Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 XYZ Corp. reported a per share book value of $12 in its balance sheet on December 31, 2019. Analysts are forecasting consensus earnings

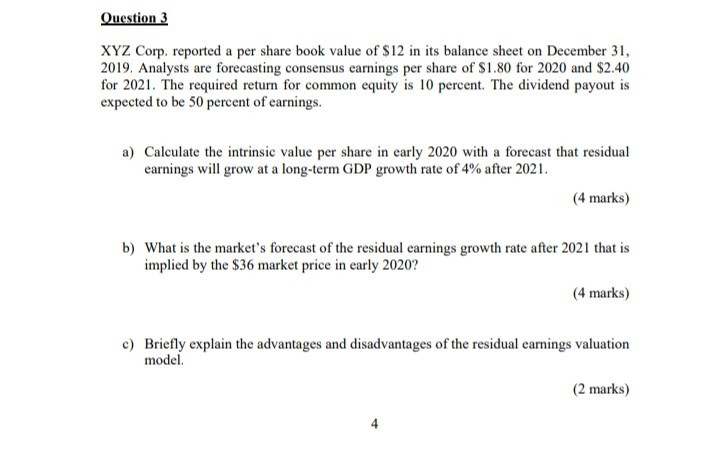

Question 3 XYZ Corp. reported a per share book value of $12 in its balance sheet on December 31, 2019. Analysts are forecasting consensus earnings per share of $1.80 for 2020 and $2.40 for 2021. The required return for common equity is 10 percent. The dividend payout is expected to be 50 percent of earnings. a) Calculate the intrinsic value per share in early 2020 with a forecast that residual earnings will grow at a long-term GDP growth rate of 4% after 2021. (4 marks) b) What is the market's forecast of the residual earnings growth rate after 2021 that is implied by the $36 market price in early 2020? (4 marks) c) Briefly explain the advantages and disadvantages of the residual earnings valuation model (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started