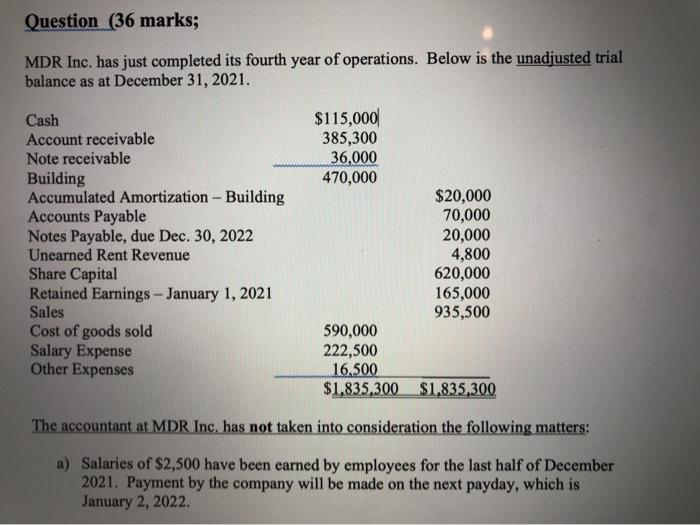

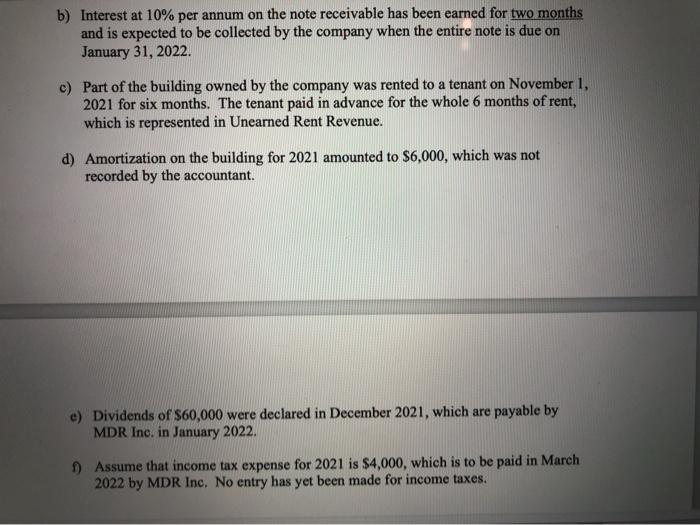

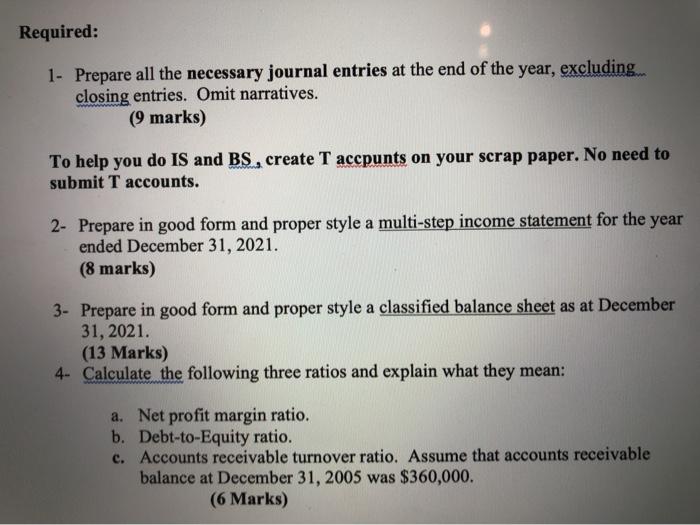

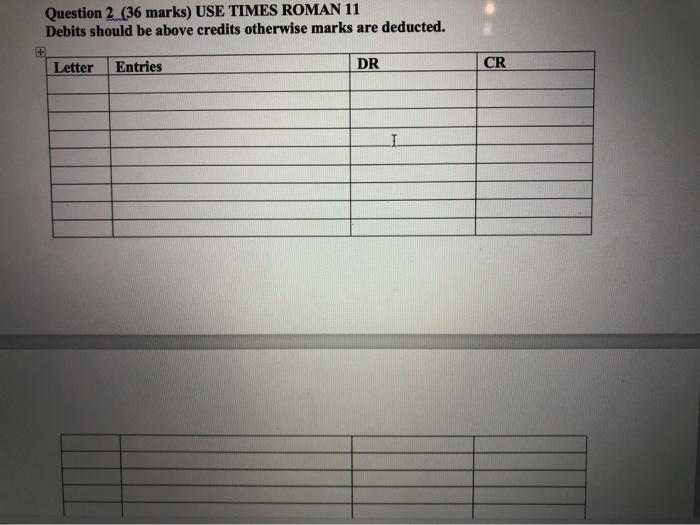

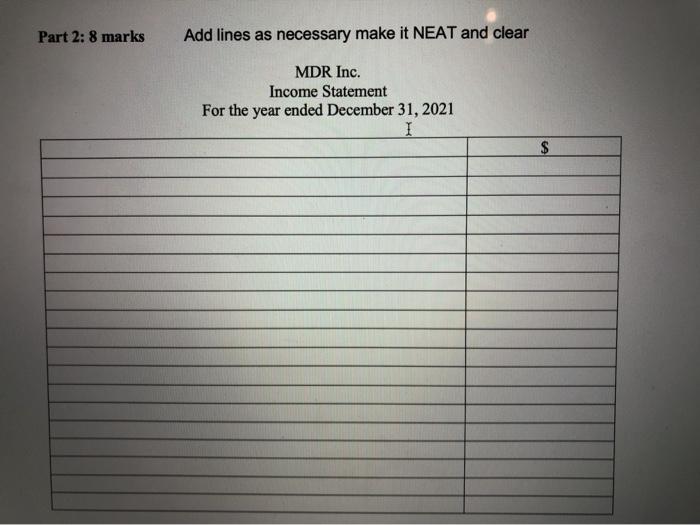

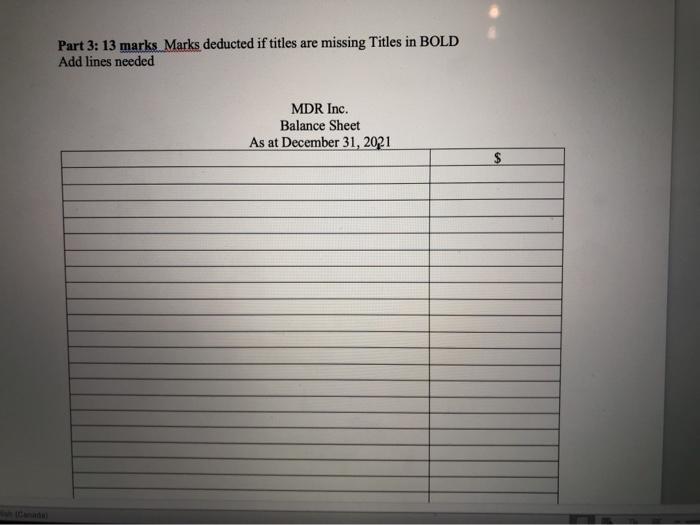

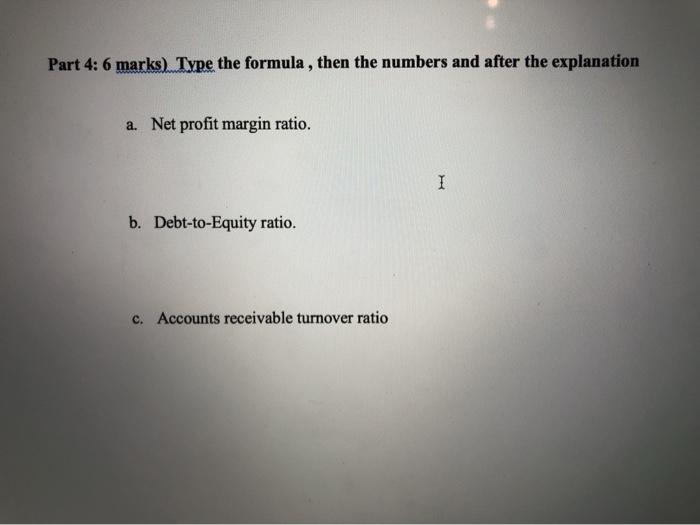

Question (36 marks; MDR Inc. has just completed its fourth year of operations. Below is the unadjusted trial balance as at December 31, 2021. Cash Account receivable Note receivable Building Accumulated Amortization - Building Accounts Payable Notes Payable, due Dec. 30, 2022 Unearned Rent Revenue Share Capital Retained Earnings - January 1, 2021 Sales Cost of goods sold Salary Expense Other Expenses $115,000 385,300 36,000 470,000 $20,000 70,000 20,000 4,800 620,000 165,000 935,500 590,000 222,500 16,500 $1,835,300 $1,835,300 The accountant at MDR Inc. has not taken into consideration the following matters: a) Salaries of $2,500 have been earned by employees for the last half of December 2021. Payment by the company will be made on the next payday, which is January 2, 2022 b) Interest at 10% per annum on the note receivable has been earned for two months and is expected to be collected by the company when the entire note is due on January 31, 2022. c) Part of the building owned by the company was rented to a tenant on November 1, 2021 for six months. The tenant paid in advance for the whole 6 months of rent, which is represented in Unearned Rent Revenue. d) Amortization on the building for 2021 amounted to $6,000, which was not recorded by the accountant. e) Dividends of $60,000 were declared in December 2021, which are payable by MDR Inc. in January 2022. 1) Assume that income tax expense for 2021 is $4,000, which is to be paid in March 2022 by MDR Inc. No entry has yet been made for income taxes. Required: 1- Prepare all the necessary journal entries at the end of the year, excluding closing entries. Omit narratives. (9 marks) To help you do IS and BS, create T accpunts on your scrap paper. No need to submit T accounts. 2- Prepare in good form and proper style a multi-step income statement for the year ended December 31, 2021. (8 marks) 3- Prepare in good form and proper style a classified balance sheet as at December 31, 2021. (13 Marks) 4- Calculate the following three ratios and explain what they mean: a. Net profit margin ratio. b. Debt-to-Equity ratio. c. Accounts receivable turnover ratio. Assume that accounts receivable balance at December 31, 2005 was $360,000. (6 Marks) Question 2 (36 marks) USE TIMES ROMAN 11 Debits should be above credits otherwise marks are deducted. Letter Entries DR CR 1 Part 2: 8 marks Add lines as necessary make it NEAT and clear MDR Inc. Income Statement For the year ended December 31, 2021 I $ Part 3: 13 marks Marks deducted if titles are missing Titles in BOLD Add lines needed MDR Inc. Balance Sheet As at December 31, 2021 $ Part 4: 6 marks) Type the formula , then the numbers and after the explanation a. Net profit margin ratio. 1 b. Debt-to-Equity ratio. c. Accounts receivable turnover ratio