Answered step by step

Verified Expert Solution

Question

1 Approved Answer

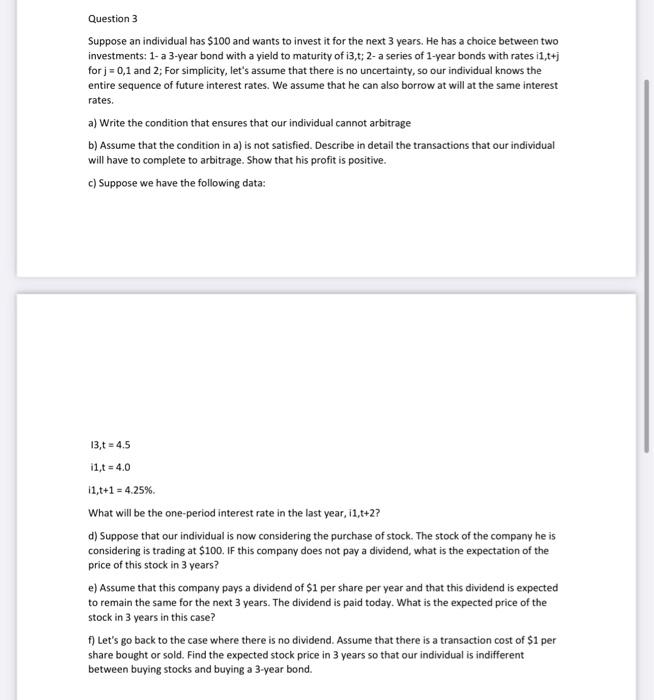

Question 3 Suppose an individual has $100 and wants to invest it for the next 3 years. He has a choice between two investments: 1-

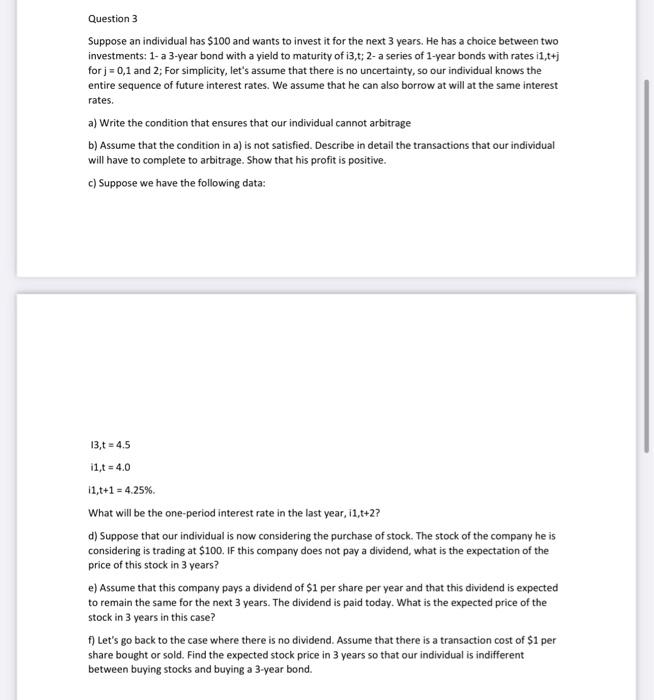

Question 3

c) Supposons que nous avons les donnes suivantes : I3,t=4,5% i1,t=4,0% i1,t+1=4,25% Que sera le taux d'Intrt d'une priode dans la dernire anne, i1,++2 ? Question 3 Suppose an individual has $100 and wants to invest it for the next 3 years. He has a choice between two investments: 1- a 3-year bond with a yield to maturity of i3,t; 2-a series of 1-year bonds with rates i1,t+j for j=0,1 and 2; For simplicity, let's assume that there is no uncertainty, so our individual knows the entire sequence of future interest rates. We assume that he can also borrow at will at the same interest rates. a) Write the condition that ensures that our individual cannot arbitrage b) Assume that the condition in a) is not satisfied. Describe in detail the transactions that our individual will have to complete to arbitrage. Show that his profit is positive. c) Suppose we have the following data: 13,t=4.511,t=4.011,t+1=4.25% What will be the one-period interest rate in the last year, 11,t+2? d) Suppose that our individual is now considering the purchase of stock. The stock of the company he is considering is trading at $100. IF this company does not pay a dividend, what is the expectation of the price of this stock in 3 years? e) Assume that this company pays a dividend of $1 per share per year and that this dividend is expected to remain the same for the next 3 years. The dividend is paid today. What is the expected price of the stock in 3 years in this case? f) Let's go back to the case where there is no dividend. Assume that there is a transaction cost of $1 per share bought or sold. Find the expected stock price in 3 years so that our individual is indifferent between buying stocks and buying a 3-year bond Suppose an individual has $100 and wants to invest it for the next 3 years. He has a choice between two investments:

1- a 3-year bond with a yield to maturity of i3,t;

2- a serie of 1-year bond with rates i1, t+j for j= 0,1 and 2;

For simplicity, let's assume that there is no uncertainty, so our individual knows the entire sequence of future interest rates. We assume that he can also borrow at will at the same interest rates.

a) Write the condition that ensures that our individual cannot arbitrage

b) Assume that the condition in a) is not satisfied. Describe in detail the transactions that our individual will have to complete to arbitrage. Show that his profit is positive.

c) Suppose we have the following data:

What will be the one-period interest rate in the last year, i1, t+2?

d) Suppose that our individual is now considering the purchase of stock. The stock of the company he is considering is trading at $100. IF this company does not pay a dividend, what is the expectation of the price of this stock in 3 years?

e) Assume that this company pays a dividend of $1 per share per year and that this dividend is expected to remain the same for the next 3 years. The dividend is paid today. What is the expected price of the stock in 3 years in this case?

f) Let's go back to the case where there is no dividend. Assume that there is a transaction cost of $1 per share bought or sold. Find the expected stock price in 3 years so that our individual is indifferent between buying stocks and buying a 3-year bond.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started