Answered step by step

Verified Expert Solution

Question

1 Approved Answer

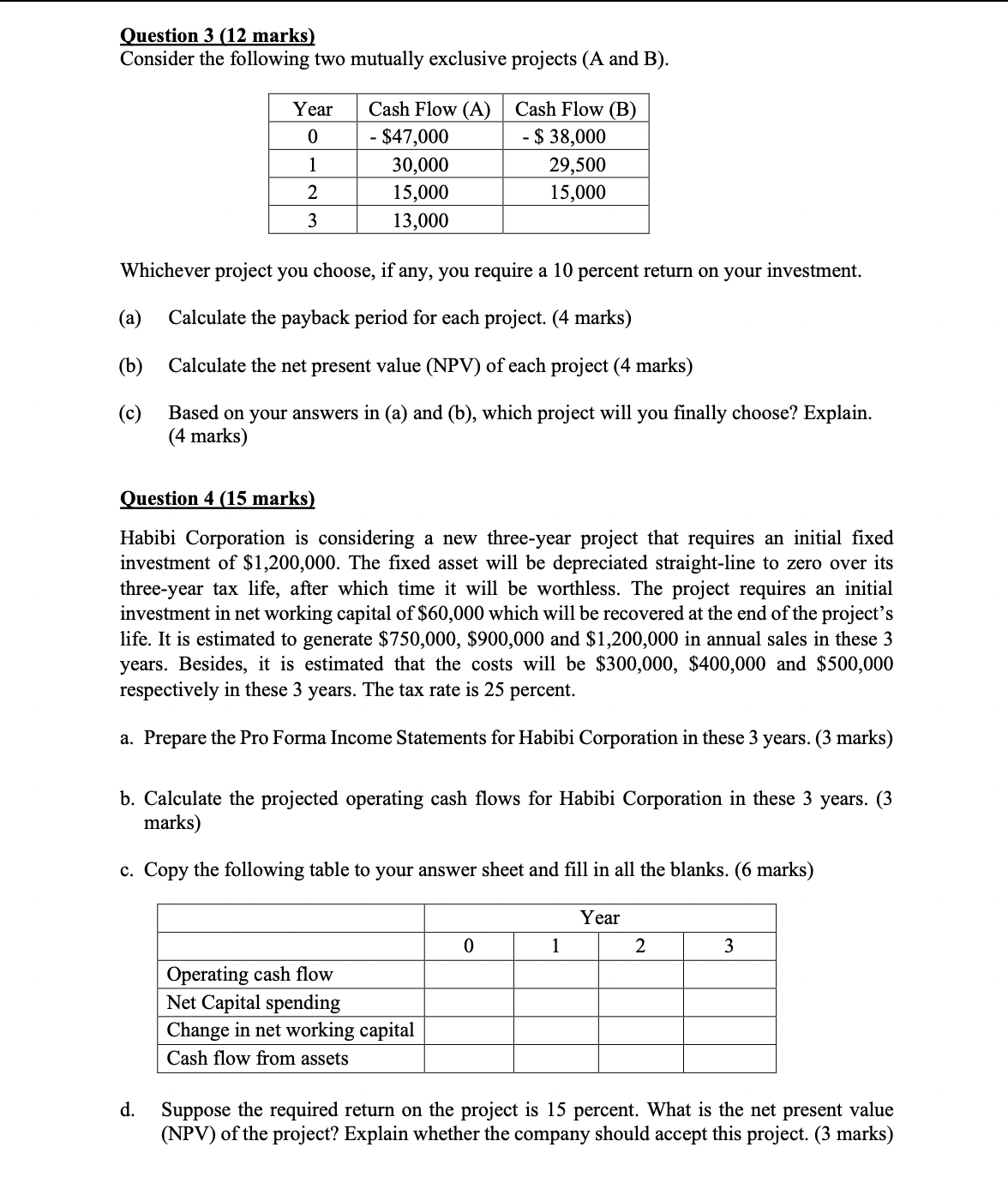

Question 3 ( 1 2 marks ) Consider the following two mutually exclusive projects ( A and B ) . Whichever project you choose, if

Question marks

Consider the following two mutually exclusive projects A and B

Whichever project you choose, if any, you require a percent return on your investment.

a Calculate the payback period for each project. marks

b Calculate the net present value NPV of each project marks

c Based on your answers in a and b which project will you finally choose? Explain.

marks

Question marks

Habibi Corporation is considering a new threeyear project that requires an initial fixed

investment of $ The fixed asset will be depreciated straightline to zero over its

threeyear tax life, after which time it will be worthless. The project requires an initial

investment in net working capital of $ which will be recovered at the end of the project's

life. It is estimated to generate $$ and $ in annual sales in these

years. Besides, it is estimated that the costs will be $$ and $

respectively in these years. The tax rate is percent.

a Prepare the Pro Forma Income Statements for Habibi Corporation in these years. marks

b Calculate the projected operating cash flows for Habibi Corporation in these years.

marks

c Copy the following table to your answer sheet and fill in all the blanks. marks

d Suppose the required return on the project is percent. What is the net present value

NPV of the project? Explain whether the company should accept this project. marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started