Answered step by step

Verified Expert Solution

Question

1 Approved Answer

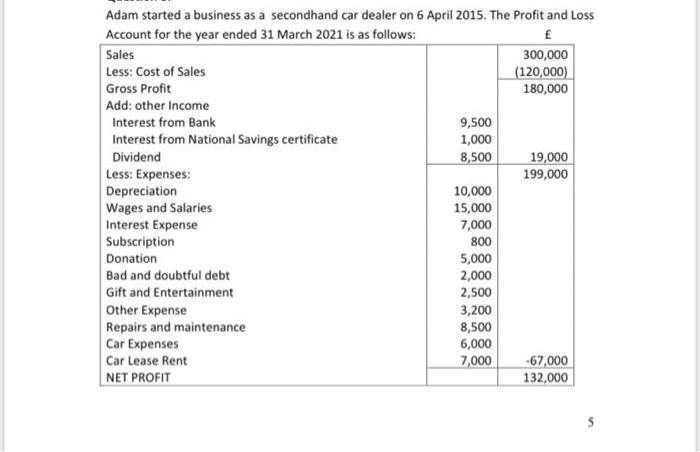

Adam started a business as a secondhand car dealer on 6 April 2015. The Profit and Loss Account for the year ended 31 March

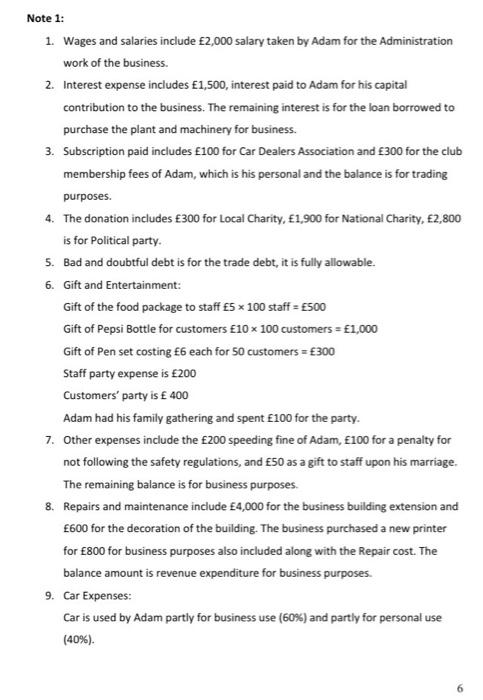

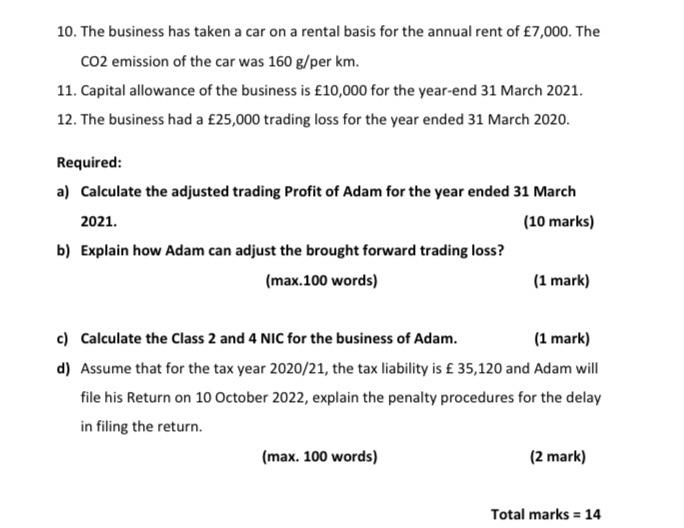

Adam started a business as a secondhand car dealer on 6 April 2015. The Profit and Loss Account for the year ended 31 March 2021 is as follows: Sales Less: Cost of Sales Gross Profit Add: other Income Interest from Bank Interest from National Savings certificate Dividend Less: Expenses: Depreciation Wages and Salaries Interest Expense Subscription Donation Bad and doubtful debt Gift and Entertainment Other Expense Repairs and maintenance Car Expenses Car Lease Rent NET PROFIT 9,500 1,000 8,500 10,000 15,000 7,000 800 5,000 2,000 2,500 3,200 8,500 6,000 7,000 300,000 (120,000) 180,000 19,000 199,000 -67,000 132,000 Note 1: 1. Wages and salaries include 2,000 salary taken by Adam for the Administration work of the business. 2. Interest expense includes 1,500, interest paid to Adam for his capital contribution to the business. The remaining interest is for the loan borrowed to purchase the plant and machinery for business. 3. Subscription paid includes 100 for Car Dealers Association and 300 for the club membership fees of Adam, which is his personal and the balance is for trading purposes. 4. The donation includes 300 for Local Charity, 1,900 for National Charity, 2,800 is for Political party. 5. Bad and doubtful debt is for the trade debt, it is fully allowable. 6. Gift and Entertainment: Gift of the food package to staff 5 x 100 staff = 500 Gift of Pepsi Bottle for customers 10 x 100 customers = 1,000 Gift of Pen set costing 6 each for 50 customers = 300 Staff party expense is 200 Customers' party is 400 Adam had his family gathering and spent 100 for the party. 7. Other expenses include the 200 speeding fine of Adam, 100 for a penalty for not following the safety regulations, and 50 as a gift to staff upon his marriage. The remaining balance is for business purposes. 8. Repairs and maintenance include 4,000 for the business building extension and 600 for the decoration of the building. The business purchased a new printer for 800 for business purposes also included along with the Repair cost. The balance amount is revenue expenditure for business purposes. 9. Car Expenses: Car is used by Adam partly for business use (60 %) and partly for personal use (40%). 10. The business has taken a car on a rental basis for the annual rent of 7,000. The CO2 emission of the car was 160 g/per km. 11. Capital allowance of the business is 10,000 for the year-end 31 March 2021. 12. The business had a 25,000 trading loss for the year ended 31 March 2020. Required: a) Calculate the adjusted trading Profit of Adam for the year ended 31 March 2021. (10 marks) b) Explain how Adam can adjust the brought forward trading loss? (max.100 words) (1 mark) c) Calculate the Class 2 and 4 NIC for the business of Adam. (1 mark) d) Assume that for the tax year 2020/21, the tax liability is 35,120 and Adam will file his Return on 10 October 2022, explain the penalty procedures for the delay in filing the return. (max. 100 words) (2 mark) Total marks = 14

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Calculation of adjusted trading profit for the year ended 31 March 2021 Net Profit as per PL Accou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started