Question

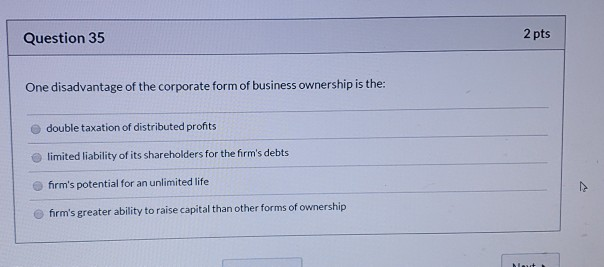

Question 35 One disadvantage of the corporate form of business ownership is the: double taxation of distributed profits limited liability of its shareholders for

Question 35 One disadvantage of the corporate form of business ownership is the: double taxation of distributed profits limited liability of its shareholders for the firm's debts firm's potential for an unlimited life firm's greater ability to raise capital than other forms of ownership 2 pts Mat

Step by Step Solution

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Answer The Correct Option is A Explanation i Corporat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

12th edition

134725980, 9780134726656 , 978-0134725987

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App