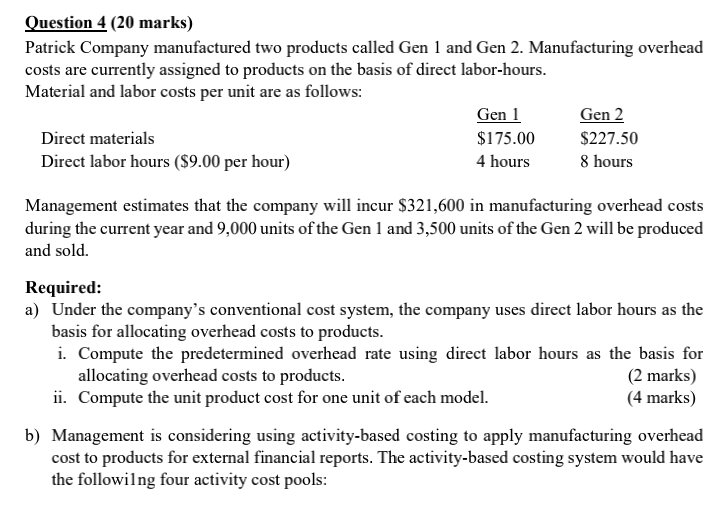

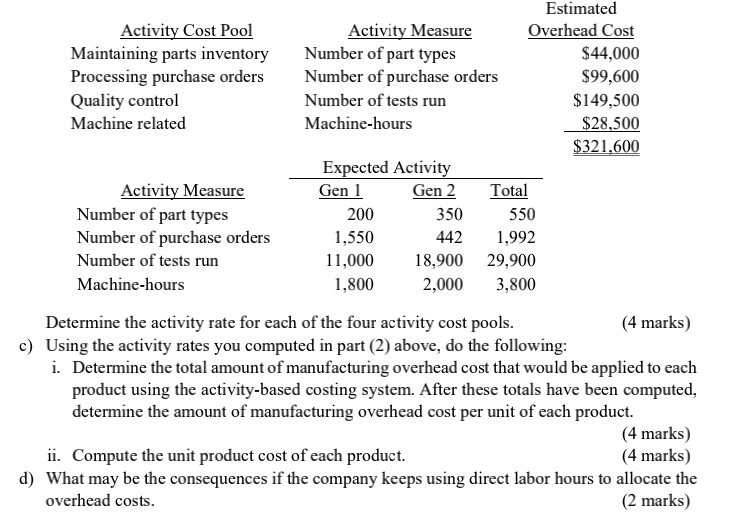

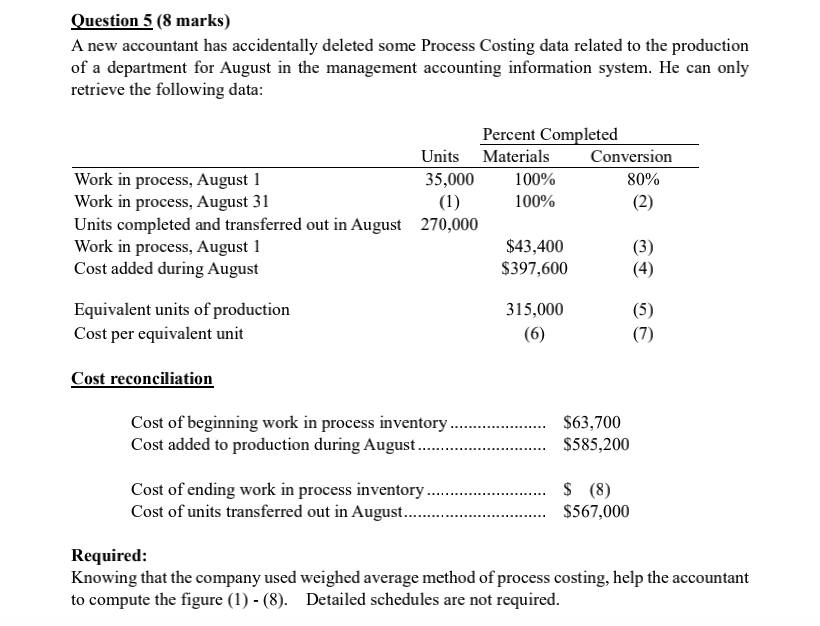

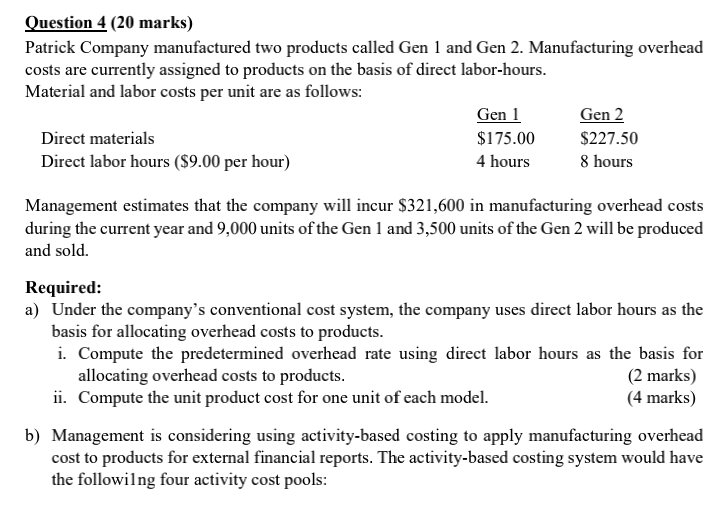

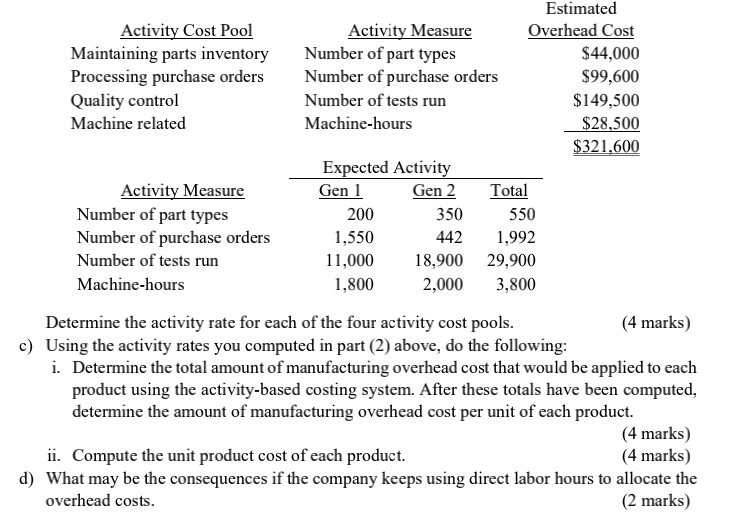

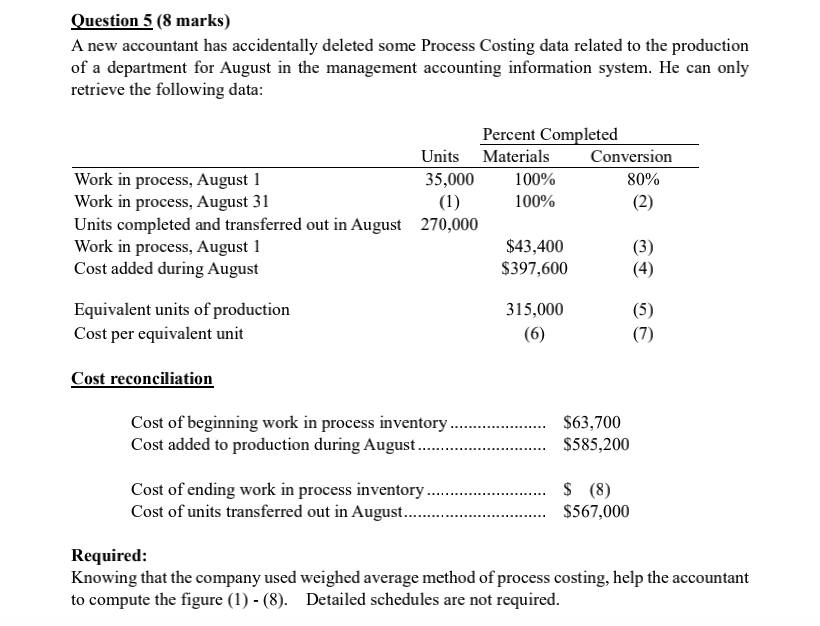

Question 4 (20 marks) Patrick Company manufactured two products called Gen 1 and Gen 2. Manufacturing overhead costs are currently assigned to products on the basis of direct labor-hours. Material and labor costs per unit are as follows: Gen 1 Gen 2 Direct materials $175.00 $227.50 Direct labor hours ($9.00 per hour) 4 hours 8 hours Management estimates that the company will incur $321,600 in manufacturing overhead costs during the current year and 9,000 units of the Gen 1 and 3,500 units of the Gen 2 will be produced and sold. Required: a) Under the company's conventional cost system, the company uses direct labor hours as the basis for allocating overhead costs to products. i. Compute the predetermined overhead rate using direct labor hours as the basis for allocating overhead costs to products. (2 marks) ii. Compute the unit product cost for one unit of each model. (4 marks) b) Management is considering using activity-based costing to apply manufacturing overhead cost to products for external financial reports. The activity-based costing system would have the followilng four activity cost pools: Estimated Activity Cost Pool Activity Measure Overhead Cost Maintaining parts inventory Number of part types $44,000 Processing purchase orders Number of purchase orders $99,600 Quality control Number of tests run $149,500 Machine related Machine-hours $28,500 $321,600 Expected Activity Activity Measure Gen 1 Gen 2 Total Number of part types 200 350 550 Number of purchase orders 1,550 442 1,992 Number of tests run 11,000 18,900 29,900 Machine-hours 1,800 2,000 3,800 Determine the activity rate for each of the four activity cost pools. (4 marks) c) Using the activity rates you computed in part (2) above, do the following: i. Determine the total amount of manufacturing overhead cost that would be applied to each product using the activity-based costing system. After these totals have been computed, determine the amount of manufacturing overhead cost per unit of each product. (4 marks) ii. Compute the unit product cost of each product. (4 marks) d) What may be the consequences if the company keeps using direct labor hours to allocate the overhead costs. (2 marks) Question 5 (8 marks) A new accountant has accidentally deleted some Process Costing data related to the production of a department for August in the management accounting information system. He can only retrieve the following data: Percent Completed Units Materials Conversion Work in process, August 1 35,000 100% 80% Work in process, August 31 (1) 100% (2) Units completed and transferred out in August 270,000 Work in process, August 1 $43,400 (3) Cost added during August $397,600 (4) Equivalent units of production Cost per equivalent unit 315,000 (6) (5) (7) Cost reconciliation Cost of beginning work in process inventory. Cost added to production during August ....... $63,700 $585,200 Cost of ending work in process inventory... Cost of units transferred out in August......... $ (8) $567,000 Required: Knowing that the company used weighed average method of process costing, help the accountant to compute the figure (1) - (8). Detailed schedules are not required