Answered step by step

Verified Expert Solution

Question

1 Approved Answer

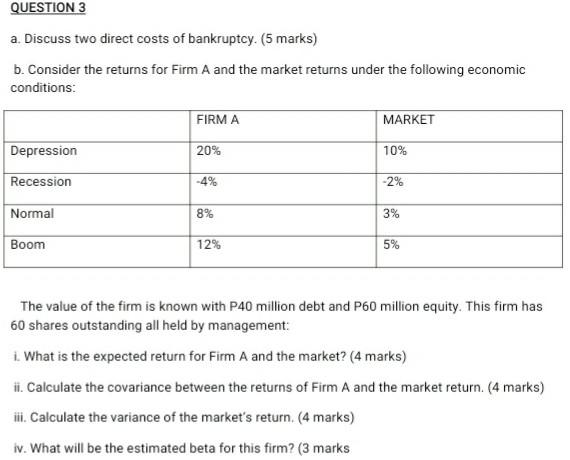

QUESTION 3 a. Discuss two direct costs of bankruptcy. (5 marks) b. Consider the returns for Firm A and the market returns under the following

QUESTION 3 a. Discuss two direct costs of bankruptcy. (5 marks) b. Consider the returns for Firm A and the market returns under the following economic conditions: FIRMA MARKET Depression 20% 10% Recession -2% Normal 8% 3% Boom 12% 5% The value of the firm is known with P40 million debt and P60 million equity. This firm has 60 shares outstanding all held by management: 1. What is the expected return for Firm A and the market? (4 marks) ii. Calculate the covariance between the returns of Firm A and the market return. (4 marks) ili. Calculate the variance of the market's return. (4 marks) iv. What will be the estimated beta for this firm? (3 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started