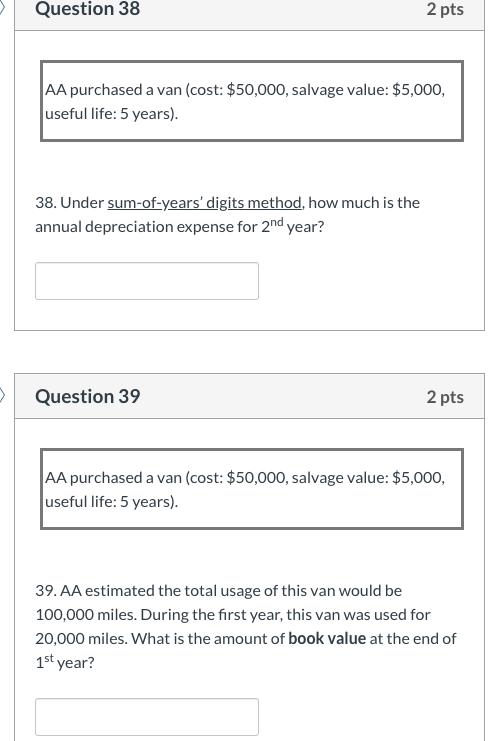

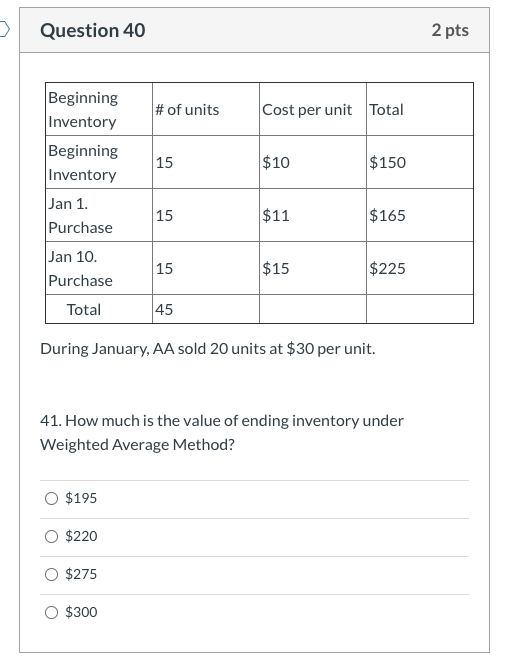

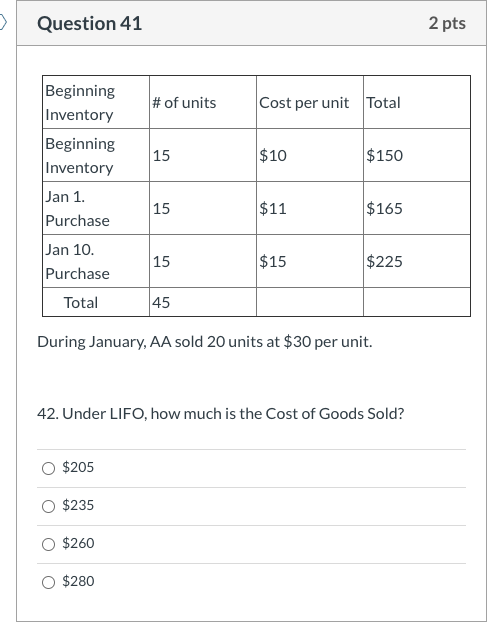

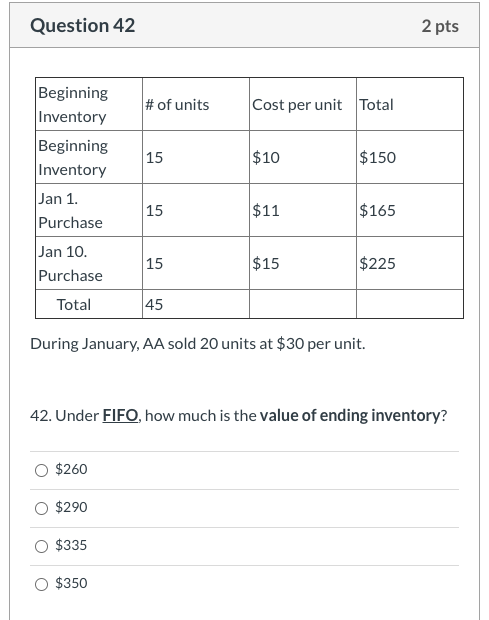

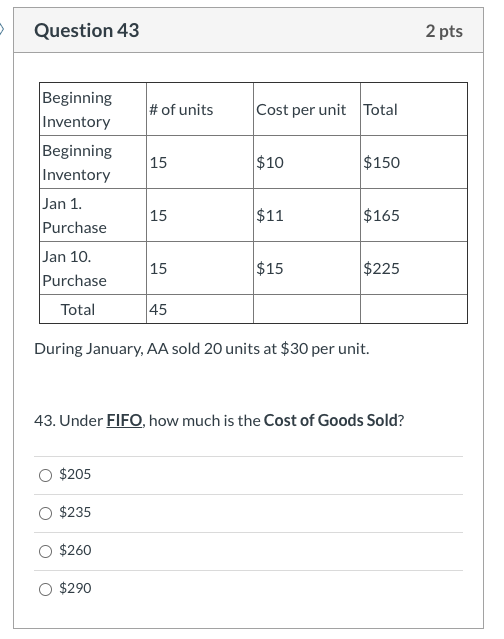

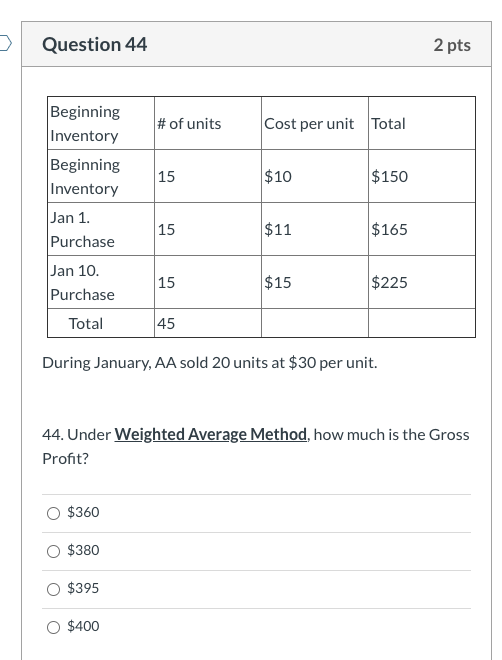

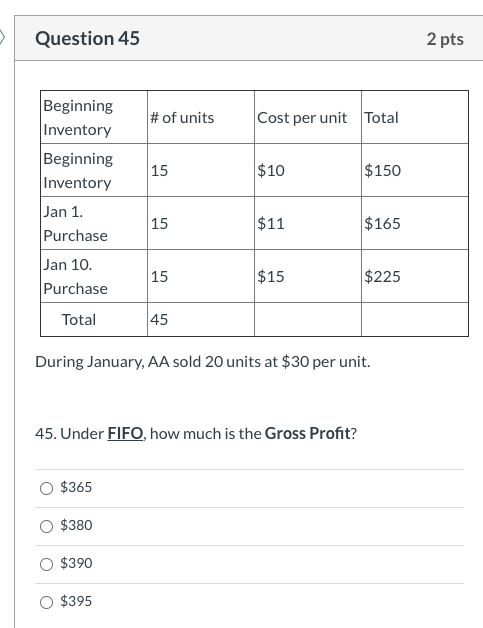

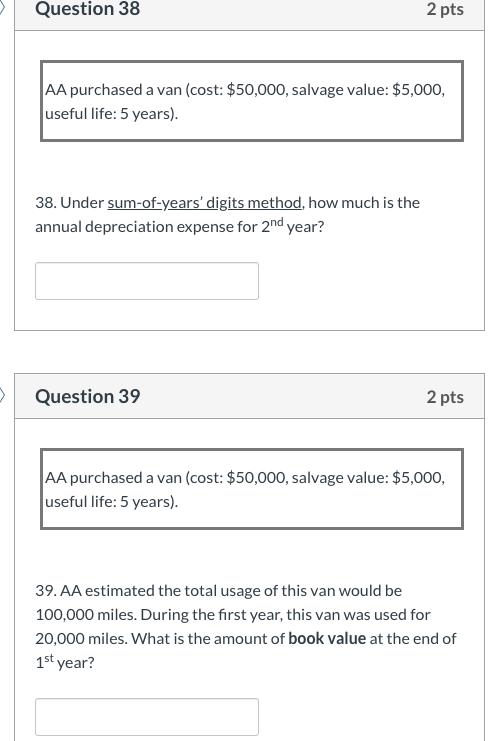

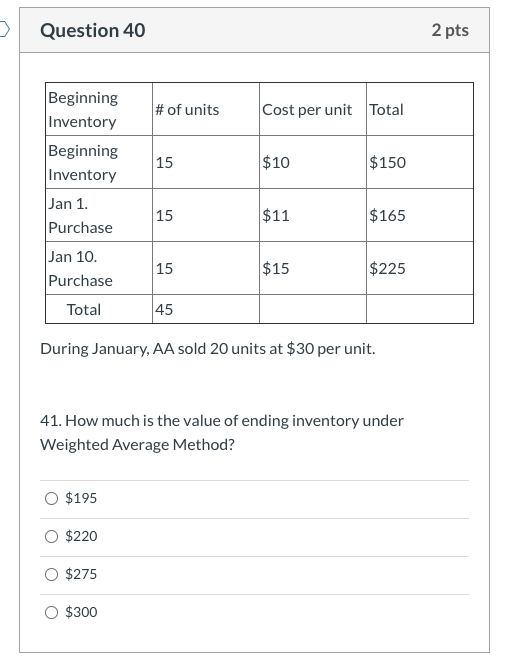

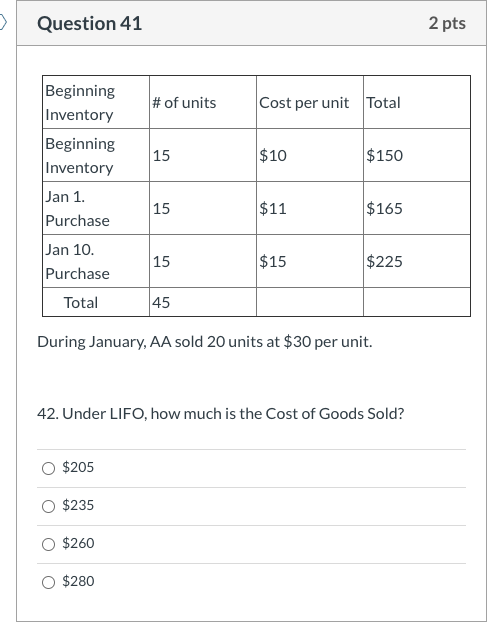

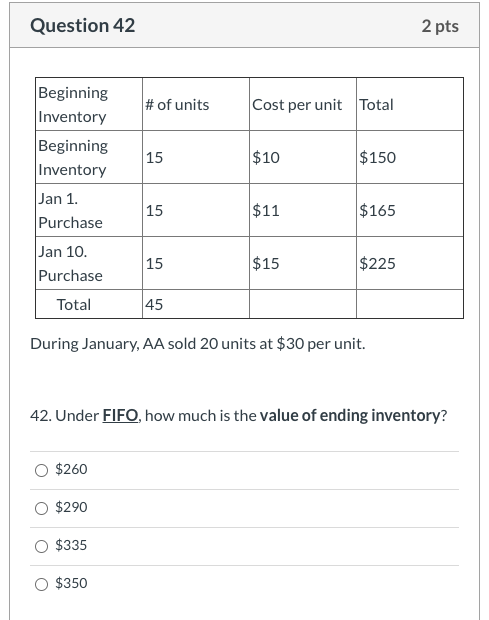

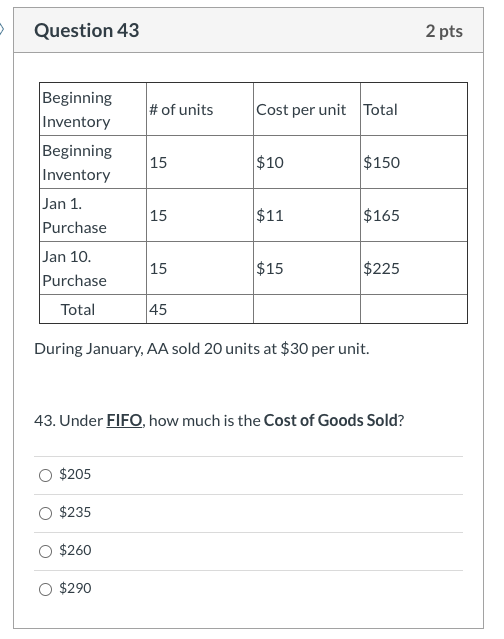

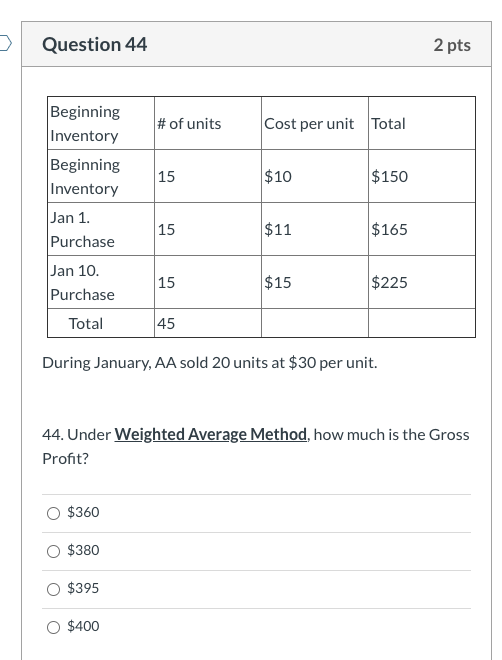

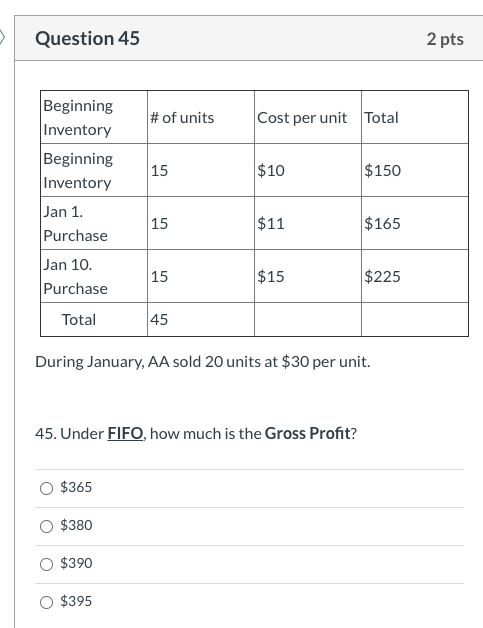

Question 38 2 pts AA purchased a van (cost: $50,000, salvage value: $5,000, useful life: 5 years). 38. Under sum-of-years' digits method, how much is the annual depreciation expense for 2nd year? Question 39 2 pts AA purchased a van (cost: $50,000, salvage value: $5,000, useful life: 5 years). 39. AA estimated the total usage of this van would be 100,000 miles. During the first year, this van was used for 20,000 miles. What is the amount of book value at the end of 1st year? Question 40 2 pts # of units Cost per unit Total 15 $10 $150 Beginning Inventory Beginning Inventory Jan 1. Purchase Jan 10. Purchase Total 15 $11 $165 15 $15 $225 45 During January, AA sold 20 units at $30 per unit. 41. How much is the value of ending inventory under Weighted Average Method? $195 $220 $275 $300 Question 41 2 pts # of units Cost per unit Total Beginning Inventory Beginning Inventory Jan 1. Purchase 15 $10 $150 15 $11 $165 15 $15 $225 Jan 10. Purchase Total 45 During January, AA sold 20 units at $30 per unit. 42. Under LIFO, how much is the Cost of Goods Sold? $205 $235 $260 $280 Question 42 2 pts # of units Cost per unit Total Beginning Inventory Beginning Inventory Jan 1. Purchase 15 $10 $150 15 $11 $165 Jan 10. Purchase 15 $15 $225 Total 45 During January, AA sold 20 units at $30 per unit. 42. Under FIFO, how much is the value of ending inventory? $260 $290 $335 $350 Question 43 2 pts # of units Cost per unit Total Beginning Inventory Beginning Inventory Jan 1. Purchase 15 $10 $150 15 $11 $ $165 15 $15 $225 Jan 10. Purchase Total 45 During January, AA sold 20 units at $30 per unit. 43. Under FIFO, how much is the Cost of Goods Sold? $205 $235 $260 $290 Question 44 2 pts # of units Cost per unit Total Beginning Inventory Beginning Inventory Jan 1. Purchase 15 $10 $150 15 $11 $165 15 $15 $225 Jan 10. Purchase Total 45 During January, AA sold 20 units at $30 per unit. 44. Under Weighted Average Method, how much is the Gross Profit? $360 $380 $395 $400 Question 45 2 pts # of units Cost per unit Total Beginning Inventory Beginning Inventory Jan 1. Purchase un $10 $150 15 $11 $165 Jan 10. Purchase 15 $15 $225 Total 45 During January, AA sold 20 units at $30 per unit. 45. Under FIFO, how much is the Gross Profit? $365 $380 $390 O $395