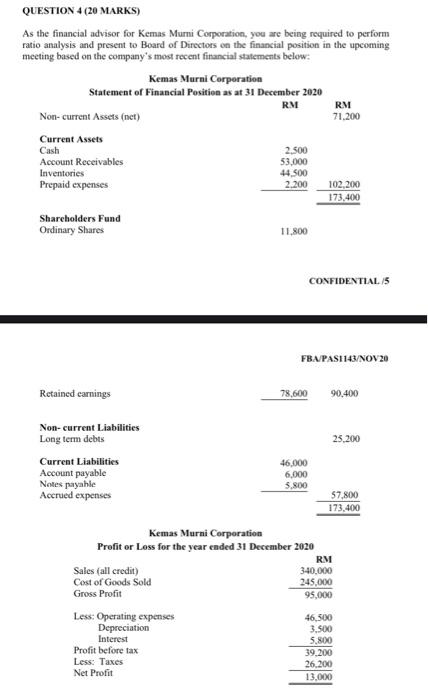

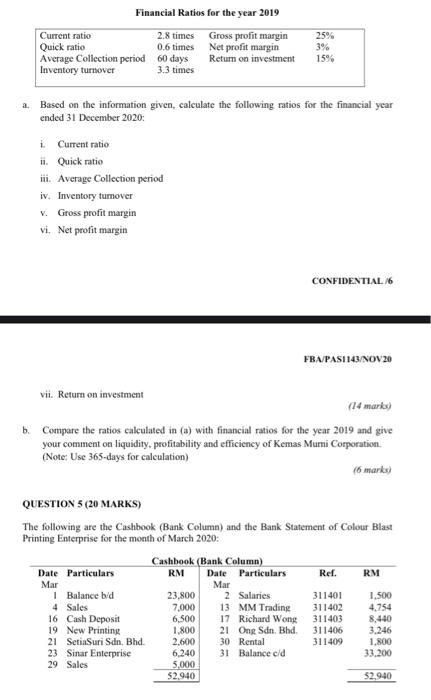

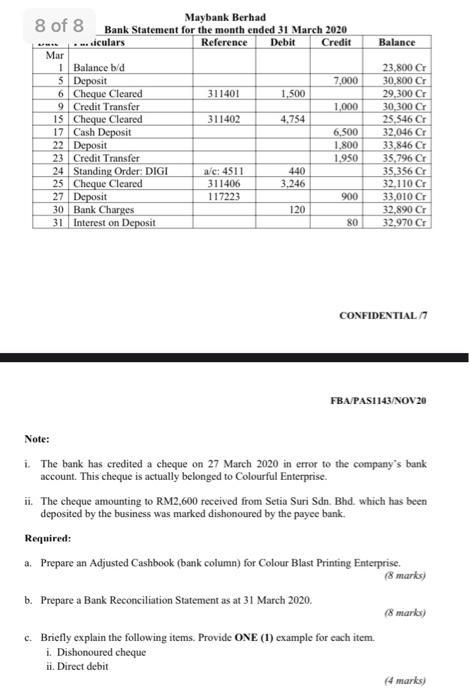

QUESTION 4 (20 MARKS) As the financial advisor for Kemas Murni Corporation, you are being required to perform ratio analysis and present to Board of Directors on the financial position in the upcoming meeting based on the company's most recent financial statements below: Kemas Murni Corporation Statement of Financial Position as at 31 December 2020 RM RM Non-current Assets (net) 71.200 Current Assets Cash 2.500 Account Receivables 53,000 Inventories 44.500 Prepaid expenses 2.200 102,200 173.400 Shareholders Fund Ordinary Shares 11,800 CONFIDENTIALS FBA/PASI143/NOV20 Retained earnings 78,600 90,400 Non-current Liabilities Long term debts 25,200 Current Liabilities 46,000 Account payable 6.000 Notes payable 3.800 Accrued expenses 57,800 173.400 Kemas Murni Corporation Profit or Less for the year ended 31 December 2020 RM Sales (all credit) 340.000 Cost of Goods Sold 245.000 Gross Profit 95.000 Less: Operating expenses 46.500 Depreciation 3.500 Interest 5.800 Profit before tax 39.200 Less: Taxes 26.200 Net Profit 13.000 Financial Ratios for the year 2019 Current ratio 2.8 times Gross profit margin Quick ratio 0.6 times Net profit margin Average Collection period 60 days Return on investment Inventory turnover 3.3 times 25% 3% 15% 2. Based on the information given, calculate the following ratios for the financial year ended 31 December 2020: i. Current ratio it. Quick ratio ii. Average Collection period iv. Inventory tumover V. Gross profit margin vi. Net profit margin CONFIDENTIAL 6 FBA/PASI14) NOV 20 vii. Return on investment (14 marks) b. Compare the ratios calculated in (a) with financial ratios for the year 2019 and give your comment on liquidity, profitability and efficiency of Kemas Mumi Corporation (Note: Use 365-days for calculation) 16 marks) QUESTION 5 (20 MARKS) The following are the Cashbook (Bank Column) and the Bank Statement of Colour Blast Printing Enterprise for the month of March 2020: Cashbook (Bank Column) Date Particulars RM Date Particulars Ref. RM Mar Mar 1 Balance bd 23,800 2 Salaries 311401 1,500 4 Sales 7,000 13 MM Trading 311402 4.754 16 Cash Deposit 6,500 17 Richard Wong 311403 8,440 19 New Printing 1.800 21 Ong Sdn. Bhd 311406 3.246 21 SetiaSuri Sdn. Bhd. 2.600 30 Rental 311409 1.800 23 Sinar Enterprise 6.240 31 Balance cid 33.200 29 Sales 5.000 52.940 $2.940 Balance Maybank Berhad 8 of 8 Bank Statement for the month ended 31 March 2020 ... iculars Reference Debit Credit Mar 1 Balance b/d 5 Deposit 7,000 6 Cheque Cleared 311401 1,500 9 Credit Transfer 1.000 15 Cheque Cleared 311402 4.754 17 Cash Deposit 6,500 22 Deposit 1.800 23 Credit Transfer 1.950 24 Standing Order: DIGI alc: 4511 440 25 Cheque Cleared 311406 3.246 27 Deposit 117223 900 30 Bank Charges 120 31 Interest on Deposit 80 23.800 C 30.800 C 29,300 C 30,300 C 25.546 Cr 32,046 CT 33.846 Cr 35,796 C 35,356 C 32,110 Cr 33,010 C 32,890 Cr 32.970 C CONFIDENTIAL FBA/PASI143/NOV 20 Note: i. The bank has credited a cheque on 27 March 2020 in error to the company's bank account. This cheque is actually belonged to Colourful Enterprise ii. The cheque amounting to RM2,600 received from Setia Suri Sdn. Bhd. which has been deposited by the business was marked dishonoured by the payee bank. Required: a. Prepare an Adjusted Cashbook (bank column) for Colour Blast Printing Enterprise. (8 marks) b. Prepare a Bank Reconciliation Statement as at 31 March 2020. (8 marks) c. Briefly explain the following items. Provide ONE (1) example for each item. i. Dishonoured cheque ii. Direct debit (4 marks)