Answered step by step

Verified Expert Solution

Question

1 Approved Answer

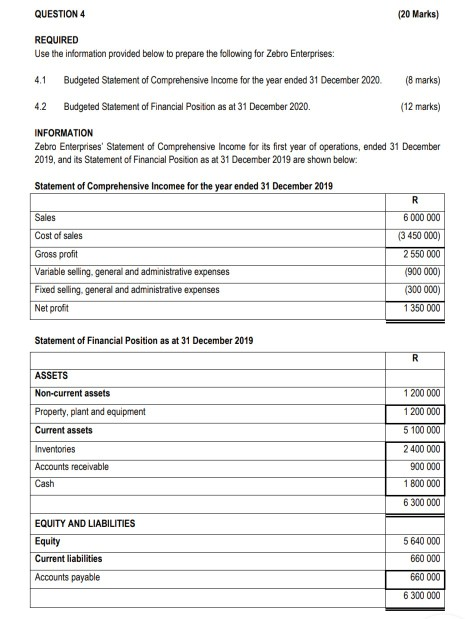

QUESTION 4 (20 Marks) REQUIRED Use the information provided below to prepare the following for Zebro Enterprises Budgeted Statement of Comprehensive Income for the year

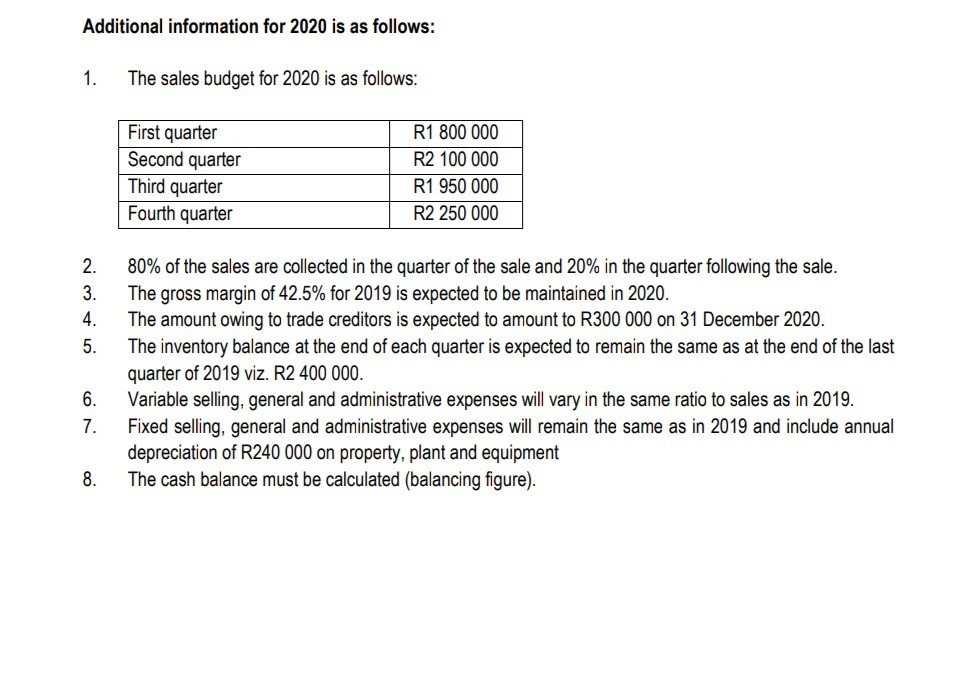

QUESTION 4 (20 Marks) REQUIRED Use the information provided below to prepare the following for Zebro Enterprises Budgeted Statement of Comprehensive Income for the year ended 31 December 2020. Budgeted Statement of Financial Position as at 31 December 2020. 4.1 (8 marks) 4.2 (12 marks) INFORMATION Zebro Enterprises' Statement of Comprehensive Income for its first year of operations, ended 31 December 2019, and its Statement of Financial Position as at 31 December 2019 are shown below: Statement of Comprehensive Income for the year ended 31 December 2019 R 6 000 000 Sales Cost of sales Gross profit Variable selling general and administrative expenses Fixed selling general and administrative expenses Net profit (3 450 000) 2 550 000 (900 000) (300 000) 1 350 000 Statement of Financial Position as at 31 December 2019 R ASSETS Non-current assets 1 200 000 1 200 000 Property, plant and equipment Current assets 5 100 000 Inventories Accounts receivable 2 400 000 900 000 Cash 1 800 000 6 300 000 EQUITY AND LIABILITIES Equity Current liabilities Accounts payable 5 640 000 660 000 660 000 6 300 000 Additional information for 2020 is as follows: 1. The sales budget for 2020 is as follows: First quarter Second quarter Third quarter Fourth quarter R1 800 000 R2 100 000 R1 950 000 R2 250 000 2. 3. 4. 5. 80% of the sales are collected in the quarter of the sale and 20% in the quarter following the sale. The gross margin of 42.5% for 2019 is expected to be maintained in 2020. The amount owing to trade creditors is expected to amount to R300 000 on 31 December 2020. The inventory balance at the end of each quarter is expected to remain the same as at the end of the last quarter of 2019 viz. R2 400 000. Variable selling, general and administrative expenses will vary in the same ratio to sales as in 2019. Fixed selling, general and administrative expenses will remain the same as in 2019 and include annual depreciation of R240 000 on property, plant and equipment The cash balance must be calculated (balancing figure). 6. 7. 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started