costs. AutoSave Off Tets 3, Problem #24 - Compatibility Md Data Review View Help AC File Home Insert Draw Page Layout Formulas B33 fx B D E F G H 1 Test 3, Problem #24 3 Increase Maximum Supplier Port Shanghai Mumbai Manila Santos Veracruz Operating costs Same 2.9 3.4 4.8 Decrease 1.9 2.1 2.3 3.5 4.1 5 6 7 8 9 10 11 12 13 4.2 6.1 5.7 8.3 4.2 6.1 5.7 63 Minimum 1.6 2.1 2.3 3.5 4.1 5.2 6.2 Minimin decision value = Minimax decision value = The Excel formula in cell C12 for the minimax decision value is =MIN(G5:68). O True o False Question 25 2.5 pts For the Excel spreadsheet in question 24 (above) the Excel formula in cell C11 for the minimin decision value is =MIN(G5:69). True O False Question 26 2.5 pts For question 24 (above) if the probabilities that operating costs will decrease is 0.19, that operating costs will remain the same is 0.27, and that that operating costs will increase is 0.54, the best decision using expected value is a. Shanghai o b. Manila O C. Santos O d. Veracruz Question 38 2.5 pts A financial services company believes it can forecast share prices for mutual funds based on the gross domestic product (GDP) and unemployment rate. The company has accumulated GDP, unemployment rates and share prices for a specific mutual fund for the past 10 years as shown in the following Excel spreadsheet: Test 3. Problem 38 - Eacel AutoSave 2 File Home sert Draw Page Layout Formulas Data Review View Help View Help ACROBAT Search A39 D E G H Share Price $147.50 15006 149 81 157.34 161.11 160.72 176.9 166.32 178.14 17521 B 1 Test 3. Problem 838 2 3 Unemployment Year GOP Rate 1 ) s 5 2010 14992 9.3 6 2011 15542 8.5 7 2012 16197 7.9 8 2013 16784 6.7 9 9 2014 17521 5.6 10 2015 18219 11 2016 18707 4.7 12 2017 19485 4.1 13 2018 20580 3.9 14 2019 21427 3.5 15 16 17 SUMMARY OUTPUT 18 19 Regression Sroristics 20 Multiple 0928689487 21 R Square 0.862464164 22 Adiusted R Square 0.823168211 23 Standard Error 4.8562082 24 Observations 10 25 26 ANOVA 27 dy 28 Regression 2 29 Residual 7 30 Total 9 Yfshore price) 5S 1035.185283 165.0794073 1200.26469 MS F Significance 517.5926413 21.94791 0.000964841 23.58277248 32 Intercept GOP Rate) Coefficients Standard Errow 126.499009 65.14082611 0.002777613 0.002724455 -2 2370523677 2.824928794 Stel P-value Lower 95% Upper 95% 1.941931298 0.093269 -27 5145682 280.5325862 1.019513842 0.341895 -0.003664693 0.009219931 -0.839144577 0.4291119_050418812 4.309371458 Lower 95.0% 27.5345682 -0.003664693 9050418812 Upper 95.0% 280.5325862 0.009219931 4.309371458 35 36 The Excel formula in cell F19 for the share price forecast for a GDP of 23,000 and an unemployment rate of 4% is =C33+C34*(4)-C35*(23000). o True o False Question 39 2.5 pts For the Excel spreadsheet in question 38 (above) the correlation coefficient in cell C20 indicates that 92.8% of the variation in the share price is due to the GDP and the unemployment rate. O True False Question 40 2.5 pts For question 38 (above) the forecasted share price for a GDP of 20,000 and an unemployment rate of 5% is closest to o a. 155 o b. 163 O C. 170 O d. 182