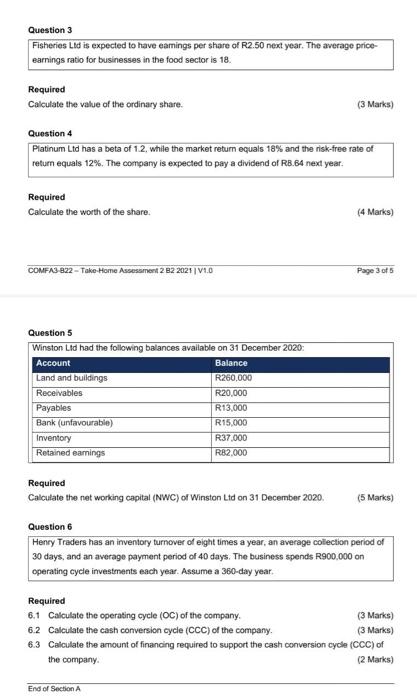

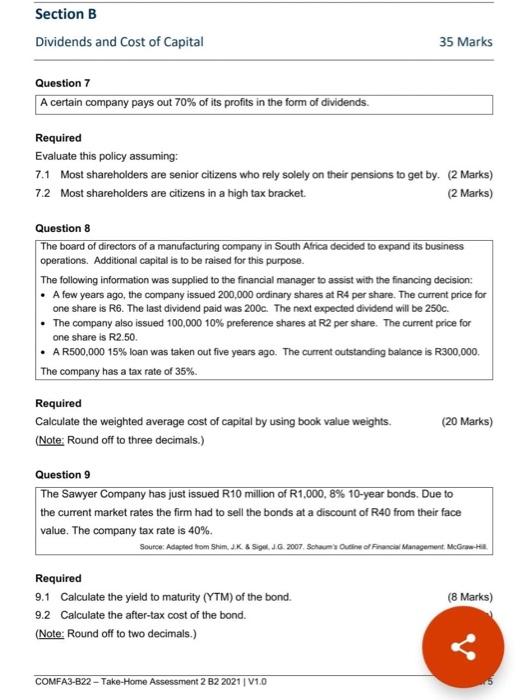

Question 3 Fisheries Lid is expected to have eamings per share of R2.50 next year. The average price earnings ratio for businesses in the food sector is 18. Required Calculate the value of the ordinary share. (3 Marks) Question 4 Platinum Ltd has a beta of 1.2, while the market return equals 18% and the risk-free rate of return equals 12%. The company is expected to pay a dividend of RB.84 next year. Required Calculate the worth of the share. (4 Marks) COMF3-822-Take Home Assessment 2 B2 2021 V1.0 Page 3 of 5 Question 5 Winston Lid had the following balances available on 31 December 2020: Account Balance Land and buildings R260,000 Receivables R20.000 Payables R13,000 Bank (unfavourable) R15,000 Inventory R37.000 Retained earnings RB2.000 Required Calculate the networking capital (NWC) of Winston Ltd on 31 December 2020. (5 Marks) Question 6 Henry Traders has an inventory turnover of eight times a year, an average collection period of 30 days, and an average payment period of 40 days. The business spends R900,000 on operating cycle investments each year. Assume a 360-day year. Required 6.1 Calculate the operating cycle (OC) of the company. (3 Marks) 6.2 Calculate the cash conversion cycle (CCC) of the company. (3 Marks) 6.3 Calculate the amount of financing required to support the cash conversion cycle (CCC) of the company (2 Marks) End of Section Section B Dividends and Cost of Capital 35 Marks Question 7 A certain company pays out 70% of its profits in the form of dividends. Required Evaluate this policy assuming: 7.1 Most shareholders are senior citizens who rely solely on their pensions to get by (2 Marks) 7.2 Most shareholders are citizens in a high tax bracket (2 Marks) Question 8 The board of directors of a manufacturing company in South Africa decided to expand its business operations. Additional capital is to be raised for this purpose. The following information was supplied to the financial manager to assist with the financing decision: A few years ago, the company issued 200,000 ordinary shares at R4 per share. The current price for one share is R6. The last dividend paid was 2000. The next expected dividend will be 250c. The company also issued 100,000 10% preference shares at R2 per share. The current price for one share is R2.50 A R500,000 15% loan was taken out five years ago. The current outstanding balance is R300,000 The company has a tax rate of 35%. Required Calculate the weighted average cost of capital by using book value weights. (Note: Round off to three decimals.) (20 Marks) Question 9 The Sawyer Company has just issued R10 million of R1,000, 8% 10-year bonds. Due to the current market rates the firm had to sell the bonds at a discount of R40 from their face value. The company tax rate is 40%. Source: Adacted from Shim. JK & Sige. J.G. 2007. Schon Outine of France Management McG (8 Marks) Required 9.1 Calculate the yield to maturity (YTM) of the bond. 9.2 Calculate the after-tax cost of the bond. (Note: Round off to two decimals.) COMFA3-B22-Take-Home Assessment 2 B2 2021 V1.0