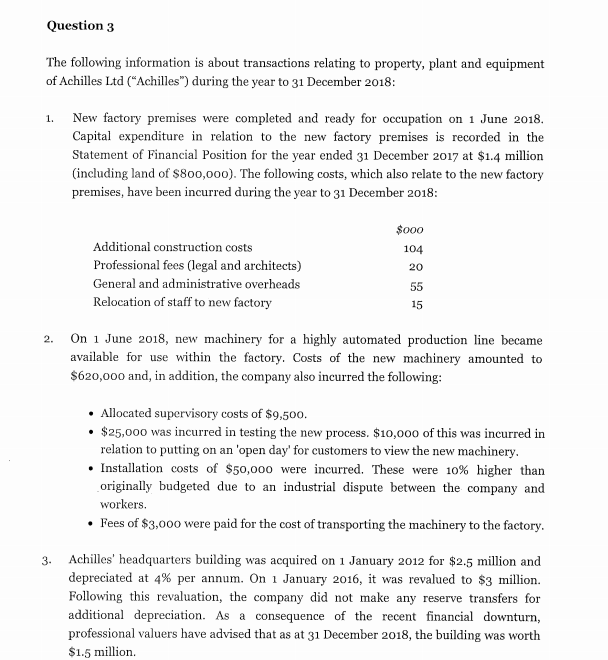

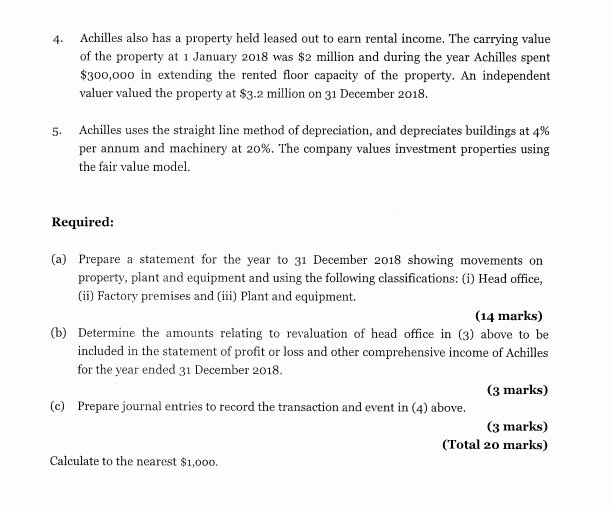

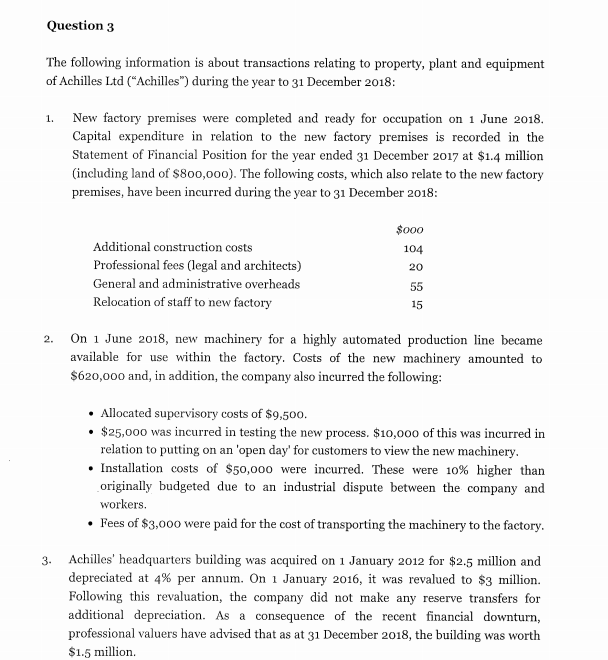

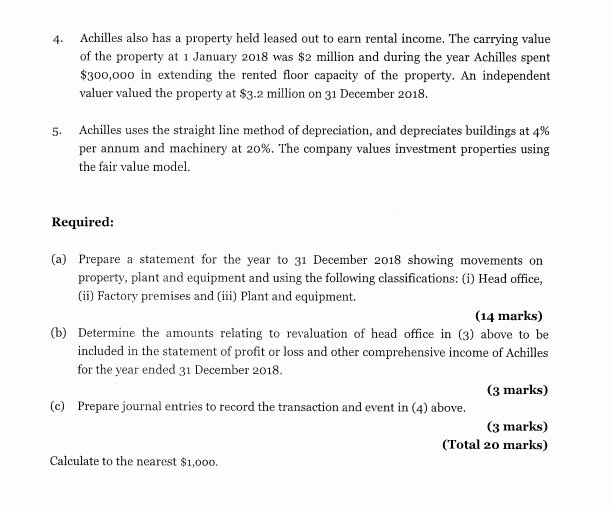

Question 3 The following information is about transactions relating to property, plant and equipment of Achilles Ltd ("Achilles") during the year to 31 December 2018: 1. w New factory premises were completed and ready for occupation on 1 June 2018. Capital expenditure in relation to the new factory premises is recorded in the Statement of Financial Position for the year ended 31 December 2017 at $1.4 million (including land of $800,000). The following costs, which also relate to the new factory premises, have been incurred during the year to 31 December 2018: Additional construction costs Professional fees (legal and architects) General and administrative overheads Relocation of staff to new factory $000 104 20 55 15 2. On 1 June 2018, new machinery for a highly automated production line became available for use within the factory. Costs of the new machinery amounted to $620,000 and, in addition, the company also incurred the following: Allocated supervisory costs of $9,500. $25,000 was incurred in testing the new process. $10,000 of this was incurred in relation to putting on an 'open day' for customers to view the new machinery. Installation costs of $50,000 were incurred. These were 10% higher than originally budgeted due to an industrial dispute between the company and workers. Fees of $3,000 were paid for the cost of transporting the machinery to the factory. 3. Achilles' headquarters building was acquired on 1 January 2012 for $2.5 million and depreciated at % per annum. On 1 January 2016, it was revalued to $3 million. Following this revaluation, the company did not make any reserve transfers for additional depreciation. As a consequence of the recent financial downturn, professional valuers have advised that as at 31 December 2018, the building was worth $1.5 million 4. Achilles also has a property held leased out to earn rental income. The carrying value of the property at 1 January 2018 was $2 million and during the year Achilles spent $300,000 in extending the rented floor capacity of the property. An independent valuer valued the property at $3.2 million on 31 December 2018. 5. Achilles uses the straight line method of depreciation, and depreciates buildings at 4% per annum and machinery at 20%. The company values investment properties using the fair value model. Required: (a) Prepare a statement for the year to 31 December 2018 showing movements on property, plant and equipment and using the following classifications: (i) Head office, (ii) Factory premises and (iii) Plant and equipment. (14 marks) (b) Determine the amounts relating to revaluation of head office in (3) above to be included in the statement of profit or loss and other comprehensive income of Achilles for the year ended 31 December 2018. (3 marks) (c) Prepare journal entries to record the transaction and event in (4) above. (3 marks) (Total 20 marks) Calculate to the nearest $1,000. Question 3 The following information is about transactions relating to property, plant and equipment of Achilles Ltd ("Achilles") during the year to 31 December 2018: 1. w New factory premises were completed and ready for occupation on 1 June 2018. Capital expenditure in relation to the new factory premises is recorded in the Statement of Financial Position for the year ended 31 December 2017 at $1.4 million (including land of $800,000). The following costs, which also relate to the new factory premises, have been incurred during the year to 31 December 2018: Additional construction costs Professional fees (legal and architects) General and administrative overheads Relocation of staff to new factory $000 104 20 55 15 2. On 1 June 2018, new machinery for a highly automated production line became available for use within the factory. Costs of the new machinery amounted to $620,000 and, in addition, the company also incurred the following: Allocated supervisory costs of $9,500. $25,000 was incurred in testing the new process. $10,000 of this was incurred in relation to putting on an 'open day' for customers to view the new machinery. Installation costs of $50,000 were incurred. These were 10% higher than originally budgeted due to an industrial dispute between the company and workers. Fees of $3,000 were paid for the cost of transporting the machinery to the factory. 3. Achilles' headquarters building was acquired on 1 January 2012 for $2.5 million and depreciated at % per annum. On 1 January 2016, it was revalued to $3 million. Following this revaluation, the company did not make any reserve transfers for additional depreciation. As a consequence of the recent financial downturn, professional valuers have advised that as at 31 December 2018, the building was worth $1.5 million 4. Achilles also has a property held leased out to earn rental income. The carrying value of the property at 1 January 2018 was $2 million and during the year Achilles spent $300,000 in extending the rented floor capacity of the property. An independent valuer valued the property at $3.2 million on 31 December 2018. 5. Achilles uses the straight line method of depreciation, and depreciates buildings at 4% per annum and machinery at 20%. The company values investment properties using the fair value model. Required: (a) Prepare a statement for the year to 31 December 2018 showing movements on property, plant and equipment and using the following classifications: (i) Head office, (ii) Factory premises and (iii) Plant and equipment. (14 marks) (b) Determine the amounts relating to revaluation of head office in (3) above to be included in the statement of profit or loss and other comprehensive income of Achilles for the year ended 31 December 2018. (3 marks) (c) Prepare journal entries to record the transaction and event in (4) above. (3 marks) (Total 20 marks) Calculate to the nearest $1,000