Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION # 3 ( 3 5 MARKS ) On January 1 s t * 2 0 2 1 , the x Company acquired 9 0

QUESTION # MARKS

On January the Company acquired of the Company for $ in cash.

Below are the balance sheets and the income statements of and for the Year

BALANCE SHEET

As at December

Cash

X Y

Accounts Receivable

Inventories.

Land

Plant& Equipment $

Accumulated Depn.

Accumulated Depn.

Investment in Y Companycost

TOTALASSETS

Accounts Payable $ $

Common Shares....

Retained Earnings

Net Income

Dividends Paid

Retained Earnings

TOTAL LIABILITIES & OWNERS' EQUITY $dots

INCOME STATEMENT

For the year ended December

X Y

Sales revenues.

Dividend Income.

$

TOTAL REVENUUES

Cost of Goods Sold.

Selling and administrative expenses.

Financing expenses.

Income Tax expenses.

NET INCOME

dotsdotsdotsdotsdots

Additional Information:

On January the following items on Ys balance sheet had differences between the carrying value and fair value:

Goodwill was valued at $ at December and at $ at December

On January had a retained earnings balance of $

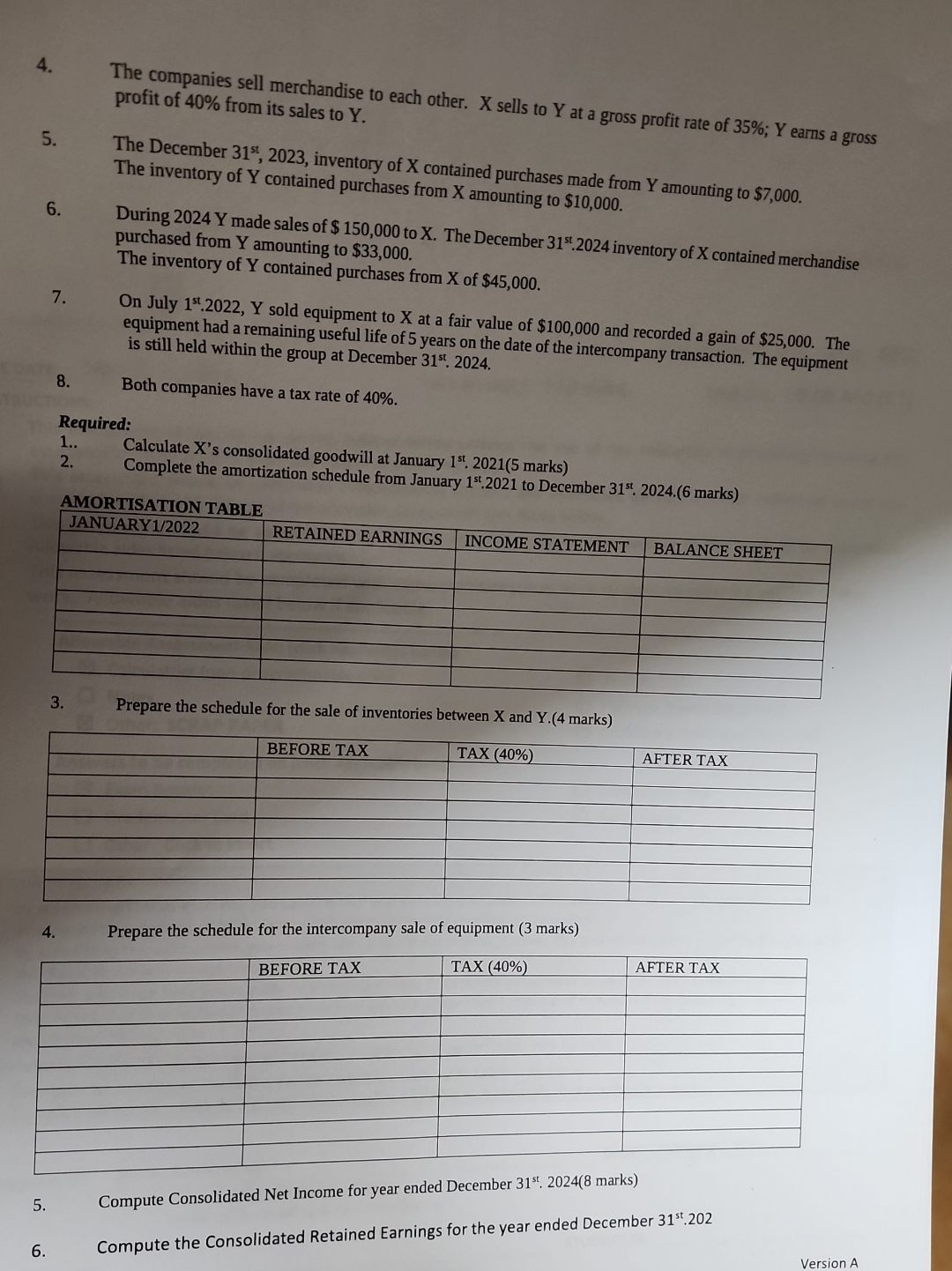

The companies sell merchandise to each other. sells to at a gross profit rate of ; earns a gross profit of from its sales to

The December inventory of contained purchases made from amounting to $ The inventory of contained purchases from amounting to $

During made sales of $ to The December inventory of contained merchandise purchased from amounting to $

The inventory of contained purchases from of $

On July sold equipment to at a fair value of $ and recorded a gain of $ The equipment had a remaining useful life of years on the date of the intercompany transaction. The equipment is still held within the group at December

Both companies have a tax rate of

Required:

Calculate Xs consolidated goodwill at January marks

Complete the amortization schedule from January to December marks

AMORTISATION TABLE

tableJANUARYRETAINED EARNINGS,INCOME STATEMENT,BALANCE SHEET

Prepare the schedule for the sale of inventories between and Y marks

tableBEFORE TAX,TAX AFTER TAX

Prepare the schedule for the intercompany sale of equipment marks

tableBEFORE TAX,TAX AFTER TAX

Compute Consolidated Net Income for year ended December marks

Compute the Consolidated Retained earnings for the year ended december st

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started