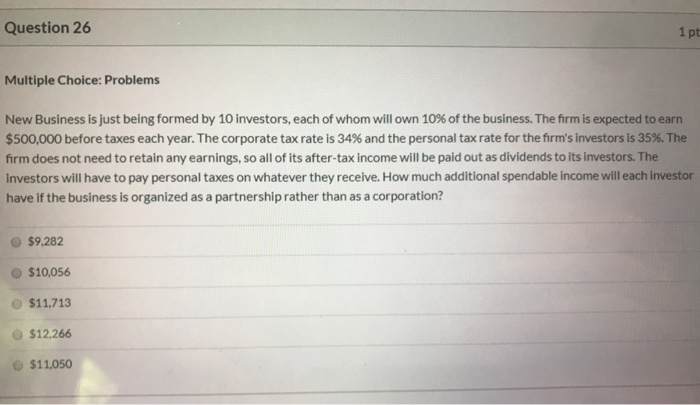

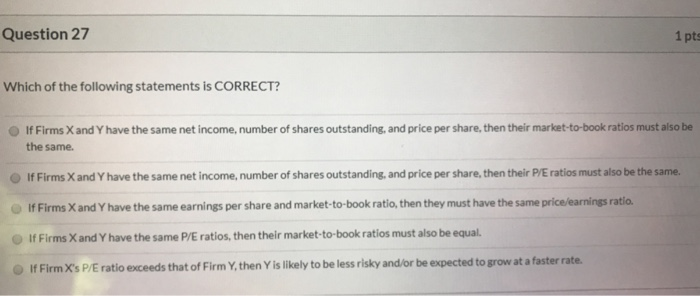

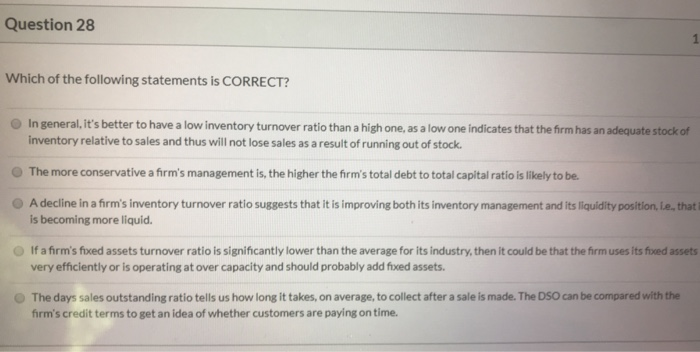

Question 26 1 pt Multiple Choice: Problems New Business is just being formed by 10 investors, each of whom will own 10% of the business. The firm is expected to earn $500,000 before taxes each year. The corporate tax rate is 34% and the personal tax rate for the firm's investors is 35%. The firm does not need to retain any earnings, so all of its after-tax income will be paid out as dividends to its investors. The Investors will have to pay personal taxes on whatever they receive. How much additional spendable income will each investor have if the business is organized as a partnership rather than as a corporation? $9,282 $10,056 $11,713 $12,266 $11,050 Question 27 1 pts Which of the following statements is CORRECT? If Firms X and Y have the same net income, number of shares outstanding, and price per share, then their market-to-book ratios must also be the same. If Firms X and Y have the same net income, number of shares outstanding, and price per share, then their P/E ratios must also be the same. If Firms X and Y have the same earnings per share and market-to-book ratio, then they must have the same price/earnings ratio. If Firms X and Y have the same P/E ratios, then their market-to-book ratios must also be equal. If Firm X's P/E ratio exceeds that of Firm Y, then Y is likely to be less risky and/or be expected to grow at a faster rate. Question 28 Which of the following statements is CORRECT? In general, it's better to have a low inventory turnover ratio than a high one, as a low one indicates that the firm has an adequate stock of inventory relative to sales and thus will not lose sales as a result of running out of stock. The more conservative a firm's management is, the higher the firm's total debt to total capital ratio is likely to be. A decline in a firm's inventory turnover ratio suggests that it is improving both its inventory management and its liquidity position, ie, that is becoming more liquid If a firm's fixed assets turnover ratio is significantly lower than the average for its industry, then it could be that the firm uses its fixed assets very efficiently or is operating at over capacity and should probably add fixed assets. The days sales outstanding ratio tells us how long it takes, on average, to collect after a sale is made. The DSO can be compared with the firm's credit terms to get an idea of whether customers are paying on time. Question 26 1 pt Multiple Choice: Problems New Business is just being formed by 10 investors, each of whom will own 10% of the business. The firm is expected to earn $500,000 before taxes each year. The corporate tax rate is 34% and the personal tax rate for the firm's investors is 35%. The firm does not need to retain any earnings, so all of its after-tax income will be paid out as dividends to its investors. The Investors will have to pay personal taxes on whatever they receive. How much additional spendable income will each investor have if the business is organized as a partnership rather than as a corporation? $9,282 $10,056 $11,713 $12,266 $11,050 Question 27 1 pts Which of the following statements is CORRECT? If Firms X and Y have the same net income, number of shares outstanding, and price per share, then their market-to-book ratios must also be the same. If Firms X and Y have the same net income, number of shares outstanding, and price per share, then their P/E ratios must also be the same. If Firms X and Y have the same earnings per share and market-to-book ratio, then they must have the same price/earnings ratio. If Firms X and Y have the same P/E ratios, then their market-to-book ratios must also be equal. If Firm X's P/E ratio exceeds that of Firm Y, then Y is likely to be less risky and/or be expected to grow at a faster rate. Question 28 Which of the following statements is CORRECT? In general, it's better to have a low inventory turnover ratio than a high one, as a low one indicates that the firm has an adequate stock of inventory relative to sales and thus will not lose sales as a result of running out of stock. The more conservative a firm's management is, the higher the firm's total debt to total capital ratio is likely to be. A decline in a firm's inventory turnover ratio suggests that it is improving both its inventory management and its liquidity position, ie, that is becoming more liquid If a firm's fixed assets turnover ratio is significantly lower than the average for its industry, then it could be that the firm uses its fixed assets very efficiently or is operating at over capacity and should probably add fixed assets. The days sales outstanding ratio tells us how long it takes, on average, to collect after a sale is made. The DSO can be compared with the firm's credit terms to get an idea of whether customers are paying on time